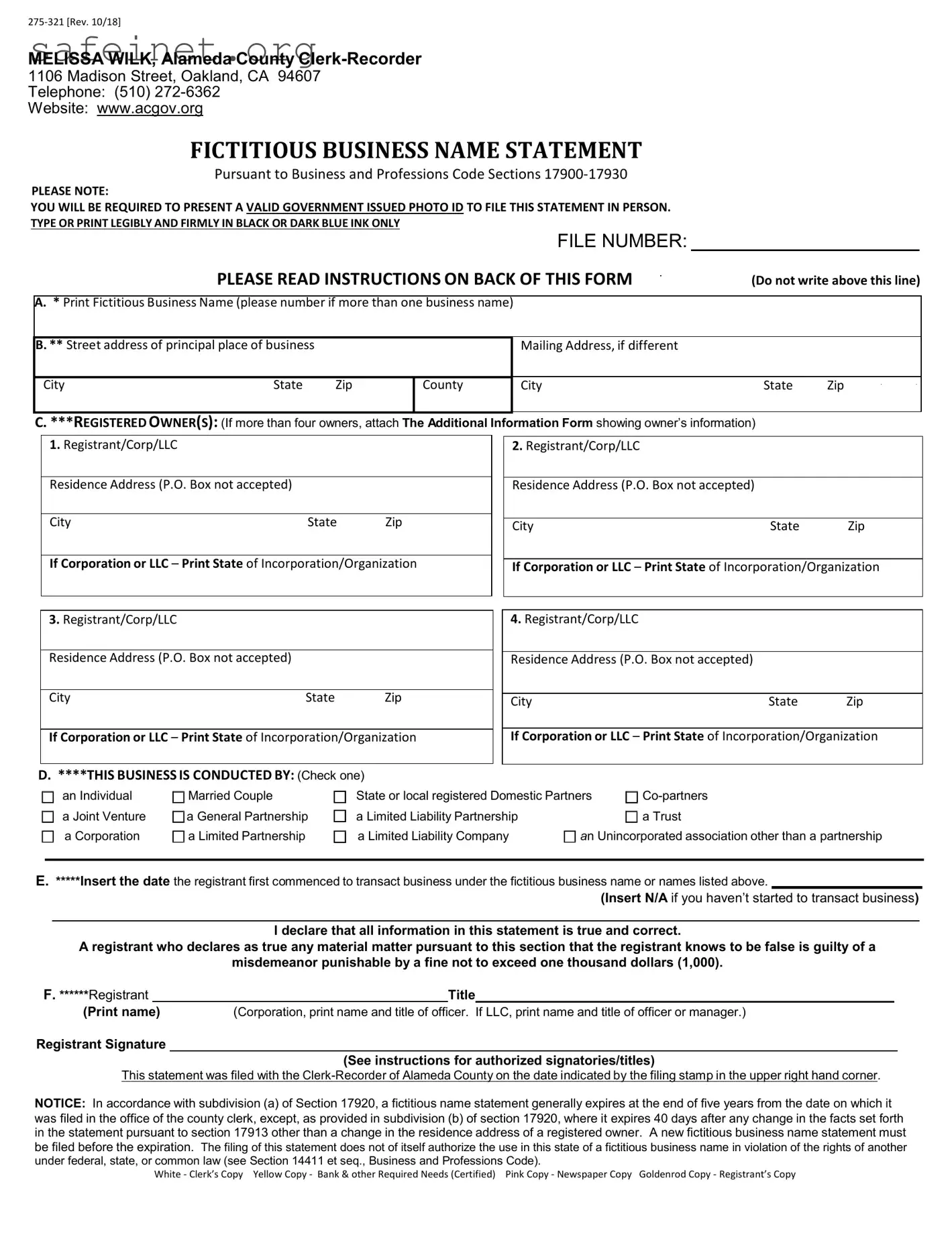

275‐321 [Rev. 10/18]

MELISSA WILK, Alameda County Clerk-Recorder

1106 Madison Street, Oakland, CA 94607

Telephone: (510) 272-6362

Website: www.acgov.org

FICTITIOUS BUSINESS NAME STATEMENT

Pursuant to Business and Professions Code Sections 17900‐17930

PLEASE NOTE:

YOU WILL BE REQUIRED TO PRESENT A VALID GOVERNMENT ISSUED PHOTO ID TO FILE THIS STATEMENT IN PERSON.

