What is the purpose of the Final Bill form?

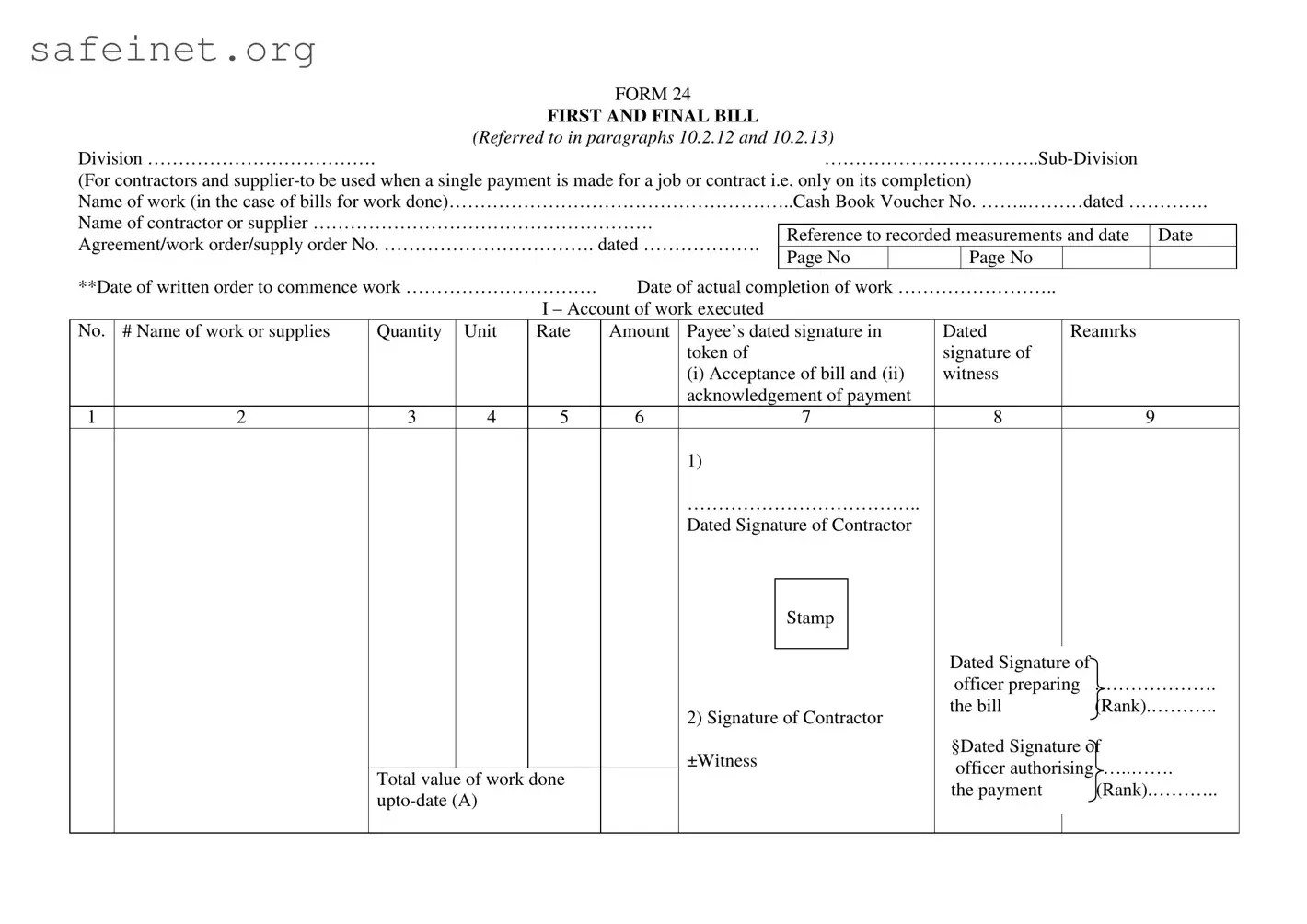

The Final Bill form, also known as FORM 24, is used when a contractor or supplier completes a job or contract and requests payment. This form ensures a systematic way to document the work done, calculate the amounts due, and facilitate the payment process within the contracting or procurement divisions.

Who should use the Final Bill form?

This form is specifically designed for contractors and suppliers who are receiving a single payment upon completion of a project or job. It is not intended for partial payments or ongoing projects. If you have completed a contract, using this form is essential to receive full compensation for your work.

What information is required on the Final Bill form?

The form requires several key pieces of information, including the name of the work, quantities and units of supplies, rates, total amounts, and dates of commencement and completion. Additionally, it requires signatures from the contractor and the officer preparing the bill, confirming the acceptance and awareness of payment. Accurate entries in all relevant sections are critical to prevent delays in payment.

What are the steps to fill out the Final Bill form?

To fill out the Final Bill form, start by entering the name of the work and any relevant cash book voucher details. Then, input the recorded measurements, contract details, and applicable dates. Proceed to account for work executed by detailing each line item regarding quantities, units, rates, and amounts. Following this, gather necessary signatures and any initials required for processing payments. Lastly, ensure that the totals are calculated correctly to match the amounts detailed in the payment summary section.

What should I do if I have not completed my work?

If the work is not completed, do not use the Final Bill form. Instead, consider detailing the work done up to that point in an alternative format or communicating with the contracting officer to discuss payment for partial work, if applicable. The form is specifically for completed projects, and using it prematurely could create complications.

Is it necessary to have witness signatures on the Final Bill form?

Yes, the form requires witness signatures to validate the payment acknowledgment. If the contractor provides a mark, seal, or thumb impression instead of a signature, a known person must attest to this acknowledgment. This process helps maintain transparency and accountability in financial transactions.

How do I submit the Final Bill form once completed?

Once the Final Bill form is completed, it should be submitted to the appropriate accounting or payment office within your organization. Ensure that all necessary signatures are obtained, and check that the totals are accurate. Submitting a fully completed form prevents delays in processing and helps ensure timely payment.

Can the amounts on the Final Bill form be adjusted after submission?

Adjustments to amounts on the Final Bill form should generally be avoided after submission. However, if discrepancies are found, communicate with the appropriate division as soon as possible. It may be necessary to provide documentation or an explanation to support any adjustments that need to be made.

What should I do if I notice an error on the Final Bill form?

Identifying an error on the Final Bill form should prompt immediate action. You must correct the mistake before submission, making the necessary adjustments and obtaining new signatures if required. If the form has already been submitted, consult with the relevant department to address the error and seek guidance on the next steps.

How do I know if my payment has been processed after submitting the Final Bill form?

After submitting the Final Bill form, it is advisable to follow up with the accounts department or the designated payment officer. Many organizations will provide a confirmation once payment processing is completed. Keeping a record of your submission and any related communications can assist in tracking your payment status effectively.