|

|

|

|

2 |

|

7. Type or complete the report using block |

even if the entire address is not known. If the |

document used. In box “e” list the number of the |

|

written letters. |

street address, city, or ZIP Code is unknown, |

identifying document. In box “f” list the issuing |

|

enter “NA” in the item. If a state or country is |

state or country. If more space is required, enter |

8. If more than one subject is being reported, |

unknown, enter “XX” in the item. |

the additional information in Part VI. If the subject |

use as many copies of the Part I Subject |

|

is an entity or an individual’s identification was |

Information page as necessary to record the |

D. Item Preparation Instructions |

not available, check box “z” and enter “XX” in |

additional subjects. Attach the additional page(s) |

|

“Other.” |

|

|

|

behind page 1. If more than one transaction |

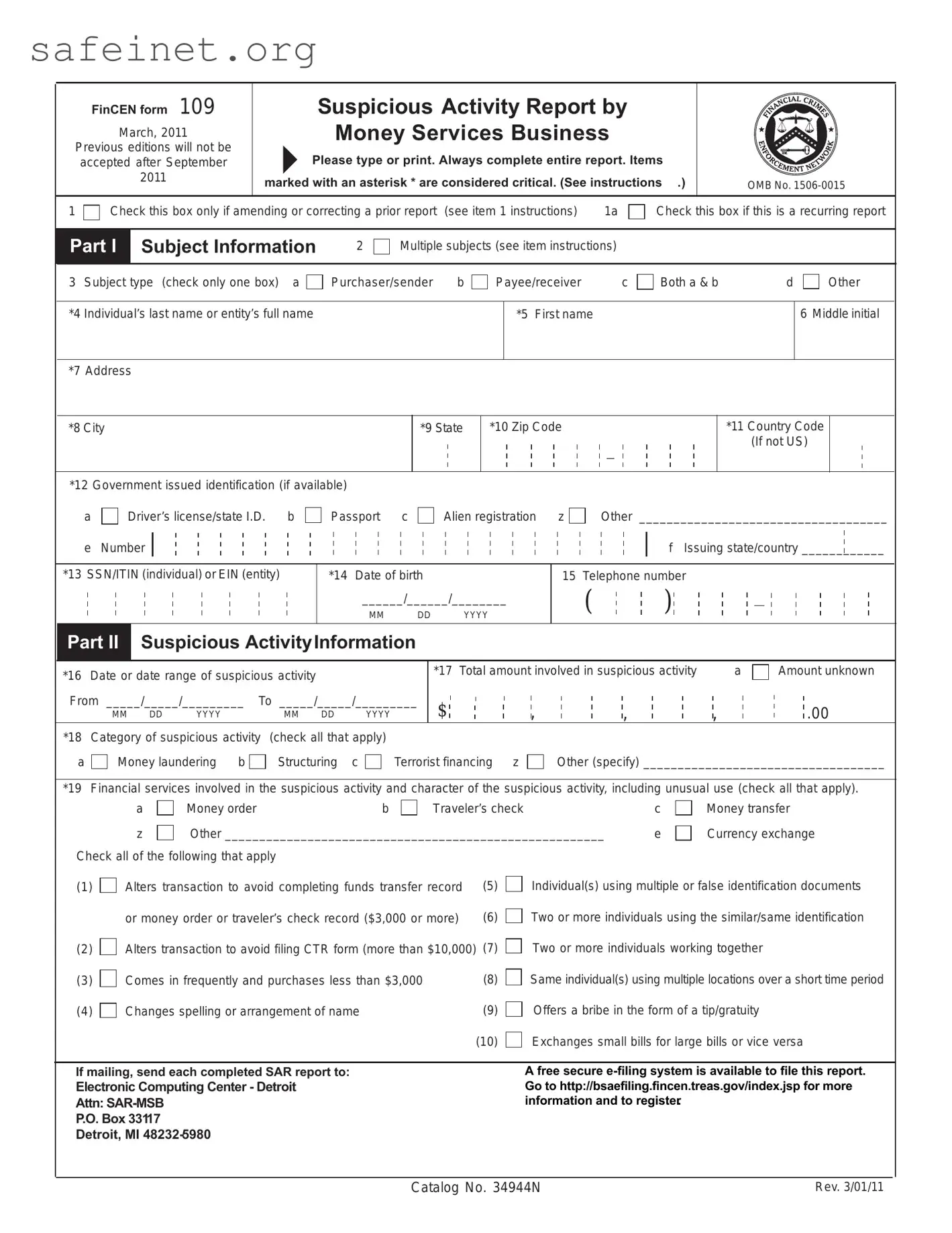

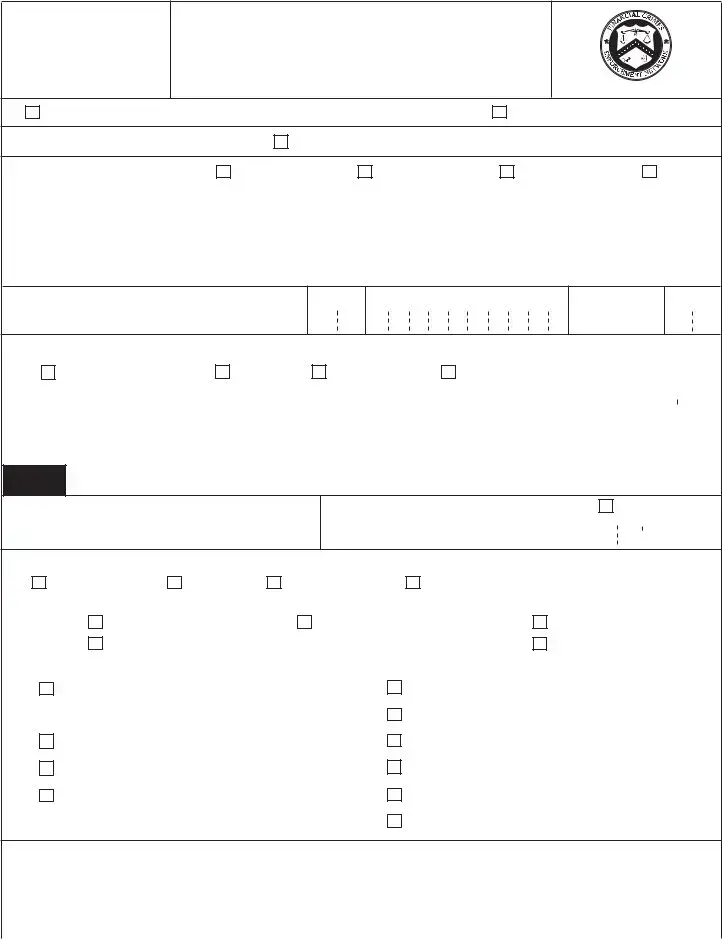

Item 1. Check the box if this report amends |

Item 13 |

*SSN/ITIN (individual) or EIN |

location is being reported, use as many copies of |

(adds missing data) or corrects errors in the prior |

the Part III Transaction Location Information page |

report. (See Part V, item “s”). |

(entity). |

See General Instruction 12 and |

as necessary to record the additional locations. |

|

definitions. If the subject named in Items 4 |

Attach the additional page(s) behind page 2. If |

Item 1a-- Check this box if this is a recurring |

through 6 is a U.S. Citizen or an alien with a SSN, |

more space is needed for the Part VI Narrative, |

report filed on continuing activity. |

enter his or her SSN in Item 13. If that person is |

add as many blank continuation pages as |

|

an alien who has an ITIN, enter that number. For |

necessary to complete the narrative. Attach the |

Part I Subject Information |

an entity, enter the EIN. If the SSN, ITIN, or EIN |

additional pages behind page 3. |

|

was unknown or not applicable, enter “XX” in this |

If more space is needed to complete any other |

Item 2 Multiple subjects. Check this box if |

item. |

|

|

|

multiple subjects are involved. Attach Part I |

Item 14 |

*Date of birth. See General |

item, identify that item in Part VI by “item |

Subject continuation pages behind page 1 to |

number” and provide the additional information. |

account for all additional subjects involved in the |

Instruction 9. If the subject is an individual, enter |

|

suspicious activity. |

the date of birth. If the month and/or day is not |

9. Enter all dates in MM/DD/YYYY format |

|

available or unknown, fill in with zeros (e.g., “01/ |

where MM = month, DD = day, and YYYY = |

Item 3 Subject type. Check box “a” if the |

00/1969” indicates an unknown date in January, |

year. Precede any single number with a zero, |

subject purchased a money order(s) or traveler’s |