TYPE OR PRINT LEGIBLY AND FIRMLY IN BLACK OR DARK BLUE INK ONLY

|

FILE NUMBER: |

|

|

PLEASE READ INSTRUCTIONS ON BACK OF THIS FORM |

(Do not write above this line) |

|

|

|

|

A. * Print Fictitious Business Name (please number if more than one business name) |

|

|

|

|

|

|

B. ** Street address of principal place of business

Mailing Address, if different

C. ***REGISTERED OWNER(S): (If more than four owners, attach The Additional Information Form showing owner’s information)

1.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

If Corporation or LLC – Print State of Incorporation/Organization

3.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

If Corporation or LLC – Print State of Incorporation/Organization

2.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

If Corporation or LLC – Print State of Incorporation/Organization

4.Registrant/Corp/LLC

Residence Address (P.O. Box not accepted)

If Corporation or LLC – Print State of Incorporation/Organization

D. ****THIS BUSINESS IS CONDUCTED BY: (Check one)

|

|

an Individual |

|

Married Couple |

|

State or local registered Domestic Partners |

|

|

Co-partners |

|

|

a Joint Venture |

|

a General Partnership |

|

a Limited Liability Partnership |

|

|

|

|

a Trust |

|

|

|

|

|

|

|

|

|

|

a Corporation |

|

a Limited Partnership |

|

a Limited Liability Company |

|

An Unincorporated association other than a partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.*****Insert the date the registrant first commenced to transact business under the fictitious business name or names listed above.

(Insert N/A if you haven’t started to transact business)

I declare that all information in this statement is true and correct.

A registrant who declares as true any material matter pursuant to this section that the registrant knows to be false is guilty of a

misdemeanor punishable by a fine not to exceed one thousand dollars (1,000).

F. ******Registrant |

|

Title |

|

(Print name) |

(Corporation, print name and title of officer. If LLC, print name and title of officer or manager.) |

|

Registrant Signature |

|

|

|

|

|

|

(See instructions for authorized signatories/titles) |

|

This statement was filed with the Clerk-Recorder of Alameda County on the date indicated by the filing stamp in the upper right hand corner.

NOTICE: In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision (b) of section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in the residence address of a registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under federal, state, or common law (see Section 14411 et seq., Business and Professions Code).

White ‐ Clerk’s Copy Yellow Copy ‐ Bank & other Required Needs (Certified) Pink Copy ‐ Newspaper Copy Goldenrod Copy ‐ Registrant’s Copy

275‐321 [Rev. 10/18]

INSTRUCTIONS FOR COMPLETION OF FICTITIOUS BUSINESS NAME STATEMENT

THE INFORMATION BELOW IS NOT TO BE PUBLISHED (SEC. 17924, B&P)

REQUIREMENTS FOR FILING THE STATEMENT

Every person or entity who regularly transacts business in this state for profit using a fictitious business name shall file a fictitious business name (FBN) statement not later than 40 days from the date such business commences. The registrant shall file a new statement on or before the date of expiration of each FBN statement. The statement shall be filed in the county in which the principal place of business is located. If the principal place of business is outside this state, the statement shall be filed with the Clerk of Sacramento County.

CONTENTS OF THE STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17913)

A. * Where one asterisk appears in the form:

(a)Insert the fictitious business name or names. (For additional business names use The Additional Information Form.)

(b)Only those businesses operated at the same address and under the same ownership may be listed on one statement.

(c)If the fictitious name includes Corporation, Corp, Incorporated, INC., PC, Limited Liability Company, LLP, or LLC, the registrant must also submit a state endorsed copy of the articles of incorporation or articles of organization for such name or for such registrant.

B.** Where two asterisks appear in the form:

(a)If the registrant has a place of business in this state, insert the street address and county of his or her principal place of business in this state.

(b)P.O. Box, postal drop box, mailing suite, or c/o addresses are not acceptable.

(c)If the registrant has no place of business in this state, insert the street address and county of his or her principal place of business outside this state and file with the Clerk of Sacramento County (B&P 17915).

PERSONS REQUIRED ON STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17913)

C. *** Where three asterisks appear in the form:

(a)If the registrant is an individual, insert his or her full name and residence address.

