What is the purpose of the Fannie Mae 194 form?

The Fannie Mae 194 form, also known as the Hardship Affidavit, is designed for borrowers experiencing difficulties in making their mortgage payments. It allows borrowers to disclose the specific hardships they face, which may qualify them for foreclosure prevention alternatives offered by their loan servicer. Submitting this form is a crucial step in seeking assistance and helps lenders understand the financial circumstances impacting the borrower.

Who should complete the Fannie Mae 194 form?

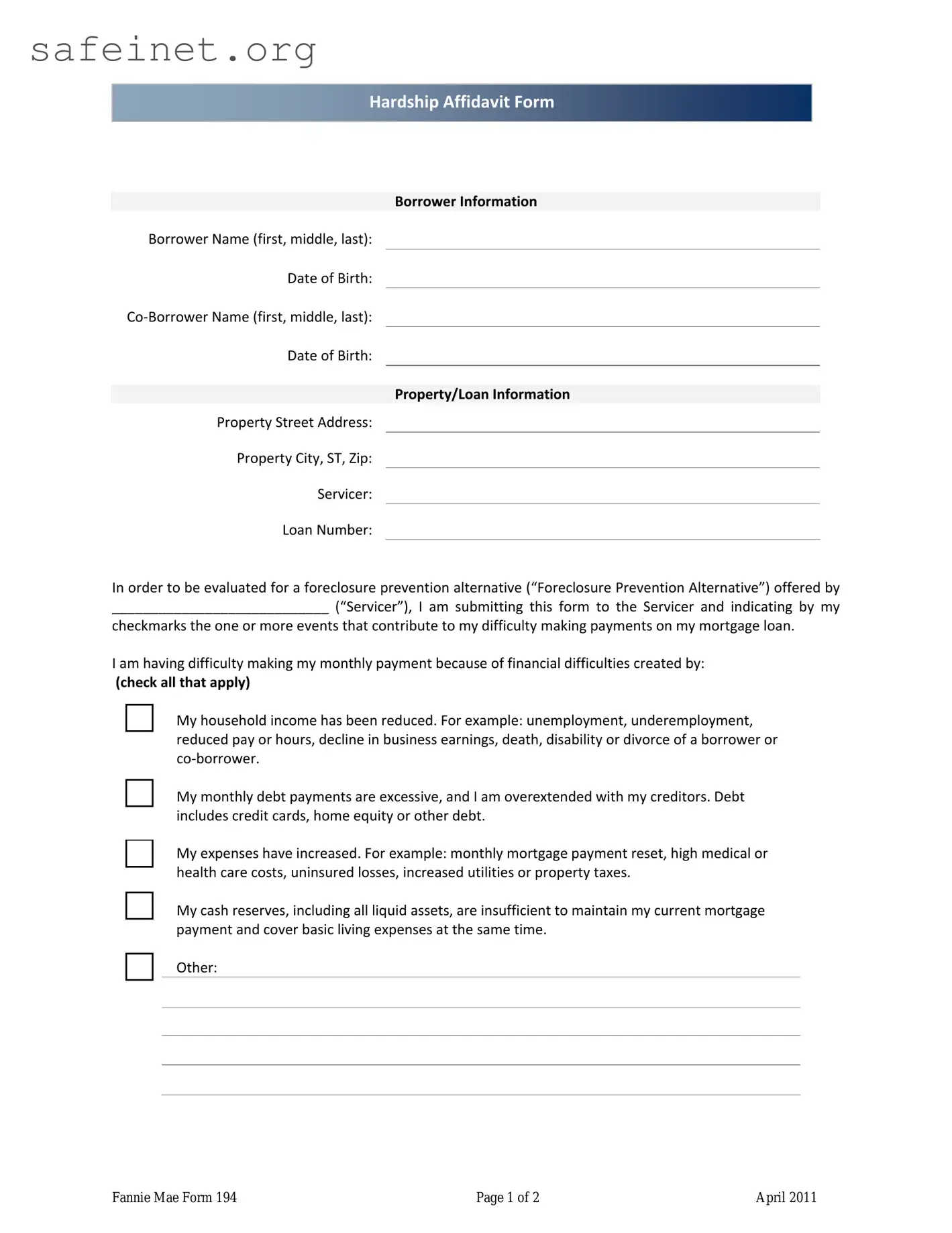

Both the primary borrower and co-borrower should complete the Fannie Mae 194 form if applicable. This ensures that all parties involved in the mortgage are on the same page regarding their financial hardships. Accurate and full disclosure is essential for the servicer to evaluate the borrower’s situation effectively.

What information is required on the Fannie Mae 194 form?

The form requires information about the borrower's and co-borrower's names and dates of birth, as well as details about the property such as the address, city, state, and loan number. Additionally, borrowers must indicate the specific financial hardships they are facing by checking relevant boxes, such as reduced income or increased expenses.

How does a borrower submit the Fannie Mae 194 form?

To submit the Fannie Mae 194 form, borrowers typically send it directly to their loan servicer. This can often be done via email, mail, or a secure online platform provided by the servicer. It’s essential to follow any specific submission guidelines provided by the servicer to ensure timely processing.

What happens after the Fannie Mae 194 form is submitted?

After submission, the servicer will review the information provided to assess the borrower's eligibility for various foreclosure prevention alternatives. The servicer may contact the borrower for additional documentation or clarification. It’s important for the borrower to respond promptly to any requests for information.

Can falsifying information on the Fannie Mae 194 form lead to legal issues?

Yes, submitting false information on the Fannie Mae 194 form can lead to serious legal ramifications. If a borrower is found to have intentionally misrepresented their circumstances, they could face foreclosure or other legal actions. Servicers have the right to investigate the accuracy of the information provided.

What types of hardships can be reported on the Fannie Mae 194 form?

Borrowers can report various hardships on the form, including reduced household income, excessive monthly debt, increased expenses such as medical bills, and insufficient cash reserves. There is also an option for borrowers to describe any other hardships that may not be specifically listed.

Is there a deadline for submitting the Fannie Mae 194 form?

While there may not be a formal deadline for submitting the Fannie Mae 194 form, borrowers are encouraged to act quickly. Timely submission is crucial because it can affect the options available to the borrower regarding foreclosure prevention. It’s beneficial to submit the form as soon as difficulties in making payments arise.

What should borrowers do if they have questions while completing the Fannie Mae 194 form?

If borrowers have questions while filling out the Fannie Mae 194 form, they should reach out to their loan servicer. Most servicers have customer service representatives who can provide guidance. Understanding the form is vital, and servicers are there to assist throughout the process.