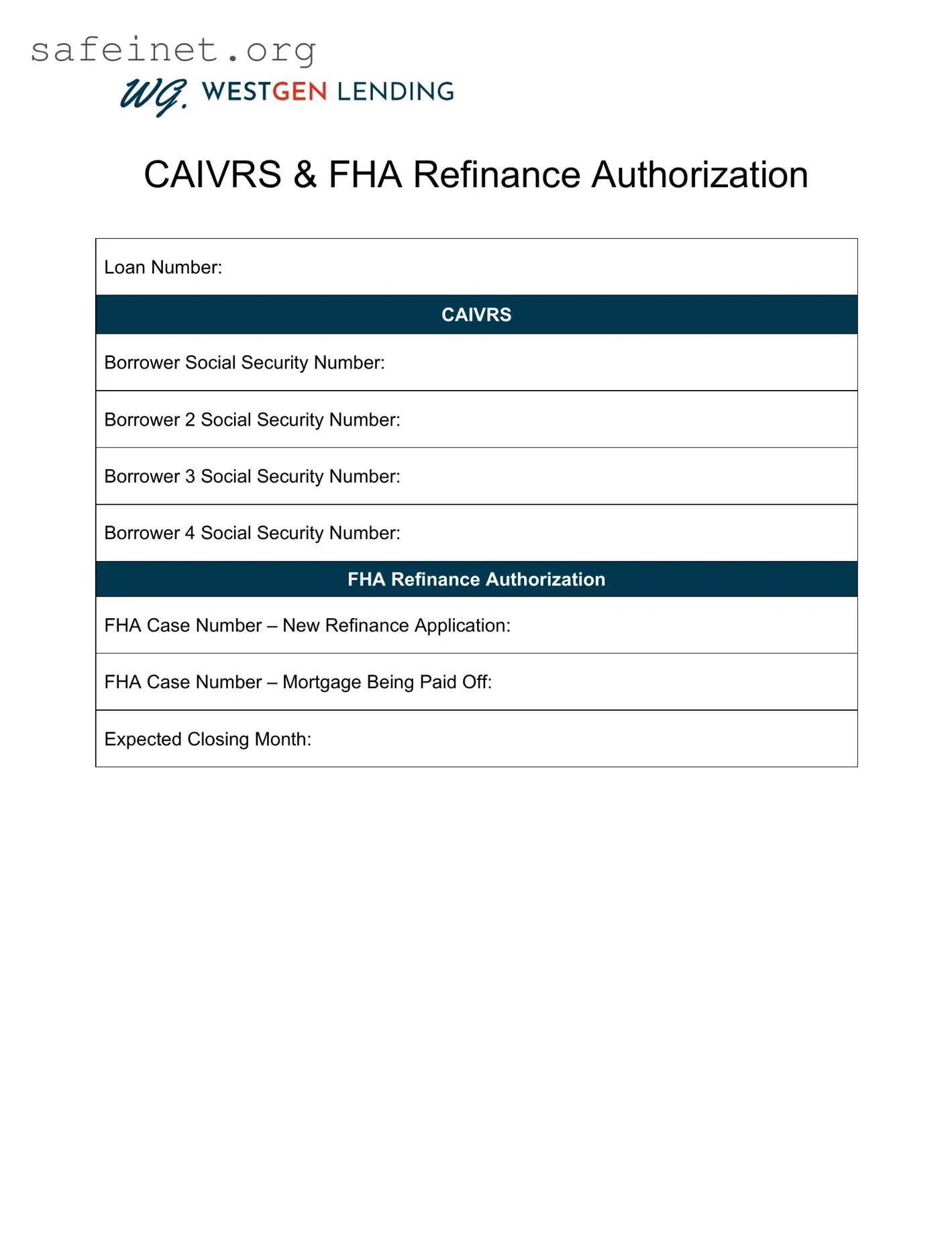

What is the FHA Refinance Authorization form?

The FHA Refinance Authorization form is a document required when you are looking to refinance your existing FHA loan. This form gives your lender permission to obtain information, such as your credit report and the status of your current mortgage, which is necessary for processing the refinancing application.

Why do I need to fill out the Social Security Number section?

The Social Security Number section collects essential identification information for each borrower. This data helps lenders verify your identity and assess your creditworthiness. Providing accurate Social Security Numbers ensures a smoother process and helps avoid any delays in your refinancing application.

What is CAIVRS, and why is it mentioned in the form?

CAIVRS stands for the Credit Alert Verification Reporting System. It is a database that includes information about borrowers who have defaulted on federal loans. Your lender will use this information to determine your eligibility for refinancing. If you’re listed in CAIVRS, it may affect your ability to get a new FHA loan.

What are the FHA Case Numbers mentioned in the form?

The form requires two FHA Case Numbers: one for the new refinance application and one for the mortgage you are paying off. The new FHA Case Number is assigned when you start the refinancing process, while the mortgage being paid off refers to the existing loan you want to replace. Both numbers are crucial for tracking your loan and ensuring the refinancing goes through without issues.

How does the 'Expected Closing Month' section work?

This section allows you to provide an estimate of when you plan to close on the new loan. It helps lenders plan and streamline the refinancing process. When you fill this out, make sure to consider any factors that might affect your closing timeline, such as home inspections or appraisal scheduling.

Can I complete the FHA Refinance Authorization form electronically?

Yes, many lenders now allow borrowers to complete the FHA Refinance Authorization form electronically. This can save time and make the process more convenient. Just ensure you securely submit the form and follow your lender's specific instructions for electronic submissions.

What happens if I do not complete the authorization form?

If you choose not to fill out the FHA Refinance Authorization form, your lender will be unable to request the necessary information required for your refinancing application. This could delay or even halt your refinancing process, so it’s essential to complete this form promptly and accurately.

Who should I contact if I have questions about the form?

If you have questions about the FHA Refinance Authorization form, your first point of contact should be your lender or mortgage broker. They can provide guidance specific to your situation and help clarify any uncertainties you may have about filling out the form.

How long does it take to process the refinancing after submitting the form?

The processing time can vary depending on several factors, including the lender's workload and your specific financial situation. Typically, it may take anywhere from a few weeks to a couple of months. Staying in contact with your lender for updates can help you stay informed about your application’s progress.