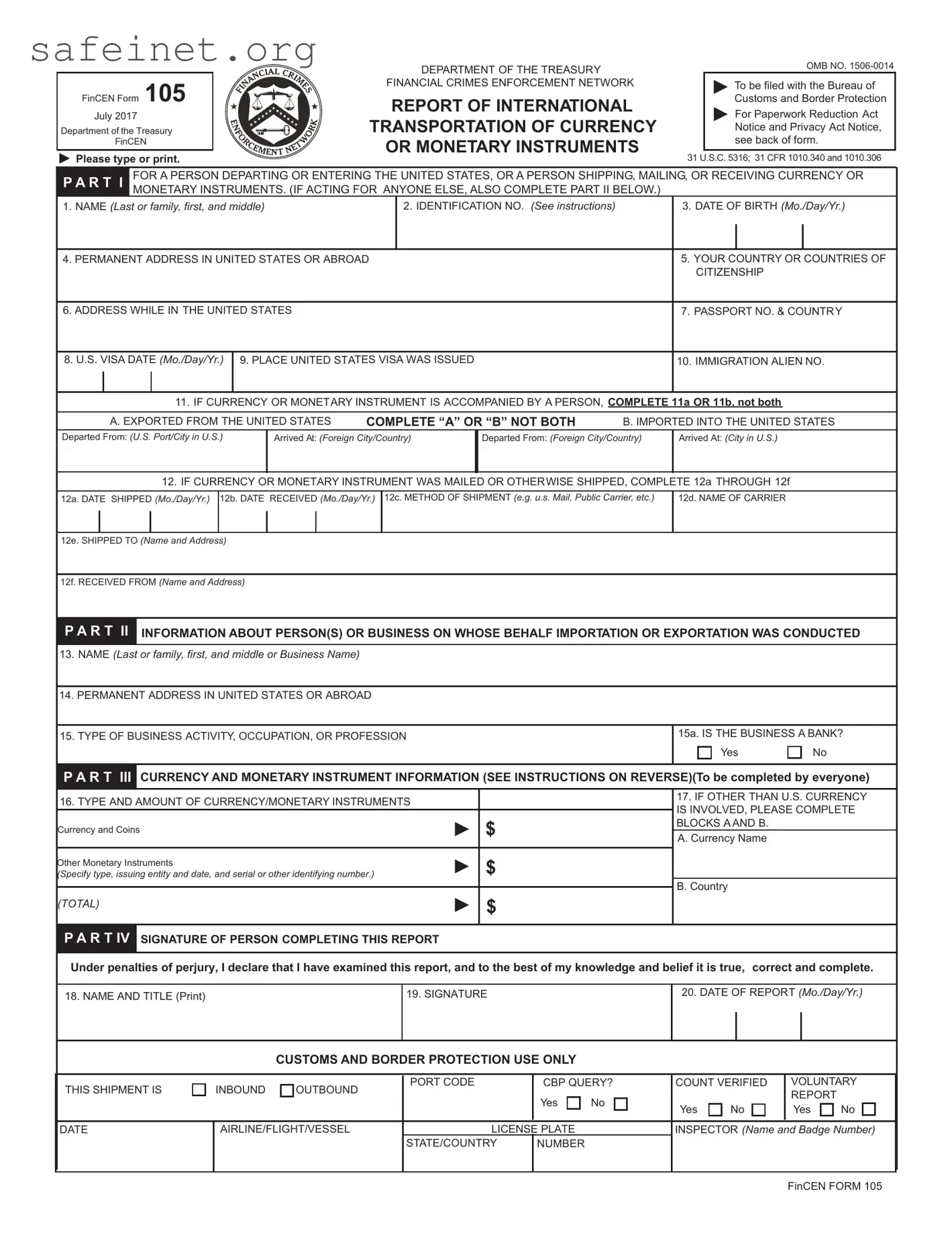

GENERAL INSTRUCTIONS

This report is required by 31 U.S.C. 5316 and Treasury Department regulations (31 CFR Chapter X).

