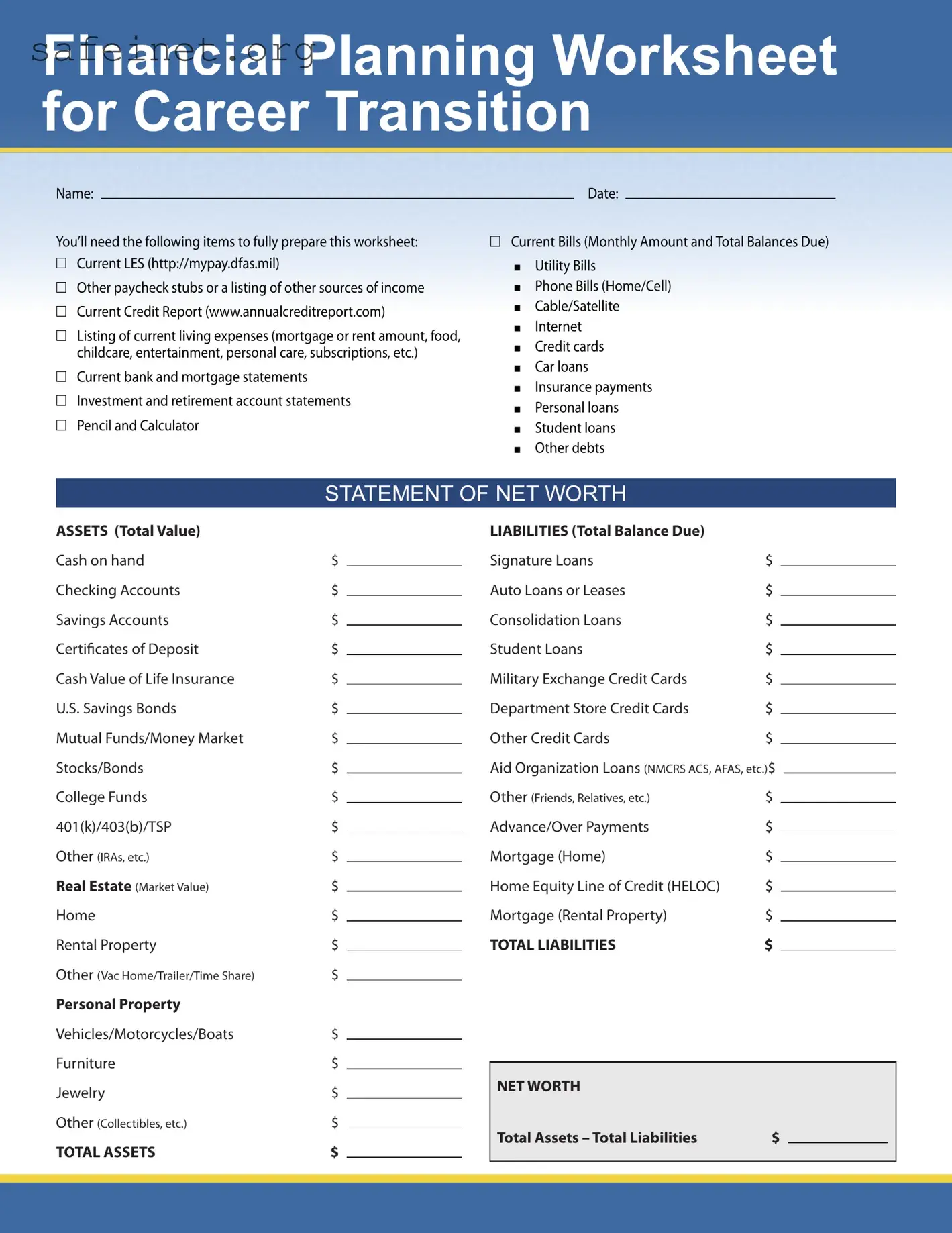

What is the purpose of the Financial Planning Worksheet for Career Transition?

The Financial Planning Worksheet for Career Transition serves as a comprehensive tool to assist individuals in assessing their financial situation as they transition into a new career. By evaluating income, expenses, assets, and liabilities, users can create a clear picture of their financial health and make informed decisions for future planning.

What information is needed to complete the worksheet?

To fully prepare the worksheet, gather several critical documents, including your current Leave and Earnings Statement (LES), paycheck stubs, credit reports, and bank statements. Additionally, have a complete list of living expenses, current bills, and records of investment and retirement accounts at hand. A pencil and calculator are also essential for calculations throughout the worksheet.

How does the worksheet help with budgeting?

The worksheet outlines both monthly income and expenses, which helps users identify where their money goes each month. By detailing fixed expenses such as housing and variable costs like entertainment and groceries, you can see clearly areas to adjust spending. This structured approach leads to improved budgeting and financial awareness.

What is ‘Net Worth,’ and why is it important?

Net Worth is the difference between total assets (what you own) and total liabilities (what you owe). Calculating your net worth is crucial because it provides insight into your overall financial health. A positive net worth suggests you're financially secure, while a negative net worth may indicate a need to reevaluate spending and saving habits.

Can this worksheet assist with debt management?

Yes, the worksheet includes a section for detailing indebtedness, which captures all debts and their respective payments. By organizing this information, users can devise strategies to reduce liabilities and manage debt more effectively. Tracking monthly payments and projecting future financial obligations will help with planning and staying on track.

What are the projected income and expense sections for?

Projected income and expense sections allow users to estimate future financial situations based on changing circumstances. By filling out these projections, such as anticipated salary changes or varying expenses, individuals can better prepare for shifts in their financial landscape. This forward-looking approach enhances preparedness and informed decision-making.

How can I set financial goals using this worksheet?

The worksheet provides a dedicated section for outlining transition goals, including specific desired costs and timelines for achieving those goals. Users can evaluate how much needs to be saved monthly to reach each financial target. This structured goal-setting creates accountability and a clear pathway towards financial success during and after the career transition.