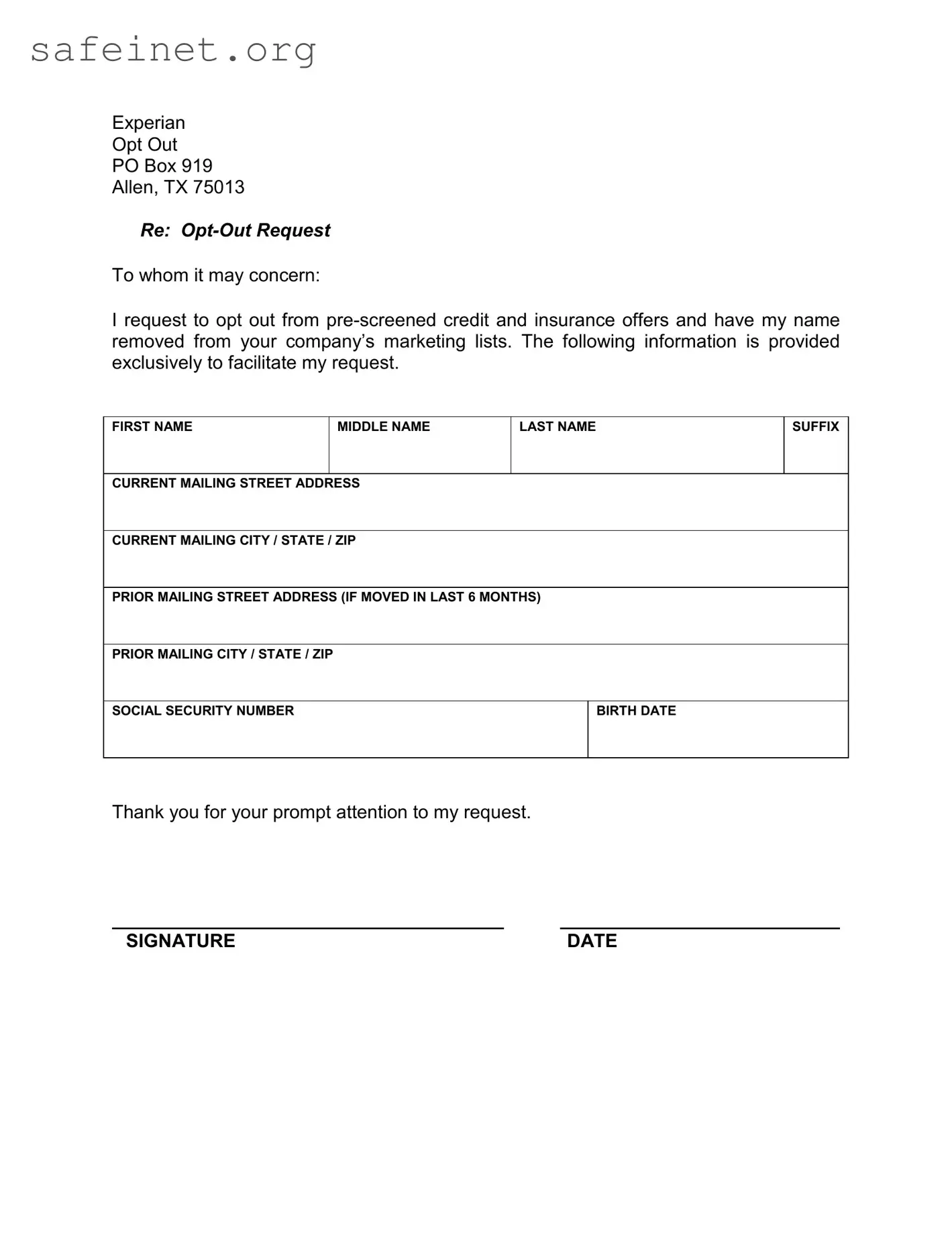

What is the purpose of the Experian P Box 919 Allen TX 75013 form?

The Experian P Box 919 Allen TX 75013 form is intended for consumers who wish to opt out of receiving pre-screened credit and insurance offers. By submitting this form, individuals can request that their names be removed from Experian’s marketing lists, reducing the volume of unsolicited offers they may receive.

Who can use this form?

Any individual who resides in the United States and wishes to stop receiving pre-screened offers from Experian can utilize this form. This includes people at various life stages looking to manage unsolicited marketing communications more effectively.

What information is required to complete the form?

The form requires several pieces of personal information to process the opt-out request. This includes your first name, middle name, last name, current contact address, city, state, ZIP code, any prior mailing address if you have moved in the last six months, Social Security Number, birth date, and a signature along with the date of submission.

How do I submit the form?

Once you have filled out the form, it should be sent to Experian at the address indicated: P.O. Box 919, Allen, TX 75013. Ensure that the form is mailed promptly to facilitate a timely response to your request.

How long will it take to process my request?

Typically, you can expect your request to be processed within a few weeks. While this may vary based on the volume of requests Experian is handling at the time, it is advisable to allow sufficient time for your request to be finalized.

Can I opt out for someone else using this form?

The form is designed for personal use; therefore, individuals may not submit requests on behalf of others unless you have legal authorization to do so. If you are submitting for a minor or someone unable to do so themselves, additional documentation may be required.

Will opting out affect my credit score?

No, opting out of pre-screened offers does not impact your credit score. Your credit score is determined by your credit history and financial behavior, and opting out is simply a preference for how marketing is received.

Can I opt back in after submitting this form?

Yes, individuals have the option to opt back in. If you wish to receive pre-screened offers again in the future, you must contact Experian directly or follow the appropriate procedures to reverse your previous opt-out request.

Is there any fee associated with submitting this form?

No, there is no fee required to opt out of pre-screened offers through the Experian form. This service is provided to consumers at no cost as part of their rights regarding unsolicited marketing communications.