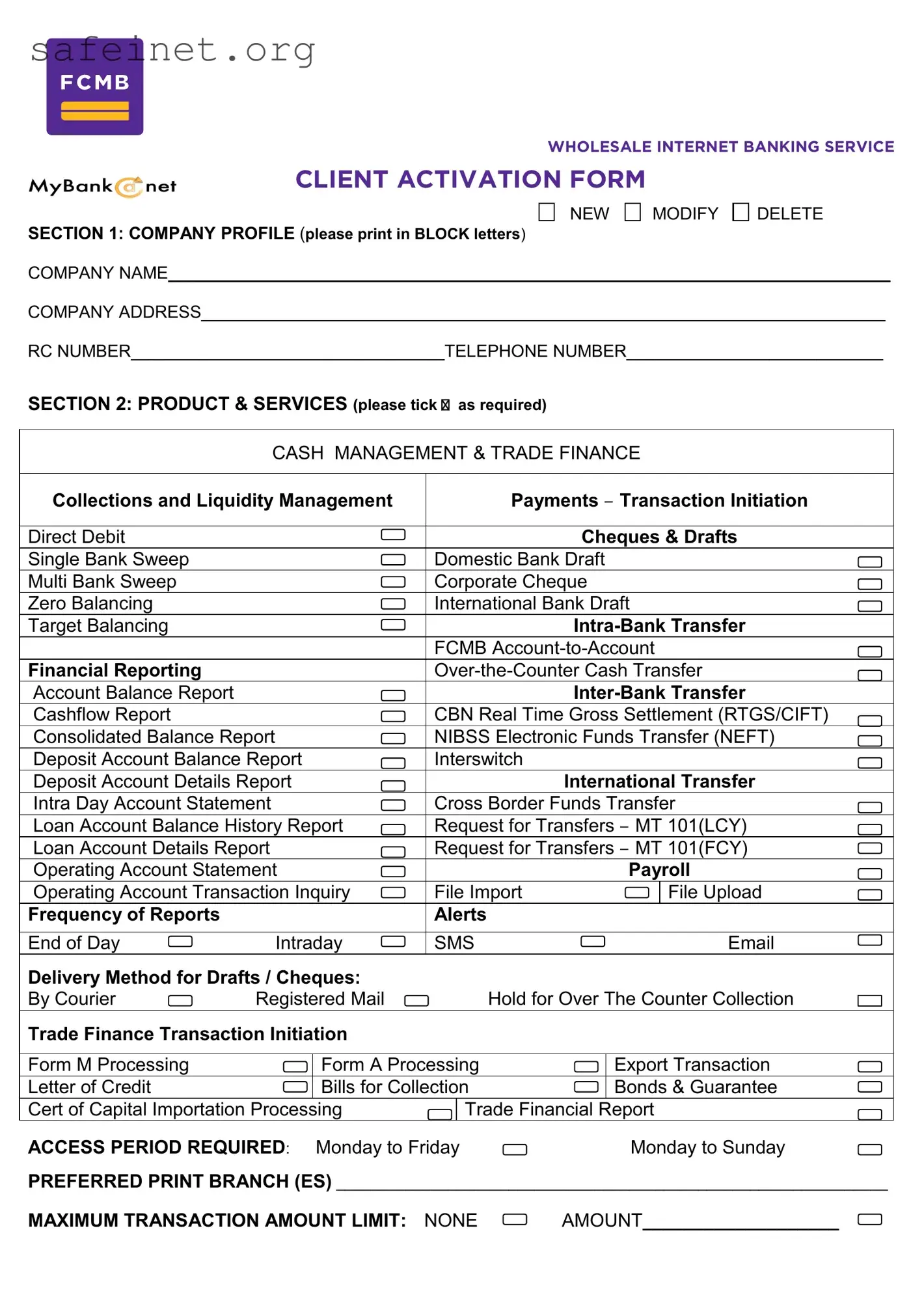

1. What is the FCMB Client Activation Form used for?

The FCMB Client Activation Form is used to establish a wholesale internet banking service for your company. It lets you request access to various banking products and services, including cash management, trade finance, and transaction initiation services. Completing this form is the first step toward setting up your company’s online banking capabilities.

