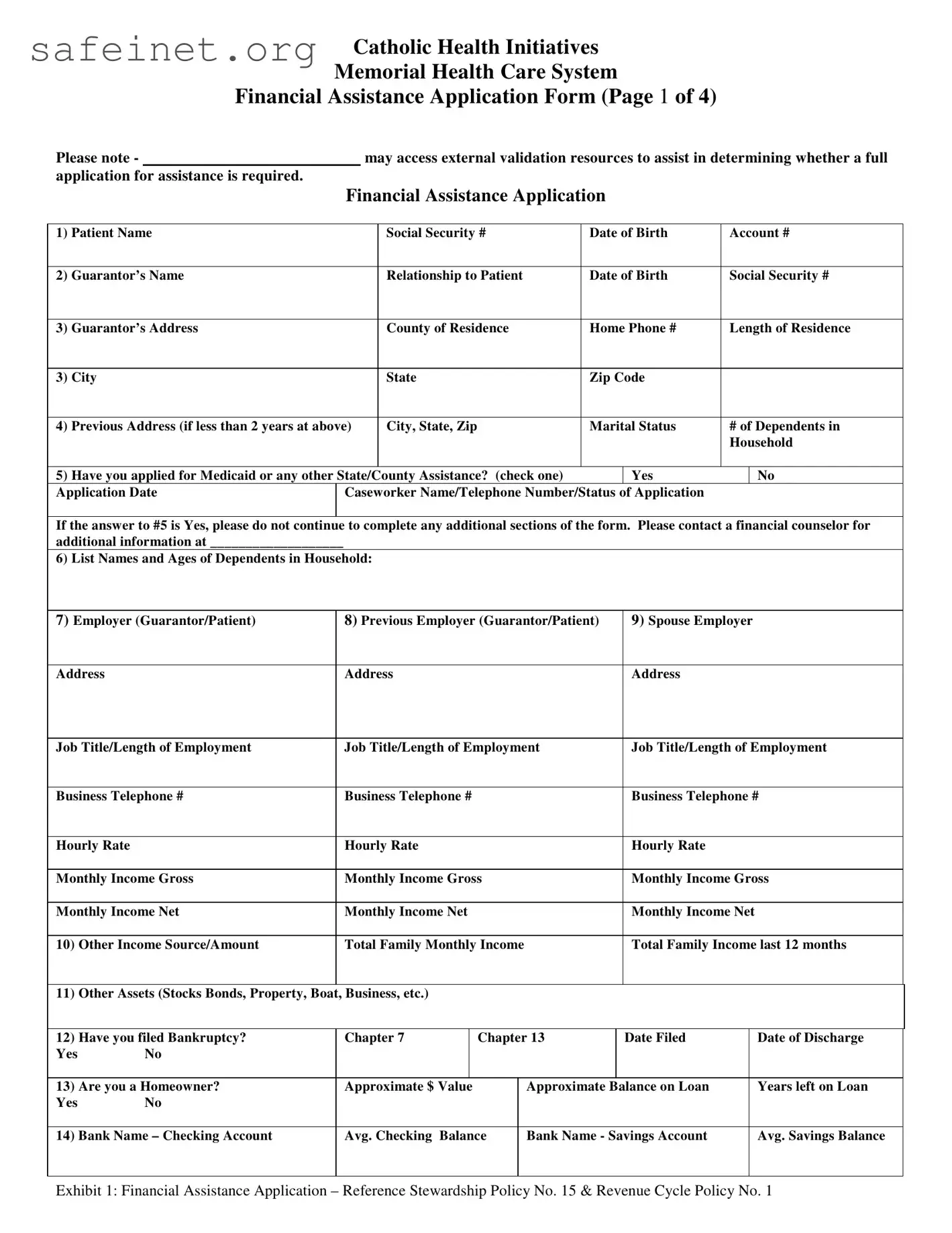

Catholic Health Initiatives

Memorial Health Care System

Financial Assistance Application Form (Page 3 of 4)

DIRECTIONS FOR COMPLETING FINANCIAL ASSISTANCE APPLICATION

1: Complete the patient name, patient’s social security number, patient’s date of birth, and the hospital account number(s) if known.

2: Complete the guarantor name, relationship to patient, guarantor’s date of birth, and guarantor’s social security number. If the guarantor is the same as the patient, note “Same” in this field.

3: Complete the guarantor’s address, home telephone number and length of residence at this address.

4: Complete the guarantor’s previous address (if current residence is less than two years), guarantor’s marital status, and number of dependents living in household. If there are no dependents, please mark “-0-“ in the dependent field.

5: Complete the questions regarding Medicaid and other State/County assistance. Please advise if you have applied for assistance (and on what date). Provide the assigned Caseworker’s name, telephone number and the status of the application. You may attach a separate sheet if needed. If your response is “Yes”, please do not proceed to complete any additional sections of the form. Please contact a financial counselor for additional information. If this section does not apply to you, please indicate this by marking it with N/A.

6: List the names and ages of dependents.

7: Complete the employer information for the guarantor or patient, depending upon who has responsibility for the balance. Please complete the name of the employer, the employer’s address, the guarantor/patient’s job title and length of employment. Please also include the guarantor/patient’s business telephone number, hourly (or salary) rate, and the monthly income (both gross and net). If there is no employment, please note how expenses are being met.

8: Complete the previous employer information for the guarantor/patient. This includes the employer’s name and address, the guarantor/patient’s job title and length of employment, business telephone number, hourly rate, and monthly income (both gross and net). If there is no prior employment, mark “N/A”.

9: Complete the income information for the guarantor/patient’s spouse. Include the name of the employer, the employer’s address, job title/length of employment, business telephone number, hourly rate, and monthly income (both gross and net). If the spouse is unemployed, or there is no spouse, mark “N/A”.

10: Complete the other income source/amount. This is for child support, social security, bonus amounts from employers, etc. This also includes rental income, alimony, pension income, welfare and VA benefits. Complete the total family income (add the guarantor/patient net income), then complete the total family income from the last 12 months. If there has been no income, please note how expenses are being met.

11:Please complete the section listing other assets you may have. This includes stocks, bonds, property, boats and businesses you may own. Use additional paper if needed to give complete details. If there are no additional assets, please mark “N/A”.

12: Please indicate if you have ever filed bankruptcy. If you have not filed bankruptcy, please mark “No”. Please verify that all questions have been completed. Attach additional paper if needed for any explanations.

13: Please complete the homeowner information. If you are a homeowner, please note the approximate dollar value, the approximate balance on the loan, and the number of years left on the loan. If you are not a homeowner, please mark “No”.

14: Please complete the banking information as requested and list the bank name. Complete the checking account number and provide the average checking account balance. Please do the same for the savings account field. If there is no savings account, please place “N/A” in the savings field.

15: For automobile information, please list the make, model and year of your vehicle. Please list the monthly payment amount and the current balance. Attach additional documentation for more than four autos.