What is the purpose of the Articles of Incorporation in Florida?

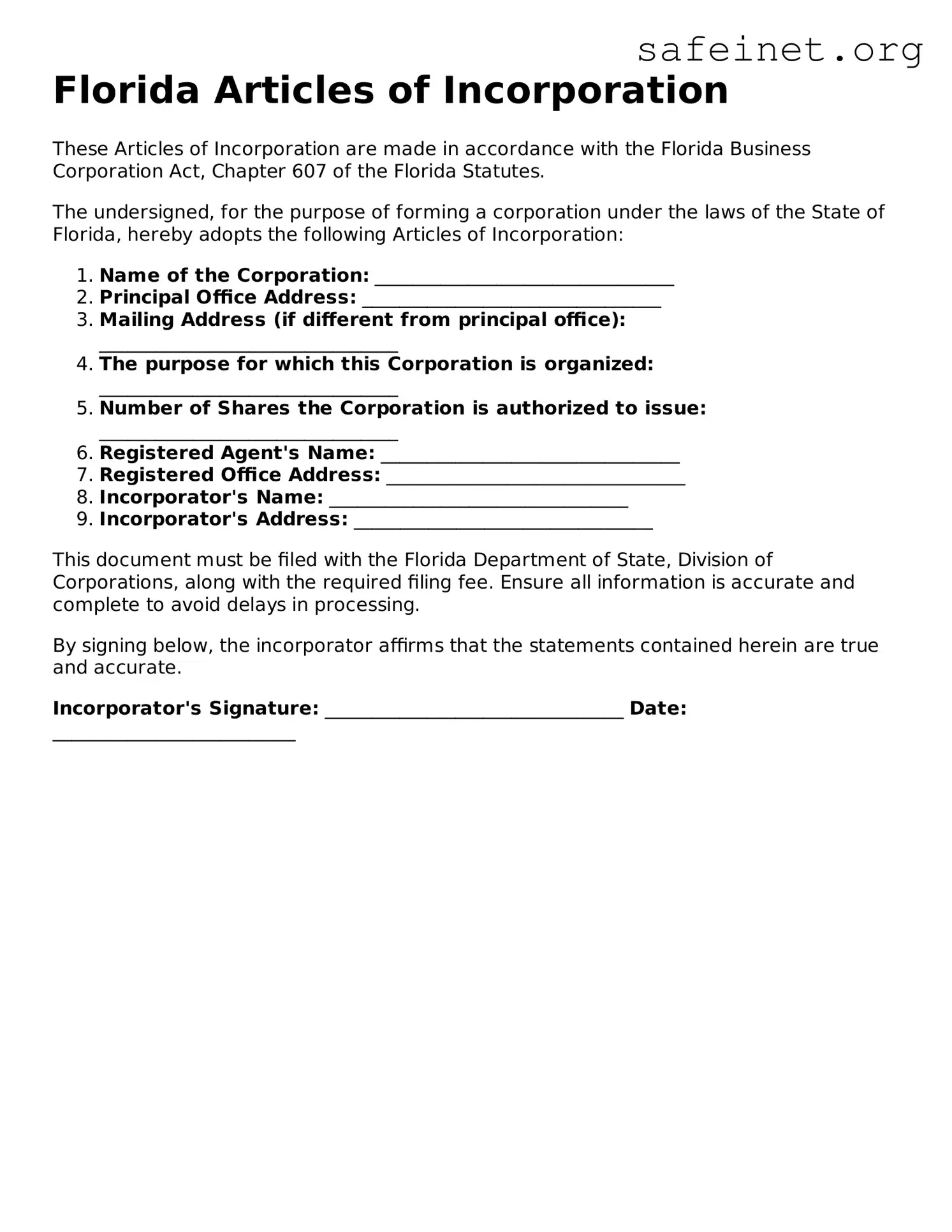

The Articles of Incorporation are essential documents needed to legally establish a corporation in Florida. This form provides foundational information about the corporation, such as its name, principal office address, and the nature of its business. Submitting this document to the Florida Department of State officially creates the corporation in the eyes of the law.

What information is required on the Articles of Incorporation form?

When filling out the Articles of Incorporation form, several key pieces of information must be included. You will need to provide the corporation’s name, which must be unique and distinguishable from other registered entities. It's also necessary to include the principal office address, the duration of the corporation (if not perpetual), and the names and addresses of the initial directors and officers. Additionally, you will have to specify the purpose for which the corporation is organized.

How do I find a unique name for my corporation?

Choosing a unique name for your corporation is crucial in Florida. Start by conducting a name search through the Florida Department of State's online database. This search helps ensure that no other registered entity has the same name or a name that is too similar. Once you identify a suitable name, it's advisable to reserve it to prevent others from using it while you prepare the Articles of Incorporation.

Is there a fee associated with filing the Articles of Incorporation?

Yes, there is a filing fee required when submitting the Articles of Incorporation. As of October 2023, the standard fee for filing is $70 for profit corporations and $35 for nonprofit corporations. Additional costs may apply if you choose to expedite the processing or require certified copies of the documents. It’s important to check the Florida Department of State's website for the most current fees and payment methods.

How long does it take for my Articles of Incorporation to be processed?

The processing time for Articles of Incorporation can vary. Typically, it takes about 2 to 4 business days for the Florida Department of State to process the application if filed online. If submitted via mail, the timeline may extend to several weeks. For those who need quicker service, an expedited option is available for an additional fee, allowing for processing in as little as 1 business day.

Can I amend my Articles of Incorporation after they are filed?

Yes, once the Articles of Incorporation are filed and approved, amendments can be made if necessary. Common reasons for amendments include changing the corporation's name, modifying the principal address, or altering the purpose of the corporation. To amend these articles, you must file a form for amendments with the Florida Department of State, and a filing fee will also apply.

Do I need legal representation to file the Articles of Incorporation?

While legal representation is not a requirement to file the Articles of Incorporation, it can be beneficial. Having a lawyer or legal professional can help ensure that the documents are completed correctly and in accordance with Florida laws. This can save time and avoid potential mistakes that might incur additional fees or delays.

What happens after my Articles of Incorporation are approved?

Once the Florida Department of State approves your Articles of Incorporation, your corporation is officially formed. You will receive a stamped copy of the Articles for your records. At this point, you can start conducting business in Florida under the corporation's name. Additionally, it is essential to maintain compliance with other ongoing requirements such as obtaining necessary licenses, permits, and filing annual reports.

Are there ongoing requirements for a Florida corporation after incorporation?

Yes, Florida corporations are subject to ongoing requirements after incorporation. Key obligations include filing an annual report with the Florida Department of State, which provides updated information about the corporation. This report is due each year on May 1st, and failure to file may lead to penalties or even dissolution of the corporation. Additionally, ensure compliance with any local, state, and federal regulations that apply to your business operations.