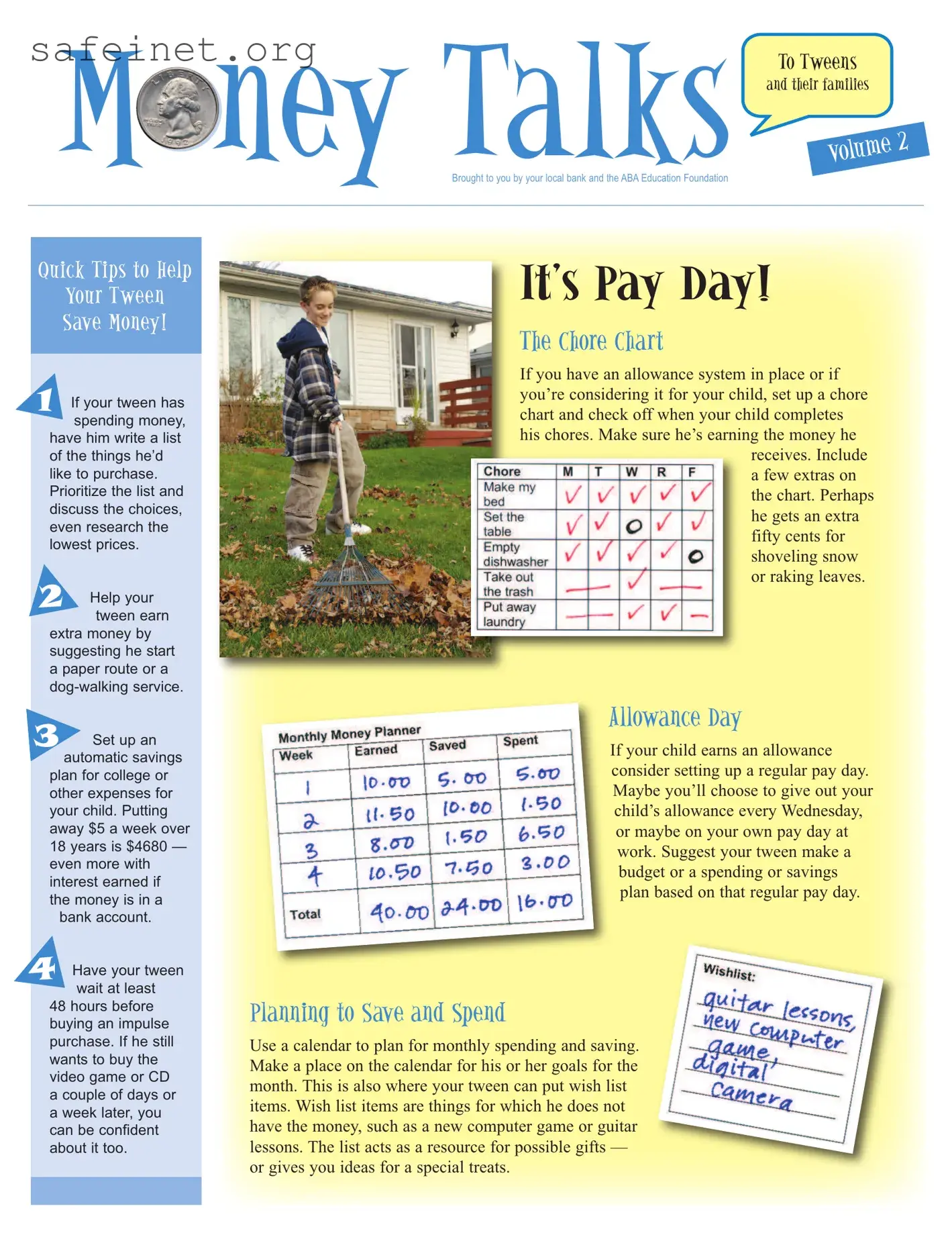

The Family Chore Chart is reminiscent of a behavior modification chart used in various educational settings. Both tools are designed to encourage and track the performance of specific tasks or behaviors. In schools, such charts often reward students for completing academic assignments or demonstrating good behavior, much like a chore chart rewards children for completing household tasks. The focus is on accountability and tangible rewards, reinforcing positive habits over time.

