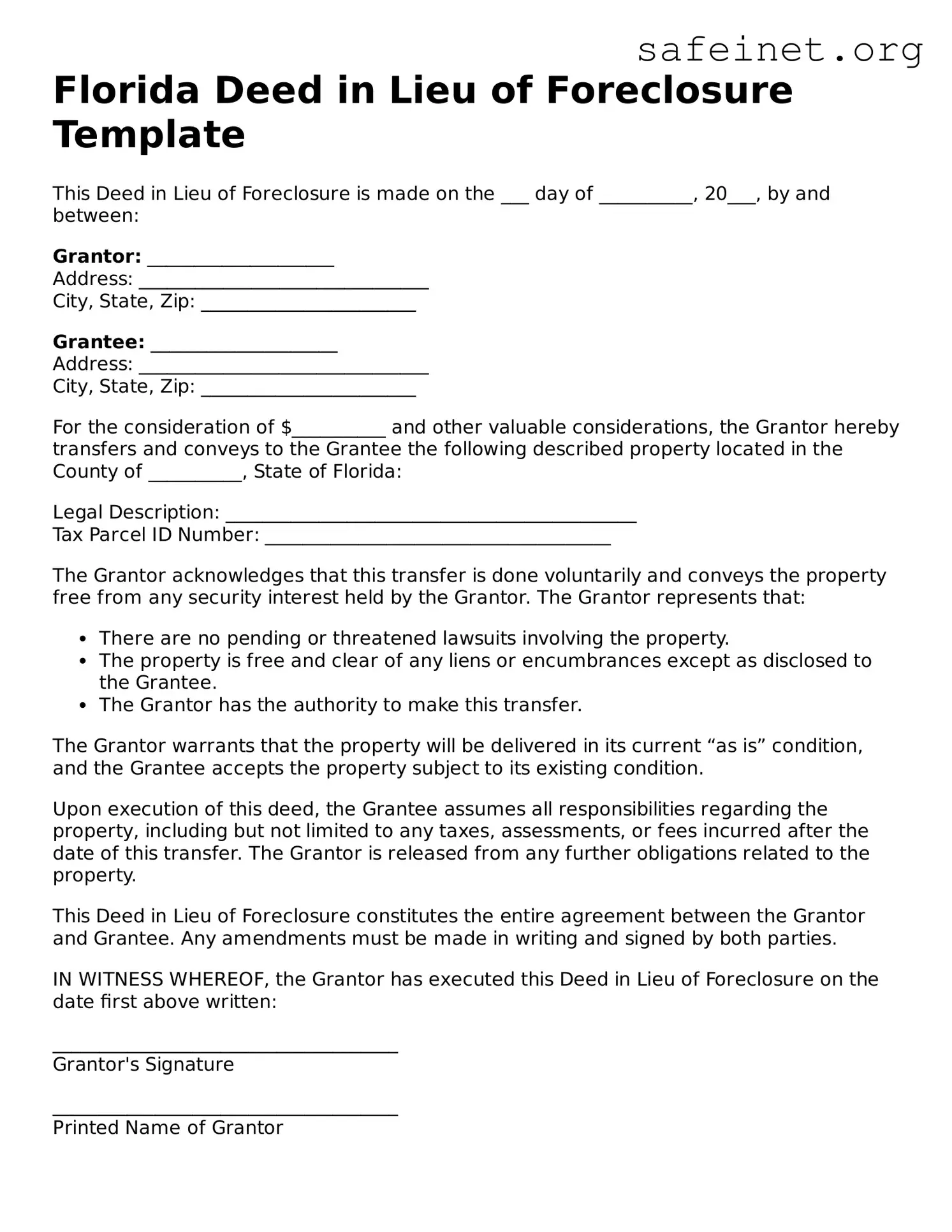

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on the ___ day of __________, 20___, by and between:

Grantor: ____________________

Address: _______________________________

City, State, Zip: _______________________

Grantee: ____________________

Address: _______________________________

City, State, Zip: _______________________

For the consideration of $__________ and other valuable considerations, the Grantor hereby transfers and conveys to the Grantee the following described property located in the County of __________, State of Florida:

Legal Description: ____________________________________________

Tax Parcel ID Number: _____________________________________

The Grantor acknowledges that this transfer is done voluntarily and conveys the property free from any security interest held by the Grantor. The Grantor represents that:

- There are no pending or threatened lawsuits involving the property.

- The property is free and clear of any liens or encumbrances except as disclosed to the Grantee.

- The Grantor has the authority to make this transfer.

The Grantor warrants that the property will be delivered in its current “as is” condition, and the Grantee accepts the property subject to its existing condition.

Upon execution of this deed, the Grantee assumes all responsibilities regarding the property, including but not limited to any taxes, assessments, or fees incurred after the date of this transfer. The Grantor is released from any further obligations related to the property.

This Deed in Lieu of Foreclosure constitutes the entire agreement between the Grantor and Grantee. Any amendments must be made in writing and signed by both parties.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on the date first above written:

_____________________________________

Grantor's Signature

_____________________________________

Printed Name of Grantor

STATE OF FLORIDA

COUNTY OF __________

On this ___ day of __________, 20___, before me personally appeared ________________________, to me known to be the person described in and who executed the foregoing instrument, and acknowledged that (he/she) executed the same.

_____________________________________

Notary Public

My Commission Expires: _______________