1. What is the Federal Probation Report form?

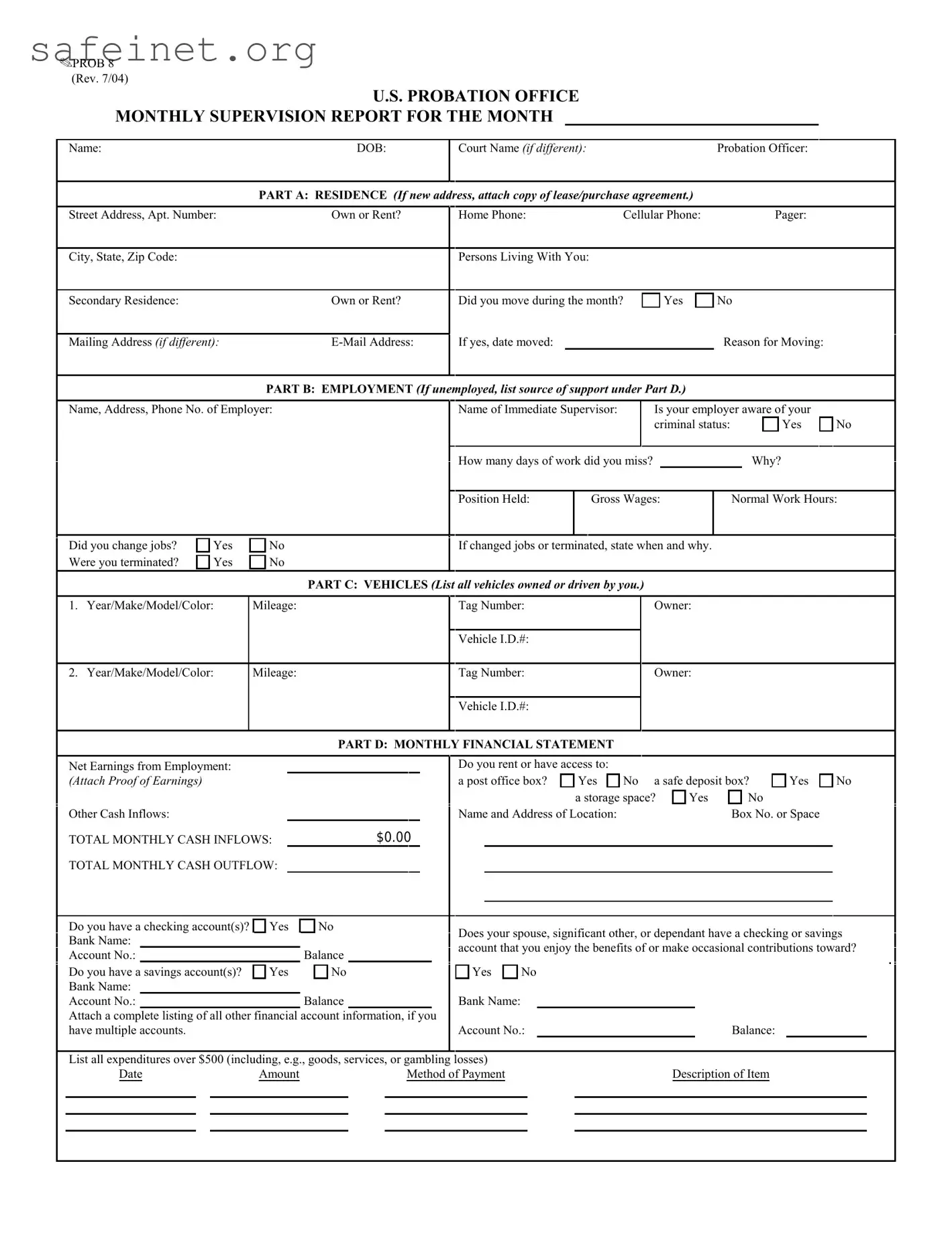

The Federal Probation Report form, also known as the OPROB 8, is a monthly supervision report that individuals on probation are required to complete. It gathers essential information about a person's residence, employment, financial status, and compliance with the conditions of their supervision. This document is crucial for the probation officer to monitor progress and ensure adherence to the terms set by the court.

2. Who needs to fill out this form?

Individuals who are currently on probation or supervised release must complete this form each month. This helps probation officers track compliance with the terms of probation and assess whether the individual is making progress toward rehabilitation.

