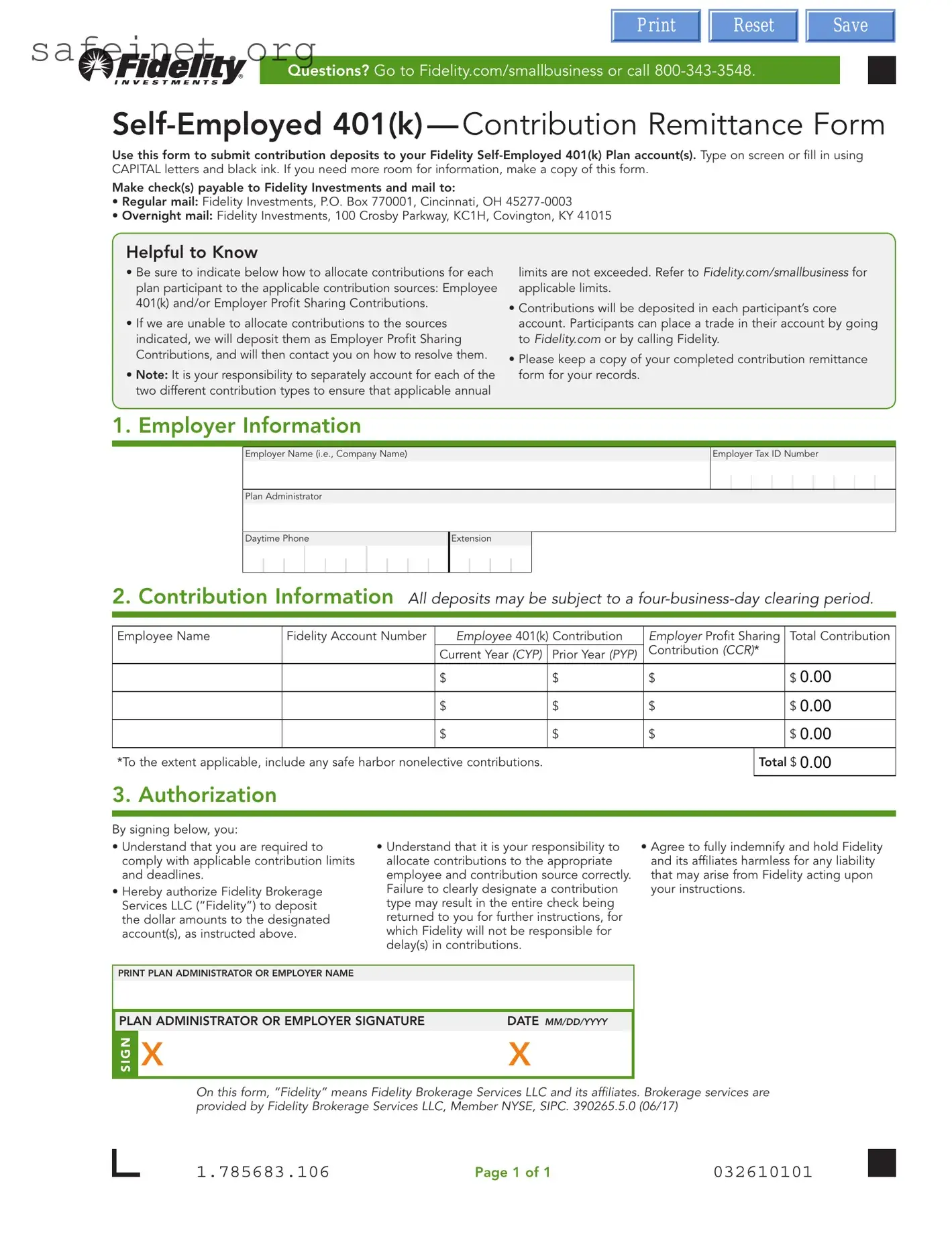

What is the purpose of the Fidelity Self Employed 401(k) Contribution Remittance Form?

This form serves as a means for self-employed individuals to submit their contribution deposits to a Fidelity Self-Employed 401(k) Plan account. It allows for the proper allocation of funds between employee 401(k) contributions and employer profit-sharing contributions. Accurate completion of this form ensures adherence to contribution limits and deadlines mandated by the plan.

How should I complete the Contribution Remittance Form?

When filling out the form, it is important to use capital letters and black ink for legibility. Begin by providing your employer information, including your Employer Name and Tax ID Number. Next, input the contribution information for each employee and their respective Fidelity account number. Specify the amounts for employee 401(k) contributions and employer profit-sharing contributions, detailing whether they pertain to the current or prior year. Make sure to keep a completed copy of the form for your records.

What are the mailing options for submitting the completed form?

You can submit your contribution deposits via regular or overnight mail. For regular mail, send your completed form and checks to Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0003. If you prefer overnight delivery, use the address Fidelity Investments, 100 Crosby Parkway, KC1H, Covington, KY 41015. Ensure that checks are made payable to Fidelity Investments.

What happens if contributions are not properly allocated?

If the contributions are not allocated as instructed on the form, Fidelity will default to depositing them as employer profit-sharing contributions. In such cases, Fidelity will reach out to address any discrepancies and resolve issues. It is critical to allocate contributions correctly to avoid potential delays or returns of checks due to incorrect designations.

What responsibilities do I have when submitting this form?

As the plan administrator or employer, you hold the responsibility of ensuring compliance with applicable contribution limits and deadlines. You must accurately allocate contributions to the correct employee and source within the form. Failure to do so may lead to administrative challenges or delays, for which Fidelity will not be liable. It is also necessary to indemnify and hold Fidelity harmless against any liability arising from acting on the instructions provided.