1969). |

|

|

|

i.e., 01, 02, etc. |

check(s) or sent a money transfer(s). Check box |

Item 15 Telephone number. See General |

|

“b” if the subject cashed a money order(s) or |

10. Enter all telephone numberswith (area |

traveler’s check(s) or received payment of a money |

Instruction 10. Enter the U.S. home or business |

code) first and then the seven numbers, using |

transfer(s). Check box “c” if both “a” and “b” |

number for individual or entity. List foreign |

the format (XXX) XXX-XXXX. List fax and |

apply. If the transaction is a currency exchange |

telephone numbers and any additional U.S. |

international telephone numbers in Part VI. |

check box “c.” Check box “d” Other and describe |

numbers (e.g., hotel, etc.) in Part VI. |

|

in Part VI if the subject is an individual other than |

Part II Suspicious Activity Information |

11. Always enter an individual’s name by |

a customer. Examples are MSB employees and |

entering the last name, first name, and middle |

agents. |

Item 16 *Date or date rangeof suspicious |

initial (if known). If a legal entity is listed, enter |

|

its legal name in the last name item and trade |

Items 4, 5, and 6 *Name of subject. See |

activity. See General Instruction 9. Enter the |

name in the first name item. |

General Instruction 11. Enter the name of the |

date of the reported suspicious activity in the |

|

subject individual in Items 4 through 6. If the |

“From” field. If more than one day is involved, |

12. Enter all identifying numbers (alien |

MSB knows that the individual has an “also known |

indicate the duration of the activity by entering |

registration, driver’s license/state ID, EIN, ITIN, |

as” (AKA) or “doing business as” (DBA) name, enter |

the first date in the “From” field and the last date |

Foreign National ID, passport, SSN, vehicle |

that name in Part VI. If the subject is an entity, |

in the “To” field. |

license number, etc.) starting from left to right. |

enter the legal name in Item 4 and the trade or |

|

|

|

|

Do not include spaces or other punctuation. |

DBA name in item 5. If the legal name is not |

Item 17 *Total dollar amount. See General |

|

known, enter the DBA name in Item 4. If there is |

Instruction 14. If unknown, check box 17a.If the |

13. Enter all ZIP Codeswith at least the first |

more than one subject, use as many Part I Subject |

suspicious activity only involved purchases, or |

five numbers (ZIP+4, if known). |

Information continuation pages as necessary to |

redemptions, or currency exchanges, enter the |

|

provide the information about each subject. |

total U.S. Dollar value involved in the reported |

14. Enter all monetary amounts in U.S. |

Attach the additional copies behind page 1. When |

activity. For instance, if multiple money orders |

Dollars. Use whole dollar amounts rounded up |