2. How do I fill out the Company Profile section?

In the Company Profile section, you need to provide important details such as your company name, address, registration number (RC number), and telephone number. Make sure to print this information in BLOCK letters to ensure clarity and avoid errors during processing.

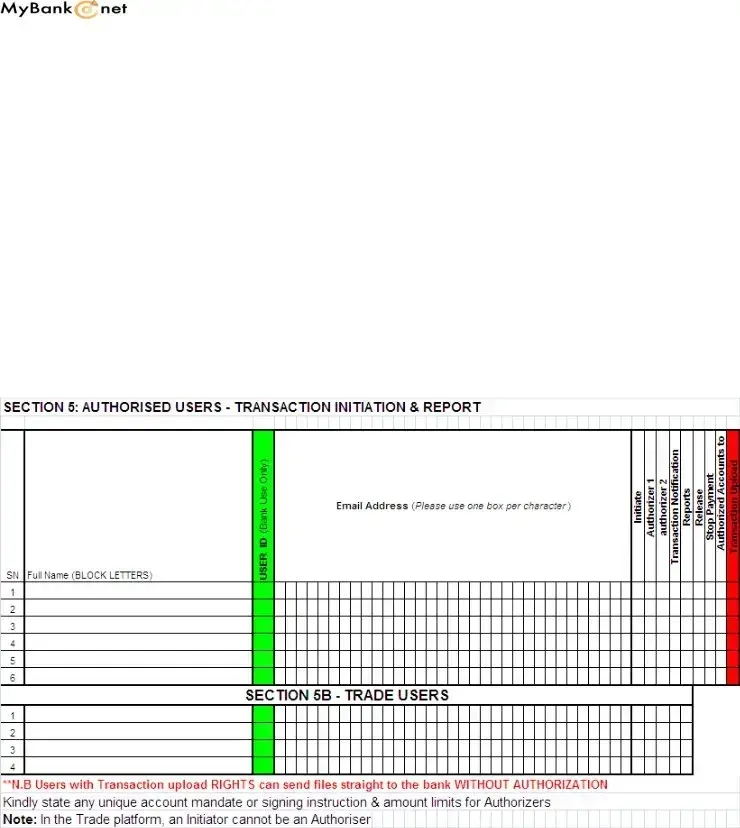

3. What products and services can I request on this form?

The form lists a variety of cash management and trade finance services that you can select. You can tick boxes next to services like collections, payments, bank drafts, and international transfers. Make sure to choose all the services relevant to your organization’s needs.

4. What are the fees associated with setting up the service?

The form indicates a setup fee of ₦20,000 and a monthly access charge of ₦10,000. Additionally, there may be transaction charges based on the specific payment gateway selected. Be prepared to enter your billing account details for these fees.

5. How do I specify my transaction limits?

You can state your maximum transaction amount limit directly in the designated section of the form. If you do not wish to set a limit, you can indicate that the limit is "NONE." Ensure this detail accurately reflects your business needs.

6. What happens after I submit the activation form?

Once submitted, the form will be processed by the FCMB team. They will verify your information and may reach out for any additional details needed. If everything is in order, your internet banking access will be set up accordingly. Keep an eye on your email for confirmation and next steps.

7. How do I ensure my data is protected?

When filling out the FCMB Client Activation Form, it's essential to provide accurate and truthful information. By acknowledging that you will notify FCMB of any changes, you help maintain the security and accuracy of your records. Additionally, review the terms and conditions to understand your obligations regarding data use.

8. Who can I contact for assistance while filling out the form?

If you require assistance, you can reach out to the contact person listed under the Cash Management and Trade Finance sections on the form. Having a dedicated contact point can help clarify any uncertainties you have while completing the activation form.

DELETE

DELETE