3. What information is required in the residence section?

In the residence section, individuals must provide their current address, whether they own or rent, and details about anyone living with them. If there has been a recent move, they should also include the reason for moving and attach relevant documentation, like a lease or purchase agreement.

4. What should I include in the employment section?

In the employment section, you must provide your employer's name, address, and phone number. It is also important to indicate your job title, normal work hours, gross wages, and whether there were any changes in employment status, such as job termination or changes in workload. People should mention the number of workdays missed and the reasons for any absences.

5. How do I report my financial situation?

The financial section requires individuals to report total monthly cash inflows, including earnings from employment and other income sources. You should also detail your total monthly cash outflow and report on any checking or savings accounts you or your dependents have. Additionally, any large expenditures over $500 need to be documented here.

6. What does the compliance section cover?

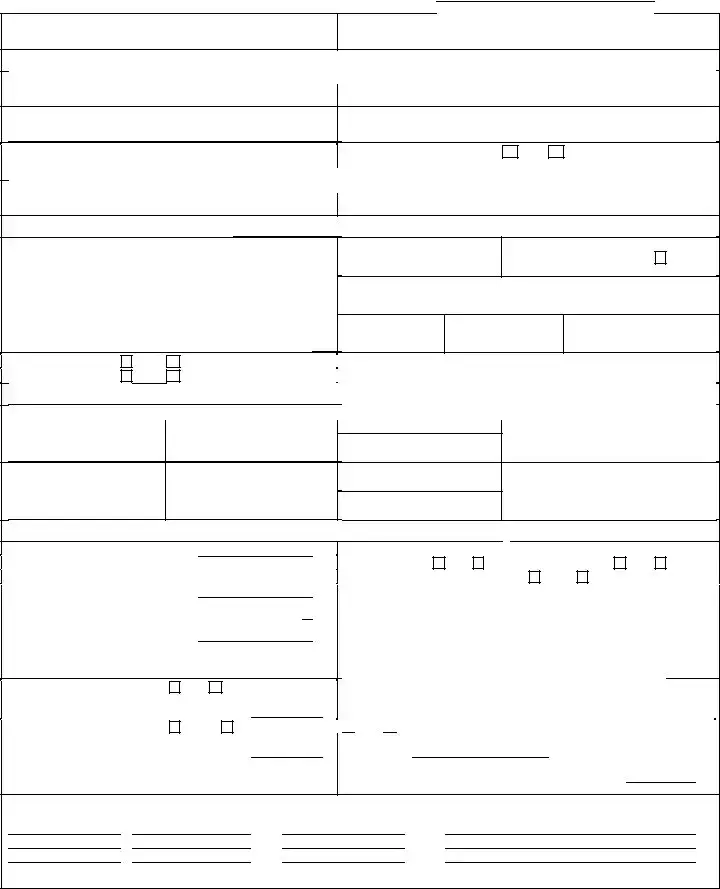

This section concerns compliance with the conditions of supervision over the past month. You will need to disclose any interactions with law enforcement, arrests, or any contact with individuals who have criminal records. Additionally, it's essential to report any possession of firearms or use of illegal substances, as these may violate probation conditions.

7. What happens if I provide false information on this form?

Providing false information can have serious consequences. Such actions may result in the revocation of probation, supervised release, or parole. Legal repercussions include imprisonment for up to five years, hefty fines reaching $250,000, or both. It is vital to be honest and thorough when filling out the form.

8. Is there a specific method for making payments mentioned in the form?

Yes, the form specifies that all payments related to special assessments, restitution, or fines must be made by money order (either postal or bank) or cashier’s check only. This is typically required to ensure secure payment processing in compliance with financial obligations.

9. What should I do if I have missed any appointments for drug or mental health treatment?

If you have missed treatment sessions, it is important to report that accurately on the form. You should note how many sessions you missed and the balance of remaining hours needed. This information is crucial for probation officers in managing your treatment plan and making necessary adjustments.

10. How do I submit this form?

The completed Federal Probation Report form should be returned to your designated U.S. Probation Officer. It’s important to ensure that you file it by the monthly deadline to remain in good standing with your probation requirements. Always keep a copy for your records for reference and tracking purposes.

Yes

Yes  No

No