(b)If the registrants are a married couple, insert the full name and residence address of both parties to the marriage.

(c)If the registrant is a general partnership, co-partnership, joint venture, limited liability partnership, or (unincorporated association other than a partnership), insert the full name and residence address of each general partner.

(d)If the registrant is a limited partnership, insert the full name and residence address of each general partner.

(e)If the registrant is a limited liability company, insert the name and address of the limited liability company, as set out in its articles of organization on file with the CA Secretary of State, and the state of organization.

(f)If the registrant is a trust, insert the full name and residence address of each trustee

(g)If the registrant is a corporation, insert the name and address of the corporation, as set out in its articles of incorporation on file with the CA Secretary of State, and the state of incorporation.

(h)If the registrants are state or local registered domestic partners, insert the full name and residence address of each domestic partner.

D.**** Where four asterisks appear in the form:

(a)Check whichever of the terms listed on the front of the form best describes the nature of the business.

E.***** Where five asterisks appear in the form:

(a)Insert the date on which the registrant first commenced to transact business under the fictitious business name or names listed, if already transacting business under that name or names.

(b)Insert N/A if you have not yet commenced to transact business under the fictitious business name or names listed.

PERSONS REQUIRED TO SIGN STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17914)

F. ****** Where six asterisk appears in the form:

The statement shall be signed as follows:

(a)If the registrant is an individual, by the individual.

(b)If the registrants are a married couple, by either party to the marriage.

(c)If the registrant is a general partnership, limited partnership, limited liability partnership, co-partnership, joint venture, or unincorporated association other than a partnership, by a general partner.

(d)If the registrant is a limited liability company, by a manager or officer. (Ex: Managing Member, Member, or Principal)

(e)If the registrant is a trust, by a trustee.

(f)If the registrant is a corporation, by an officer. (Ex: CEO, President, Secretary, Treasurer, Vice President)

(g) If the registrant is a state or local registered domestic partnership, by one of the domestic partners.

PLACE OF FILING STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17915)

The fictitious business name statement shall be filed with the clerk of the county in which the registrant has his or her principal place of business in this state or, if the registrant has no place of business in this state, with the Clerk of Sacramento County. Nothing in this chapter shall preclude a person from filing a fictitious business name statement in a county other than that where the principal place of business is located, as long as the requirements of this subdivision are also met.

PUBLICATION OF NOTICE (BUSINESS AND PROFESSIONS CODE SECTION 17917)

Publication for Original, New Filings (renewal with change in facts from previous filing), or Refile

(a)Within 30 days after a fictitious business name statement has been filed, the registrant shall cause it to be published in a newspaper of general circulation in the county where the fictitious business name statement was filed or, if there is no such newspaper in that county, in a newspaper of general circulation in an adjoining county. The publication must be once a week for four successive weeks and an affidavit of publication must be filed with the county clerk where the fictitious business name statement was filed within 30 days after the completion of the publication.

(b)If a refiling is required because the prior statement has expired, the refiling need not be published, unless there has been a change in the information required in the expired statement, provided the refiling is filed within 40 days of the date the statement expired.

EXPIRATION OF FICTITIOUS BUSINESS NAME STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17920)

(a)Unless the statement expires earlier under (b) or (c) below, a fictitious business name statement expires five years from the date it was filed.

A NEW STATEMENT MUST BE FILED BEFORE THE EXPIRATION DATE.

(b)A fictitious business name statement expires 40 days after any change in the facts set forth in the statement, except (1) a change in the residence address of an individual, general partner, or trustee does not cause the statement to expire prior to the end of the five year term; and

(2)the filing of a statement of withdrawal from partnership by a withdrawing partner does not cause the statement to expire prior to the end of the five year term. A NEW STATEMENT MUST BE FILED WITHIN 40 DAYS AFTER A CHANGE IN THE FACTS.

(c)A fictitious business name statement expires when the registrant files a statement of abandonment of the fictitious business name described

in the statement.

PENALTY FOR EXECUTION, FILING OR PUBLICATION OF FALSE STATEMENT (BUSINESS AND PROFESSIONS CODE SECTION 17930)

Any person who executes, files, or publishes any statement under this chapter, knowing that such statement is false, in whole or in part, shall be guilty of a misdemeanor and upon conviction thereof shall be punished by a fine not to exceed one thousand dollars ($1,000).