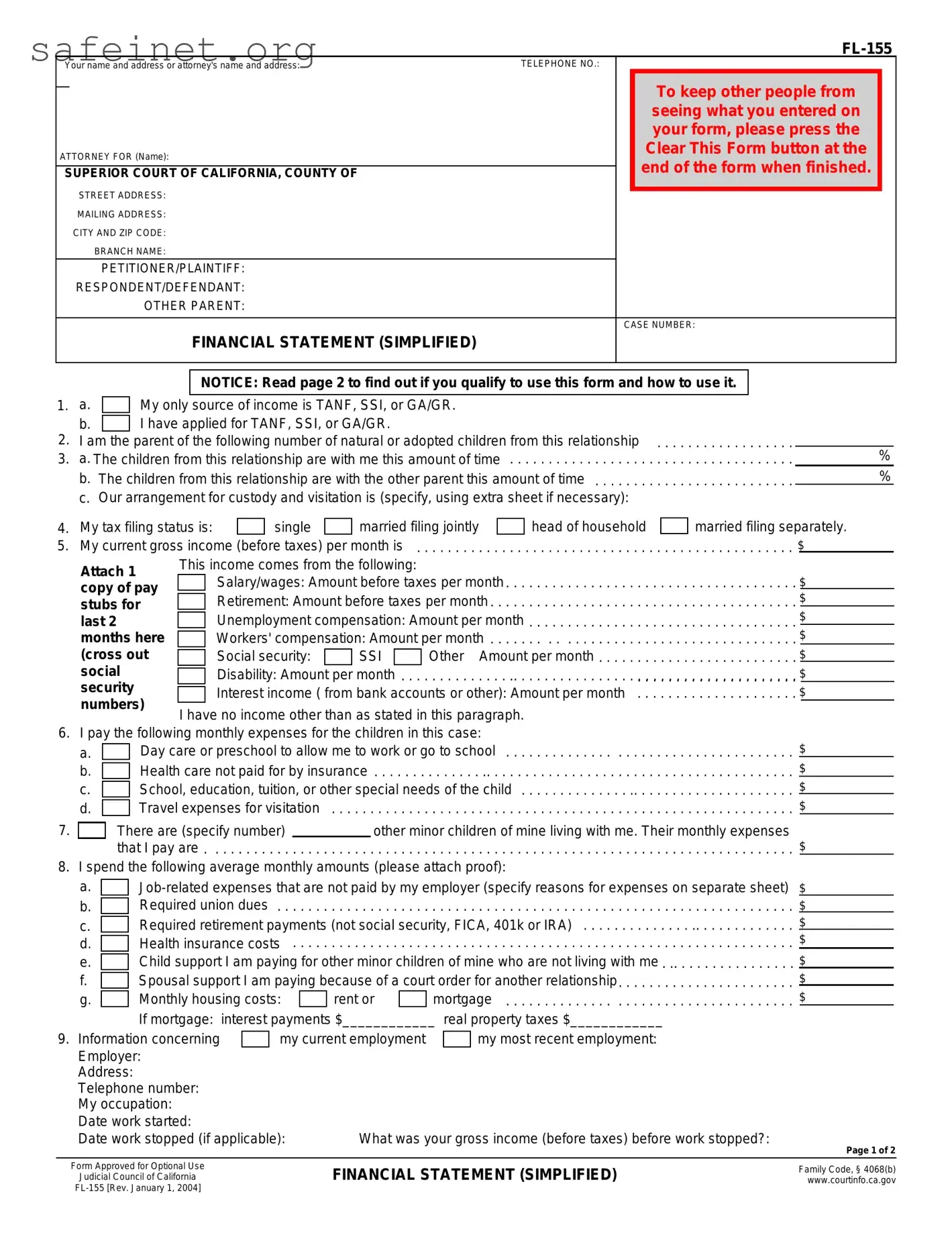

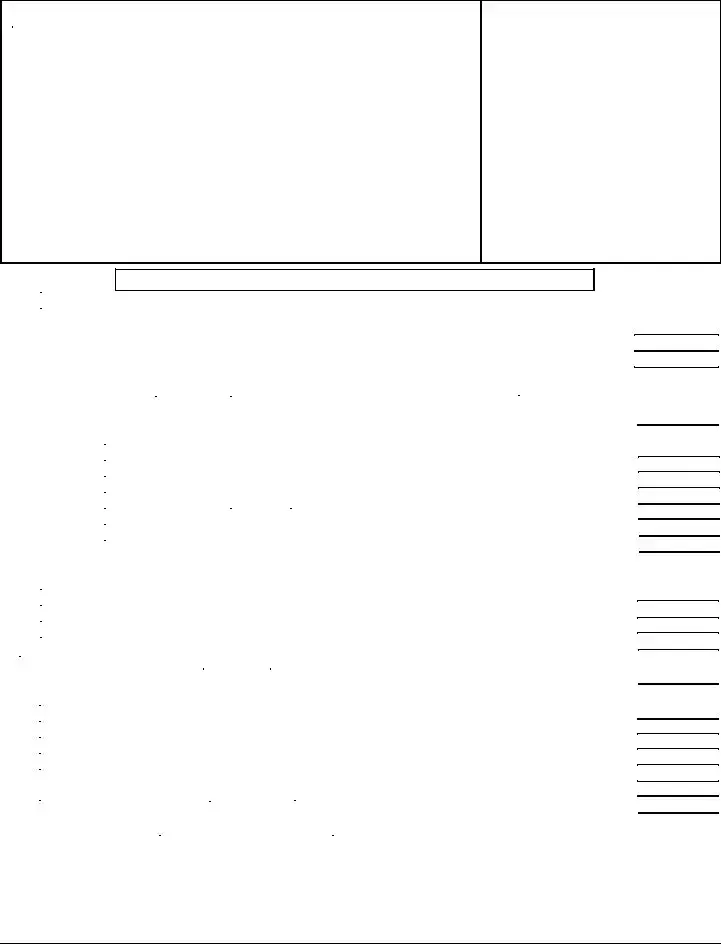

INSTRUCTIONS

Step 1: Are you eligible to use this form? If your answer is YES to any of the following questions, you may NOT use this form:

•Are you asking for spousal support (alimony) or a change in spousal support?

•Is your spouse or former spouse asking for spousal support (alimony) or a change in spousal support?

•Are you asking the other party to pay your attorney fees?

•Is the other party asking you to pay his or her attorney fees?

•Do you receive money (income) from any source other than the following?

• Welfare (such as TANF, GR, or GA)

• Salary or wages

• Disability

• Unemployment

• Are you self-employed?

If you are eligible to use this form and choose to do so, you do not need to complete the Income and Expense Declaration (form FL-150). Even if you are eligible to use this form, you may choose instead to use the Income and Expense Declaration (form FL-150).

Step 2: Make 2 copies of each of your pay stubs for the last two months. If you received money from other than wages or salary, include copies of the pay stub received with that money.

Privacy notice: If you wish, you may cross out your social security number if it appears on the pay stub, other payment notice or your tax return

Step 3: Make 2 copies of your most recent federal income tax form.

Step 4: Complete this form with the required information. Type the form if possible or complete it neatly and clearly in black ink. If you need additional room, please use plain or lined paper, 8½-by-11", and staple to this form.

Step 5: Make 2 copies of each side of this completed form and any attached pages.

Step 6: Serve a copy on the other party. Have someone other than yourself mail to the attorney for the other party, the other party, and the local child support agency, if they are handling the case, 1 copy of this form, 1 copy of each of your stubs for the last two months, and 1 copy of your most recent federal income tax return.

Step 7: File the original with the court. Staple this form with 1 copy of each of your pay stubs for the last two months. Take this document and give it to the clerk of the court. Check with your local court about how to submit your return.

Step 8: Keep the remaining copies of the documents for your file.

Step 9: Take the copy of your latest federal income tax return to the court hearing.

It is very important that you attend the hearings scheduled for this case. If you do not attend a hearing, the court may make an order without considering the information you want the court to consider.