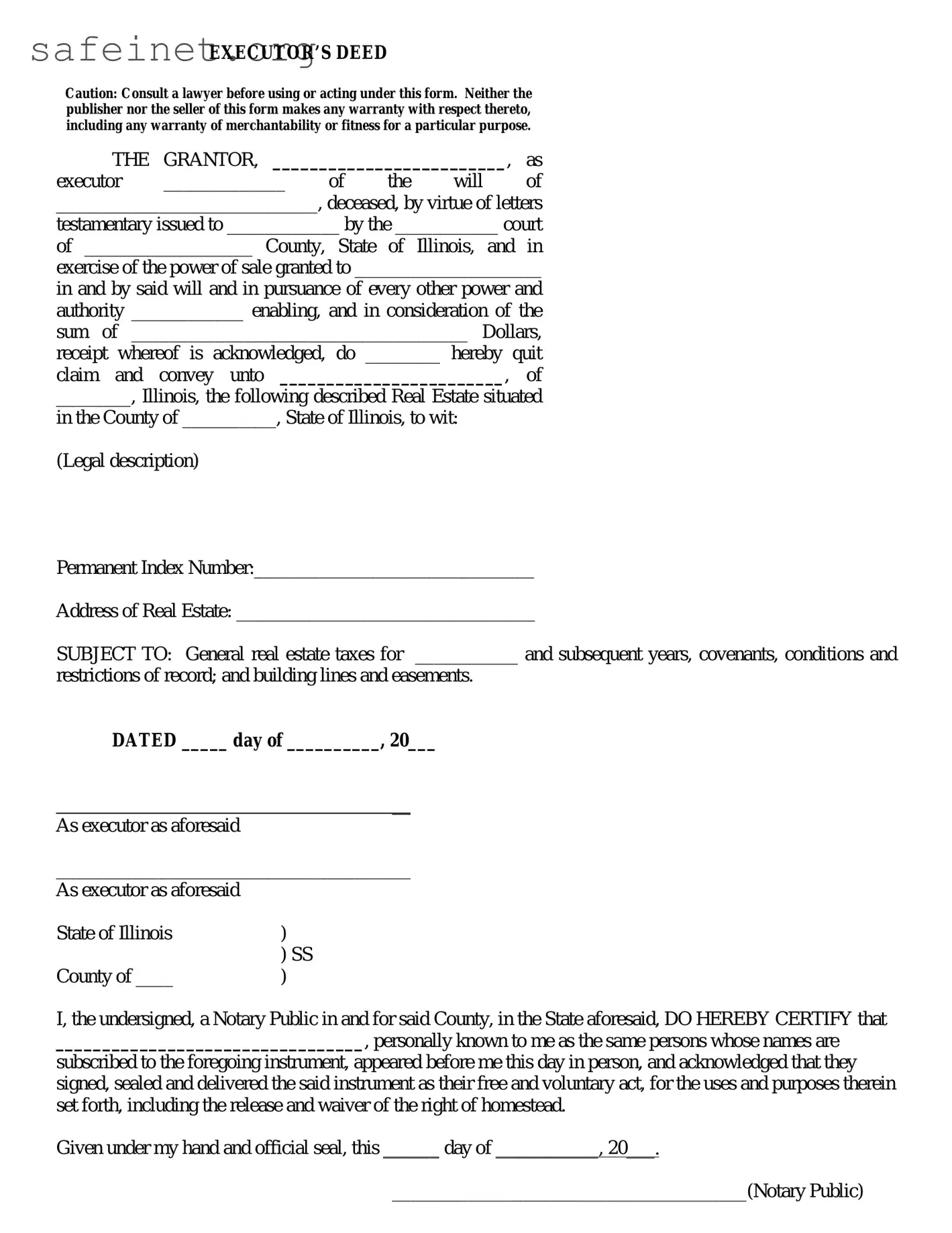

EXECUTOR’S DEED

Caution: Consult a lawyer before using or acting under this form. Neither the publisher nor the seller of this form makes any warranty with respect thereto, including any warranty of merchantability or fitness for a particular purpose.

THE GRANTOR, _________________________, as

executor _____________ of the will of

____________________________, deceased, by virtue of letters

testamentary issued to ____________ by the ___________ court

of __________________ County, State of Illinois, and in

exercise of the power of sale granted to ____________________

in and by said will and in pursuance of every other power and authority ____________ enabling, and in consideration of the

sum of ____________________________________ Dollars,

receipt whereof is acknowledged, do ________ hereby quit

claim and convey unto ________________________, of

________, Illinois, the following described Real Estate situated

in the County of __________, State of Illinois, to wit:

(Legal description)

Permanent Index Number:______________________________

Address of Real Estate: ________________________________

SUBJECT TO: General real estate taxes for ___________ and subsequent years, covenants, conditions and

restrictions of record; and building lines and easements.

DATED _____ day of __________, 20___

__

As executor as aforesaid

______________________________________

As executor as aforesaid

State of Illinois |

) |

|

) SS |

County of ____ |

) |

I, the undersigned, a Notary Public in and for said County, in the State aforesaid, DO HEREBY CERTIFY that

_________________________________, personally known to me as the same persons whose names are

subscribed to the foregoing instrument, appeared before me this day in person, and acknowledged that they signed, sealed and delivered the said instrument as their free and voluntary act, for the uses and purposes therein set forth, including the release and waiver of the right of homestead.

Given under my hand and official seal, this ______ day of ___________, 20___.

______________________________________(Notary Public)

This instrument was prepared by:

MAIL RECORDED INSTRUMENT TO:

SEND SUBSEQUENT TAX BILLS TO: