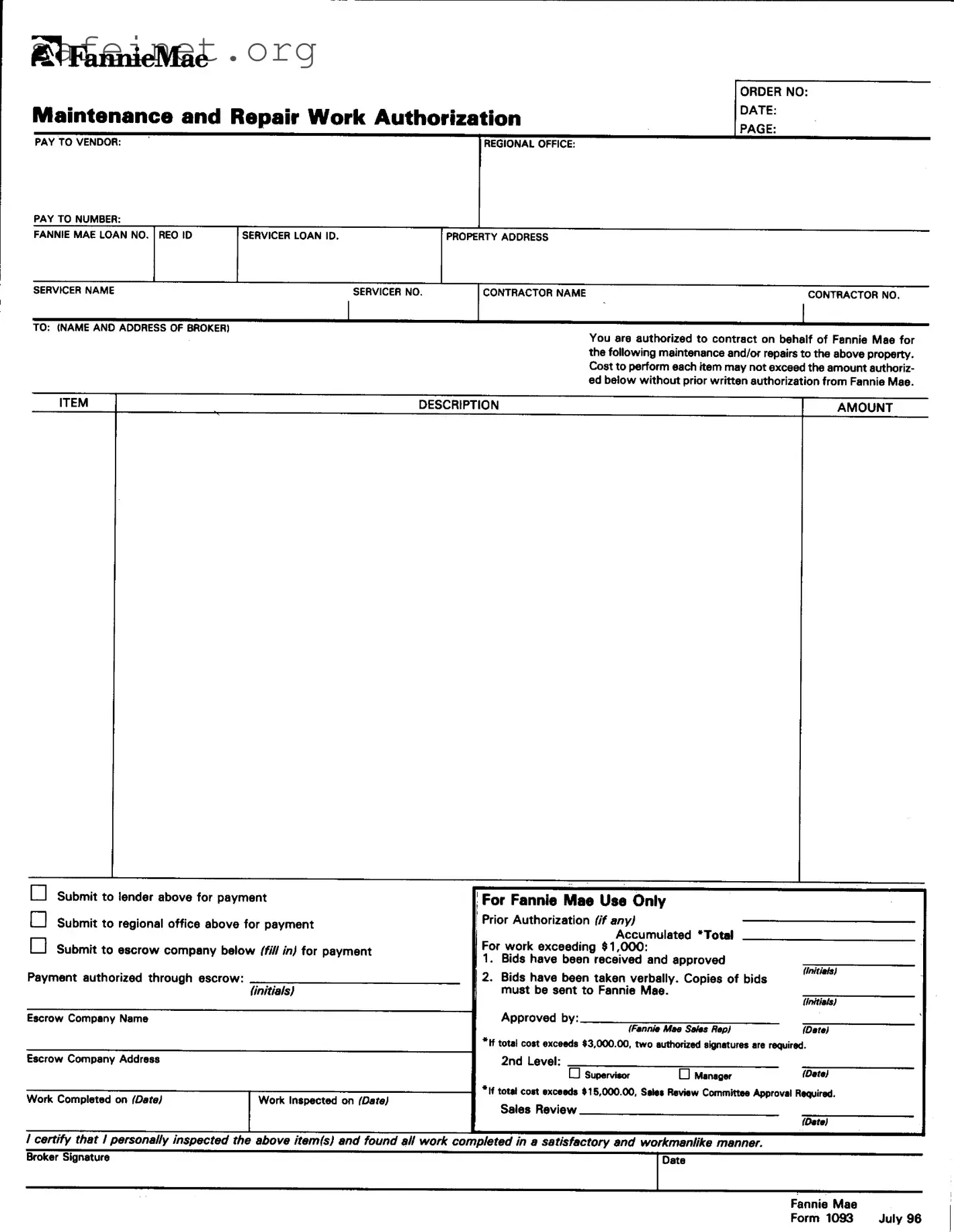

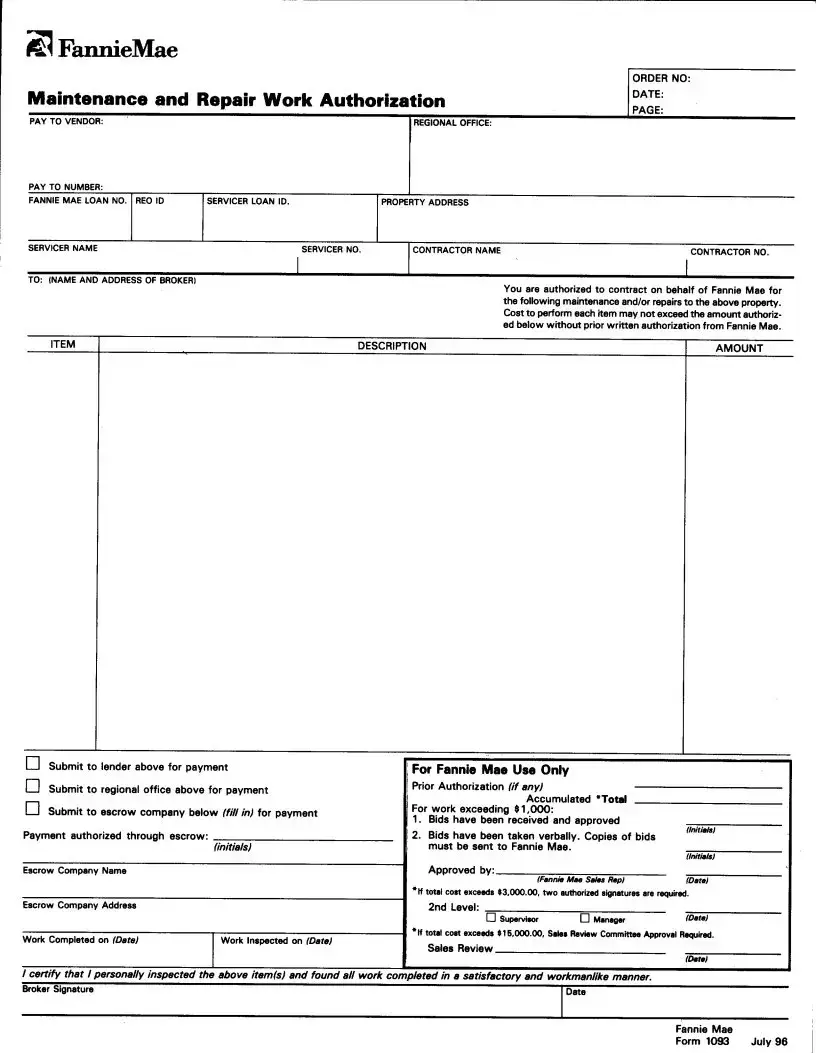

What is the Fannie Mae 1093 Form used for?

The Fannie Mae 1093 Form authorizes brokers or agents to undertake maintenance or repair work for properties that have been acquired. It is essential for ensuring that the work meets Fannie Mae's standards and allows for proper reimbursement of the expenses incurred.

Who can fill out the Fannie Mae 1093 Form?

Brokers or agents authorized by Fannie Mae use this form. They are responsible for inspecting the completed work and gathering the necessary documentation to submit for reimbursement.

What documentation is required when submitting the Fannie Mae 1093 Form?

When submitting the form, the broker or agent must include photographs of the completed work, appropriate invoices detailing the expenses, and any lien releases that might apply. This documentation helps ensure that all necessary approvals are in place before payment is made.

How many copies of the Fannie Mae 1093 Form are needed?

Four copies are required: one original and three copies. This is crucial for maintaining clear records for all parties involved in the reimbursement process.

What should I do if I need to print the Fannie Mae 1093 Form?

The form must be printed on letter-sized paper in portrait format. Make sure to use the "shrink to fit" option in the Adobe Acrobat print dialog box to avoid any formatting issues.

How is the reimbursement process initiated for expenses paid to brokers or agents?

The servicer needs to submit a Cash Disbursement Request (Form 571) to initiate the reimbursement process for any expenses incurred. This submission should be accompanied by the original Form 1093 and its supporting documentation.

Can repairs be authorized verbally?

Yes, the servicer may request verbal authorization for reimbursement from Fannie Mae before all supporting documents are available. However, this should be followed up promptly with the required documentation to avoid any reimbursement delays.

What happens if the broker or agent is not satisfied with the completed work?

If the broker or agent is not satisfied, they should not sign the certification on Form 1093. Instead, they must address the issues before submitting the form and required documentation for reimbursement.

How long should the servicer keep a copy of the Fannie Mae 1093 Form?

The servicer should retain a copy of Form 1093 along with its supporting documentation for their records. This is important for audit purposes and to resolve any potential disputes that may arise in the future.

What is the role of the servicer in the Fannie Mae 1093 process?

The servicer plays a critical role by reviewing the submitted Form 1093 and its supporting documents. They are responsible for ensuring that payments are made correctly based on the authorization provided by Fannie Mae and the certification by the broker or agent.