WHO MUST FILE:

(1)Each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an aggregate amount exceeding $10,000 at one time from the United States to any place outside the United States or into the United States from any place outside the United States, and

(2)Each person who receives in the United States currency or other monetary instruments In an aggregate amount exceeding $10,000 at one time which have been transported, mailed, or shipped to the person from any place outside the United States.

A TRANSFER OF FUNDS THROUGH NORMAL BANKING PROCEDURES, WHICH DOES NOT INVOL VE THE PHYSICAL TRANSPORTATION OF CURRENCY OR MONETARY INSTRUMENTS, IS NOT REQUIRED TO BE REPORTED.

Exceptions: Reports are not required to be filed by:

(1)a Federal Reserve bank,

(2)a bank, a foreign bank, or a broker or dealer in securities in respect to currency or other monetary instruments mailed or shipped through the postal service or by common carrier,

(3)a commercial bank or trust company organized under the laws of any State or of the United States with respect to overland shipments of currency or monetary instruments shipped to or received from an established customer maintaining a deposit relationship with the bank, in amounts which the bank may reasonably conclude do not exceed amounts commensurate with the customary conduct of the business, industry, or profession of the customer concerned,

(4)a person who is not a citizen or resident of the United States in respect to currency or other monetary instruments mailed or shipped from abroad to a bank or broker or dealer in securities through the postal service or by common carrier,

(5)a common carrier of passengers in respect to currency or other monetary instruments in the possession of its passengers,

(6)a common carrier of goods in respect to shipments of currency or monetary instruments not declared to be such by the shipper,

(7)a travelers’ check issuer or its agent in respect to the transportation of travelers’ checks prior to their delivery to selling agents for eventual sale to the public,

(8)a person with a restrictively endorsed traveler’s check that is in the collection and reconciliation process after the traveler’s check has been negotiated, nor by

(9)a person engaged as a business in the transportation of currency, monetary instruments and other commercial papers with respect to the transportation of currency or other monetary instruments overland between established offices of banks or brokers or dealers in securities and foreign persons.

WHEN AND WHERE TO FILE:

A. Recipients—Each person who receives currency or other monetary instruments in the United States shall file FinCEN Form 105, within 15 days after receipt of the currency or monetary instruments, with the Customs officer in charge at any port of entry or departure or by mail addressed to: Attn: CMIR, Passenger Systems Directorate #1256, CBP, 7375 Boston Blvd., DHS, VA 20598-1256

B. Shippers or Mailers— lf the currency or other monetary instrument does not accompany the person entering or departing the United States, FinCEN Form 105 may be filed by mail on or before the date of entry, departure, mailing, or shipping addressed to: Attn: CMIR, Passenger Systems Directorate #1256, CBP, 7375, Boston Blvd., DHS, VA 20598-1256

C. Travelers— Travelers carrying currency or other monetary instruments with them shall file FinCEN Form 105 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or departure.

An additional report of a particular transportation, mailing, or shipping of currency or the monetary instruments is not required if a complete and truthful report has already been filed. However, no person otherwise required to file a report shall be excused from liability for failure to do so if, in fact, a complete and truthful report has not been filed. Forms may be obtained from any Bureau of Customs and Border Protection office.

PENALTIES: Civil and criminal penalties, including under certain circumstances a fine of not more than $500,000 and Imprisonment of not more than ten years, are provided for failure to file a report, filing a report containing a material omission or misstatement, or filing a false or fraudulent report. In addition, the currency or monetary instrument may be subject to seizure and forfeiture. See 31 U.S.C.5321 and 31 CFR 1010.820; 31 U.S.C. 5322 and 31 CFR 1010.840; 31 U.S.C. 5317 and 31 CFR 1010.830, and U.S.C. 5332.

DEFINITIONS:

Bank—Each agent, agency, branch or office within the United States of any person doing business in one or more of the capacities listed: (1) a commercial bank or trust company organized under the laws of any State or of the United States; (2) a private bank; (3) a savings association, savings and loan association, and building and loan

association organized under the laws of any State or of the United States; (4) an insured institution as defined in section 401 of the National Housing Act; (5) a savings bank, industrial bank or other thrift institution; (6) a credit union organized under the laws of any State or of the United States; (7) any other organization chartered under the banking laws of any State and subject to the supervision of the bank supervisory authorities of a State other than a money service business; (8) a bank organized under foreign law; and (9) any national banking association or corporation acting under the provisions of section 25A of the Federal Reserve Act (12 U.S.C. Sections 611-632).

