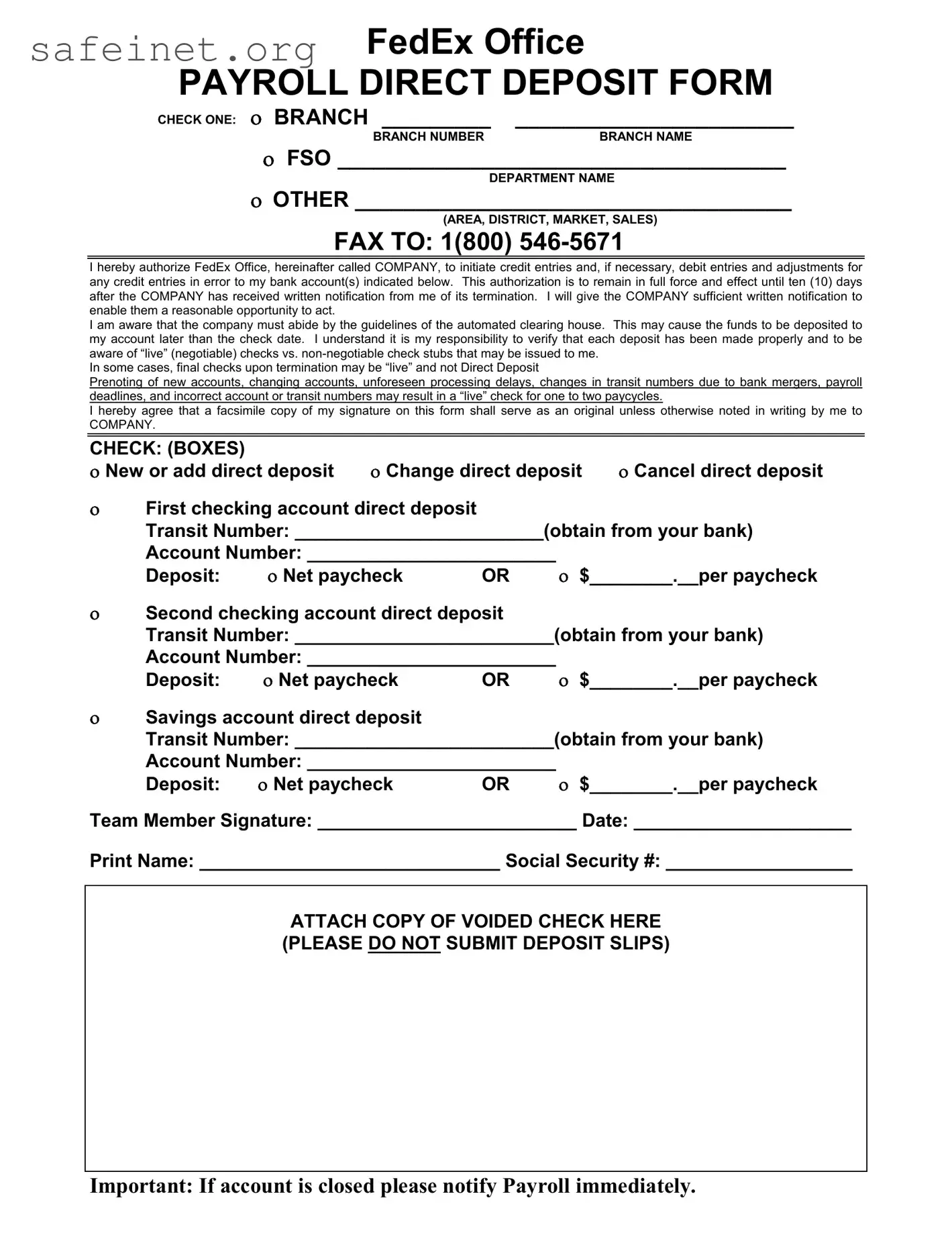

FedEx Office

PAYROLL DIRECT DEPOSIT FORM

CHECK ONE: ο BRANCH _________ |

_______________________ |

BRANCH NUMBER |

BRANCH NAME |

οFSO _____________________________________

DEPARTMENT NAME

οOTHER ____________________________________

(AREA, DISTRICT, MARKET, SALES)

FAX TO: 1(800) 546-5671

I hereby authorize FedEx Office, hereinafter called COMPANY, to initiate credit entries and, if necessary, debit entries and adjustments for any credit entries in error to my bank account(s) indicated below. This authorization is to remain in full force and effect until ten (10) days after the COMPANY has received written notification from me of its termination. I will give the COMPANY sufficient written notification to enable them a reasonable opportunity to act.

I am aware that the company must abide by the guidelines of the automated clearing house. This may cause the funds to be deposited to my account later than the check date. I understand it is my responsibility to verify that each deposit has been made properly and to be aware of “live” (negotiable) checks vs. non-negotiable check stubs that may be issued to me.

In some cases, final checks upon termination may be “live” and not Direct Deposit

Prenoting of new accounts, changing accounts, unforeseen processing delays, changes in transit numbers due to bank mergers, payroll deadlines, and incorrect account or transit numbers may result in a “live” check for one to two paycycles.

I hereby agree that a facsimile copy of my signature on this form shall serve as an original unless otherwise noted in writing by me to

COMPANY.

CHECK: (BOXES) |

|

|

ο New or add direct deposit |

ο Change direct deposit |

ο Cancel direct deposit |

οFirst checking account direct deposit

Transit Number: ________________________(obtain from your bank)

Account Number: ________________________

Deposit: |

ο Net paycheck |

OR |

ο $________.__per paycheck |

οSecond checking account direct deposit

Transit Number: _________________________(obtain from your bank)

Account Number: ________________________

Deposit: |

ο Net paycheck |

OR |

ο $________.__per paycheck |

οSavings account direct deposit

Transit Number: _________________________(obtain from your bank)

Account Number: ________________________

Deposit: ο Net paycheck OR ο $________.__per paycheck

Team Member Signature: _________________________ Date: _____________________

Print Name: _____________________________ Social Security #: __________________

ATTACH COPY OF VOIDED CHECK HERE (PLEASE DO NOT SUBMIT DEPOSIT SLIPS)