there is more than one purchaser and/or payee |

from more than one issuer were redeemed, enter |

when necessary. Use this format: $000,000,000. |

(e.g., two or more transactions), indicate in Part VI |

the total of all money orders redeemed. If |

If foreign currency is involved, record the |

whether each subject is a purchaser or payee and |

multiple activities are involved, such as a |

currency amount in U.S. Dollars, name, and |

identify the instrument or money transfer |

redemption of money orders combined with |

country of origin in the Part VI narrative. |

information associated with each subject. If part |

purchase of a money transfer, enter the largest |

|

of an individual’s name is unknown, enter “XX” in |

activity amount in Item 17. For instance, if the |

15. Addresses, general. Enter the permanent |

the appropriate name item. If the subject is an |

transaction involved redeeming $5,000 in money |

street address, city, two letter state/territory |

entity, enter “XX” in Item 5 (if the trade or legal |

orders and purchase of a $3,500 money transfer , |

abbreviation used by the U.S. Postal Service, and |

name is not known) and in Item 6. |

the Item 17 amount would be $5,000. |

ZIP code (ZIP+4, if known) of the individual or |

Items 7 - 11 *Permanent address. See |

Item 18 |

*Category of suspicious activity. |

entity. A post office box number should not be |

used for an individual, unless no other address is |

General Instructions 13 and 15. Enter “XX” if the |

Check the box(es) which best identifies the |

available. For an individual also enter any |

street address, city, and ZIP Code items are |

suspicious activity. Check box “b Structuring” |

apartment number or suite number and road or |

unknown or not applicable. Enter “XX” if the |

when it appears that a person (acting alone, in |

route number. If a P.O. Box is used for an entity, |

state or country is not known. |

conjunction with, or on behalf of other persons) |

enter the street name, suite number, and road or |

Item 12 *Government issued identification (if |

conducts or attempts to conduct activity designed |

route number. If the address is in a foreign |

to evade any record keeping or reporting |

country, enter the city, province or state if Canada |

available). See General Instruction 12. Check |

requirement of the Bank Secrecy Act. If box “d” |

or Mexico, and the name of the country. |

the box showing the type of document used to |

is checked, specify the type of suspicious activity |

Complete any part of the address that is known, |

verify subject identity. If you check box |

which occurred. Describe the character of such |

|

“z Other”, be sure to specify the type of |

activity in Part VI. Box “z” should only be used if |

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .)

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .) .00

.00

)

)