Foreign Bank—A bank organized under foreign law, or an agency, branch or office located outside the United States of a bank. The term does not include an agent, agency, branch or office within the United States of a bank organized under foreign law.

Broker or Dealer in Securities— A broker or dealer in securities, registered or required to be registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934.

Currency: The coin and paper money of the United States or any other country that is (1) designated as legal tender and that (2) circulates and (3) is customarily accepted as a medium of exchange in the country of issuance.

Identification Number—Individuals must enter their social security number, if any. However, aliens who do not have a social security number should enter passport or alien registration number. All others should enter their employer identification number.

Monetary Instruments— (1) Coin or currency of the United States or of any other country, (2) traveler’s checks in any form, (3) negotiable instruments (including checks, promissory notes, and money orders) in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title thereto passes upon delivery, (4) incomplete instruments (including checks, promissory notes, and money orders) that are signed but on which the name of the payee has been omitted, and (5) securities or stock in bearer form or otherwise in such form that title thereto passes upon delivery. Monetary instruments do not include (i) checks or money orders made payable to the order of a named person which have not been endorsed or which bear restrictive endorsements, (ii) warehouse receipts, or (iii) bills of lading.

Person—An individual, a corporation, partnership, a trust or estate, a joint stock company, an association, a syndicate, joint venture or other unincorporated organization or group, an Indian Tribe (as that term is defined in the Indian Gaming Regulatory Act), and all entities cognizable as legal personalities.

SPECIAL INSTRUCTIONS:

You should complete each line that applies to you.PART I. — Complete 11A or 11B, not both. Block 12A and 12B; enter the exact date you shipped or received currency or monetary instrument(s). PART II. -Block 13; provide the complete name of the shipper or recipient on whose behalf the exportation or importation was conducted. PART III. — Specify type of instrument, issuing entity , and date, serial or other identifying number, and payee (if any). Block 17, if currency or monetary instruments of more than one country is involved, attach a list showing each type, country or origin and amount.

PRIVACY ACTAND PAPERWORK REDUCTION ACT NOTICE:

Pursuant to the requirements of Public law 93-579 (Privacy Act of 1974), notice is hereby given that the authority to collect information on Form 105 in accordance with 5 U.S.C. 552a(e)(3) is Public law 91-508; 31 U.S.C. 5316; 5 U.S.C. 301; Reorganization Plan No.1 of 1950; Treasury Department Order No. 165, revised, as amended; 31 CFR Chapter X; and 44 U.S.C. 3501.

The principal purpose for collecting the information is to assure maintenance of reports or records where such reports or records have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings. The information collected may be provided to those officers and employees of the Bureau of Customs and Border Protection and any other constituent unit of the Department of the Treasury who have a need for the records in the performance of their duties. The records may be referred to any other department or agency of the Federal Government upon the request of the head of such dep artment or agency. The information collected may also be provided to appropriate state, local, and foreign criminal law enforcement and regulatory personnel in the performance of their official duties.

Disclosure of this information is mandatory pursuant to 31 U.S.C. 5316 and 31 CFR Chapter X. Failure to provide all or any part of the requested information may subject the currency or monetary instruments to seizure and forfeiture, as well as subject the individual to civil and criminal liabilities.

Disclosure of the social security number is mandatory . The authority to collect this number is 31 U.S.C. 5316(b) and 31 CFR 1010.306(d). The social security number will be used as a means to identify the individual who files the record.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. The collection of this information is mandatory pursuant to 31 U.S.C. 5316, of Title

IIof the Bank Secrecy Act, which is administered by Treasury’s Financial Crimes Enforcement Network (FINCEN).

Statement required by 5 CFR 1320.8(b)(3)(iii): The estimated average burden associated with this collection of information is 11 minutes per respondent or record keeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Department of the Treasury, Financial Crimes Enforcement Network, P.O. Box 39 Vienna, Virginia 22183. DO NOT send completed forms to this office—See When and WhereoT File above.

FinCEN FORM 105

Please type or print.

Please type or print.