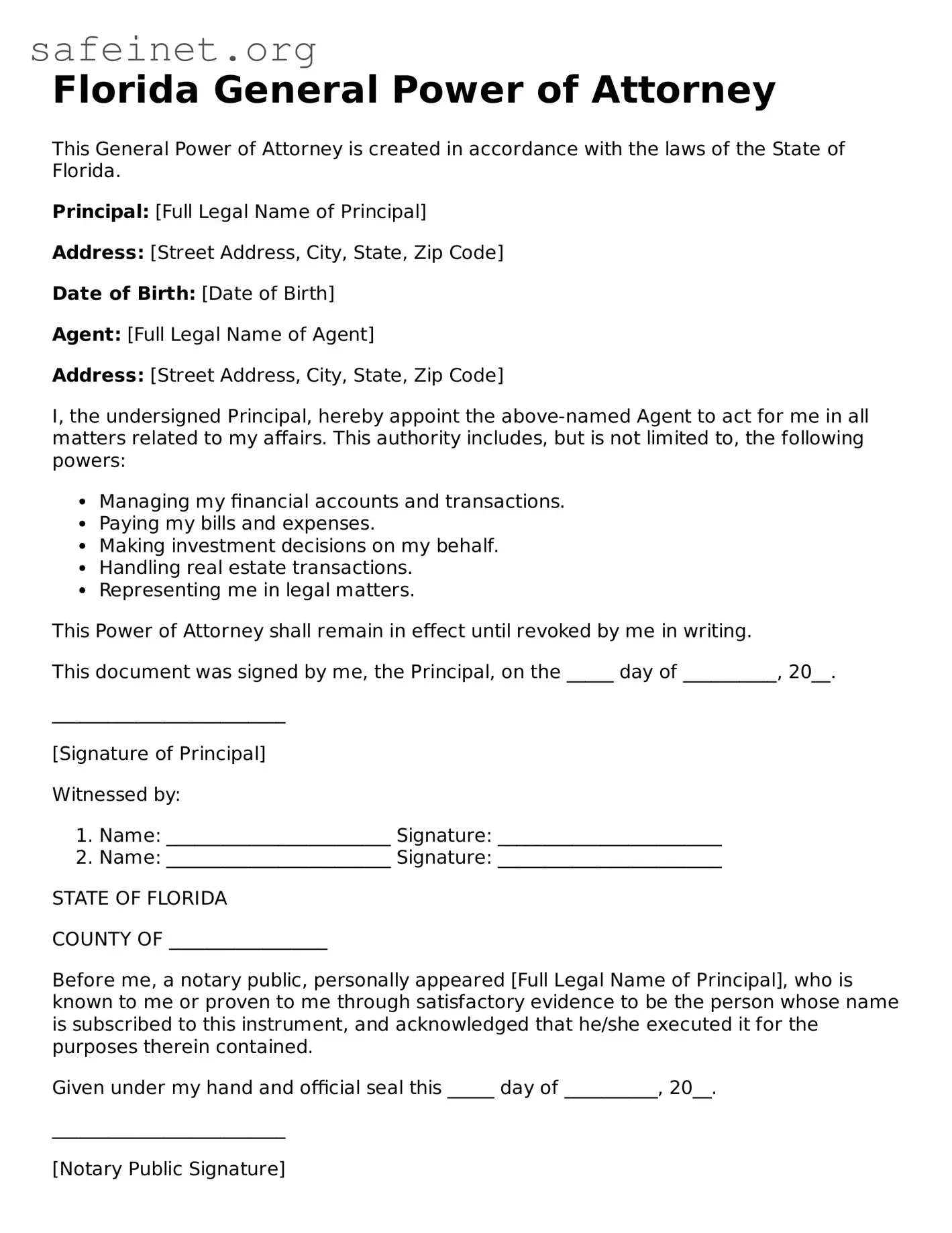

Florida General Power of Attorney

This General Power of Attorney is created in accordance with the laws of the State of Florida.

Principal: [Full Legal Name of Principal]

Address: [Street Address, City, State, Zip Code]

Date of Birth: [Date of Birth]

Agent: [Full Legal Name of Agent]

Address: [Street Address, City, State, Zip Code]

I, the undersigned Principal, hereby appoint the above-named Agent to act for me in all matters related to my affairs. This authority includes, but is not limited to, the following powers:

- Managing my financial accounts and transactions.

- Paying my bills and expenses.

- Making investment decisions on my behalf.

- Handling real estate transactions.

- Representing me in legal matters.

This Power of Attorney shall remain in effect until revoked by me in writing.

This document was signed by me, the Principal, on the _____ day of __________, 20__.

_________________________

[Signature of Principal]

Witnessed by:

- Name: ________________________ Signature: ________________________

- Name: ________________________ Signature: ________________________

STATE OF FLORIDA

COUNTY OF _________________

Before me, a notary public, personally appeared [Full Legal Name of Principal], who is known to me or proven to me through satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed it for the purposes therein contained.

Given under my hand and official seal this _____ day of __________, 20__.

_________________________

[Notary Public Signature]

My Commission Expires: ____________