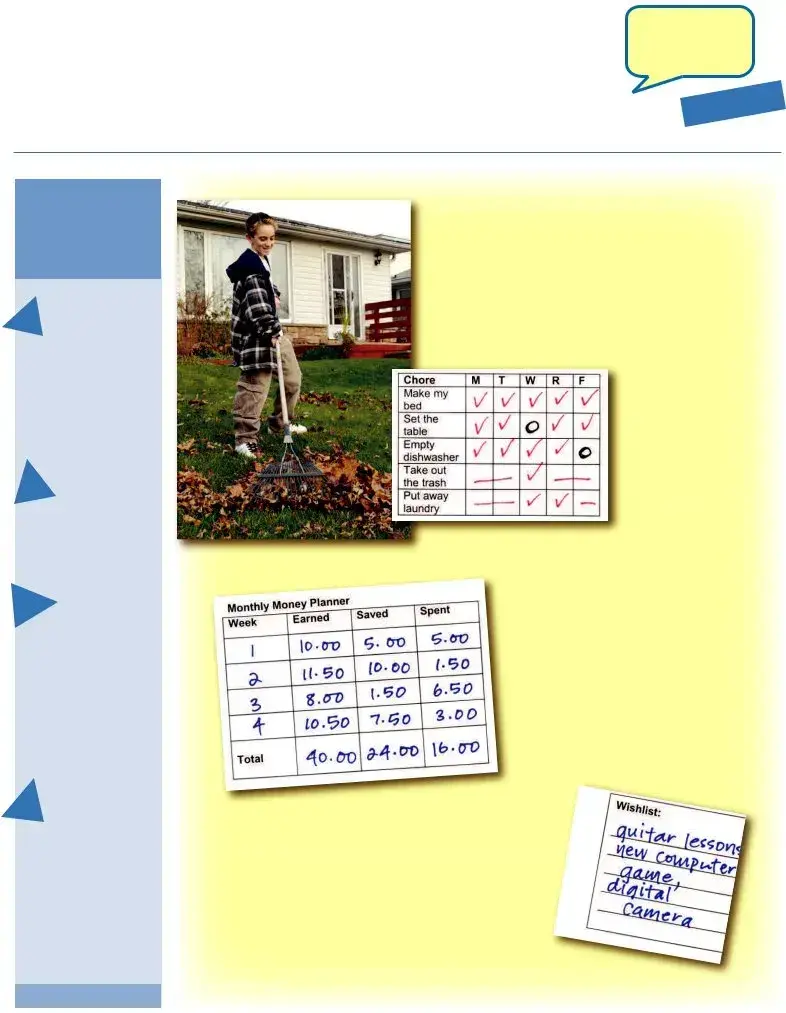

Another similar document is a daily or weekly planner. Both a chore chart and a planner help individuals organize their tasks and responsibilities. While the planner serves a broader purpose by allowing for scheduling of appointments, assignments, and personal goals, the chore chart specifically tracks household duties. Each encourages time management and prioritization, promoting a structured approach to completing necessary activities.

Bullet journals share similarities with the Family Chore Chart as well. Both serve as creative outlets for tracking progress and responsibilities. With bullet journals, users customize layouts and designs, making tracking enjoyable. The chore chart’s straightforward design focuses primarily on chores, but both documents encourage consistency and reflection on completed tasks, fostering a sense of achievement.

Goal-setting worksheets are another comparable document. A Family Chore Chart can include specific goals related to household responsibilities, similar to how goal-setting worksheets outline personal, educational, or professional aspirations. Both tools encourage individuals to define objectives and monitor their progress toward achieving them, enhancing motivation and accountability.

The concept of a family calendar also aligns with the Family Chore Chart. While a family calendar outlines events, appointments, and special occasions, it can also incorporate chore schedules. Both documents serve to keep family members informed about responsibilities and commitments, fostering communication and cooperation within the home.

Similar to the Family Chore Chart, a rewards system or incentive chart is used to motivate children to complete tasks. Parents might design a rewards chart that allows children to earn points or stickers for chores completed, redeemable for desired rewards. Both systems promote responsibility and create a positive association with completing tasks, encouraging continued participation.

Visual aids, such as charts or infographics illustrating chores and responsibilities, are also related to the Family Chore Chart. These visuals simplify complex information, making it easier for children to understand what is expected of them. Just like the chore chart, these visual aids serve to engage family members and promote a sense of ownership over their responsibilities.

Lastly, a weekly meal plan shares similarities with the Family Chore Chart. Both documents aim to organize and simplify family life. A meal plan outlines meals for the week, ensuring that dietary needs are met while a chore chart outlines household duties, ensuring that the home remains organized and clean. Both encourage planning ahead, establishing routines, and maximizing efficiency in daily life.

ney Talks

ney Talks

Enlist Someone Cool

Enlist Someone Cool