Clear Form

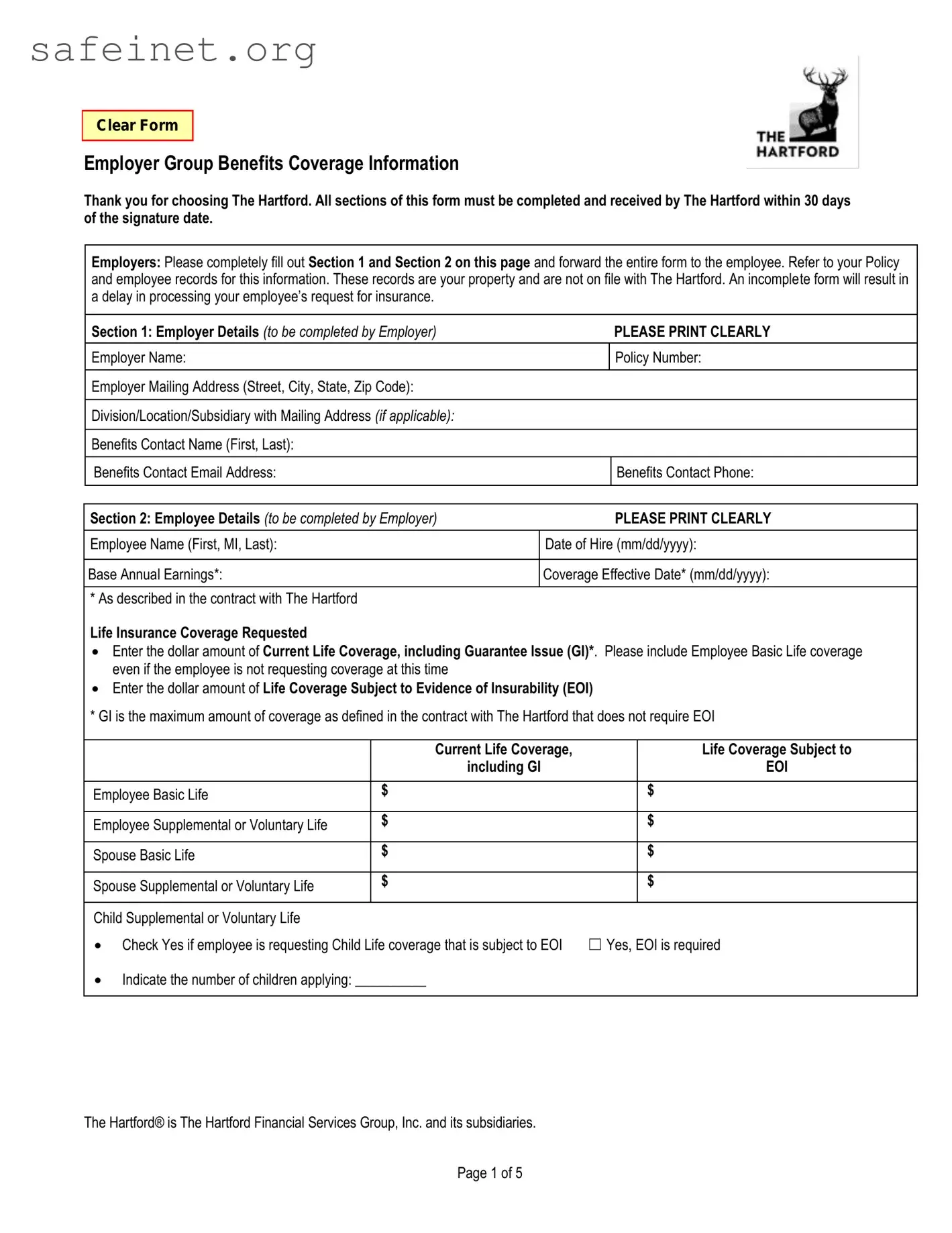

Employer Group Benefits Coverage Information

Thank you for choosing The Hartford. All sections of this form must be completed and received by The Hartford within 30 days of the signature date.

Employers: Please completely fill out Section 1 and Section 2 on this page and forward the entire form to the employee. Refer to your Policy and employee records for this information. These records are your property and are not on file with The Hartford. An incomplete form will result in a delay in processing your employee’s request for insurance.

Section 1: Employer Details (to be completed by Employer) |

PLEASE PRINT CLEARLY |

|

|

Employer Name: |

Policy Number: |

|

|

|

|

|

|

Employer Mailing Address (Street, City, State, Zip Code): |

|

|

|

|

|

|

|

Division/Location/Subsidiary with Mailing Address (if applicable): |

|

|

|

|

|

|

|

Benefits Contact Name (First, Last): |

|

|

|

|

|

|

|

Benefits Contact Email Address: |

Benefits Contact Phone: ( |

) |

- |

|

|

|

|

Section 2: Employee Details (to be completed by Employer) |

PLEASE PRINT CLEARLY |

|

|

|

|

|

|

|

Employee Name (First, MI, Last): |

Date of Hire (mm/dd/yyyy): |

/ |

/ |

|

|

|

|

|

Base Annual Earnings*: |

Coverage Effective Date* (mm/dd/yyyy): |

/ |

/ |

|

|

|

|

|

* As described in the contract with The Hartford |

|

|

|

|

Life Insurance Coverage Requested

Enter the dollar amount of Current Life Coverage, including Guarantee Issue (GI)*. Please include Employee Basic Life coverage even if the employee is not requesting coverage at this time

Enter the dollar amount of Life Coverage Subject to Evidence of Insurability (EOI)

* GI is the maximum amount of coverage as defined in the contract with The Hartford that does not require EOI

|

Current Life Coverage, |

|

Life Coverage Subject to |

|

including GI |

|

EOI |

|

|

|

|

Employee Basic Life |

$ |

|

$ |

|

|

|

|

Employee Supplemental or Voluntary Life |

$ |

|

$ |

|

|

|

|

|

|

|

Spouse Basic Life |

$ |

|

$ |

|

|

|

|

|

|

|

Spouse Supplemental or Voluntary Life |

$ |

|

$ |

|

|

|

|

|

|

|

Child Supplemental or Voluntary Life |

|

|

|

Check Yes if employee is requesting Child Life coverage that is subject to EOI |

☐ Yes, EOI is required |

Indicate the number of children applying: __________ |

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Page 1 of 5

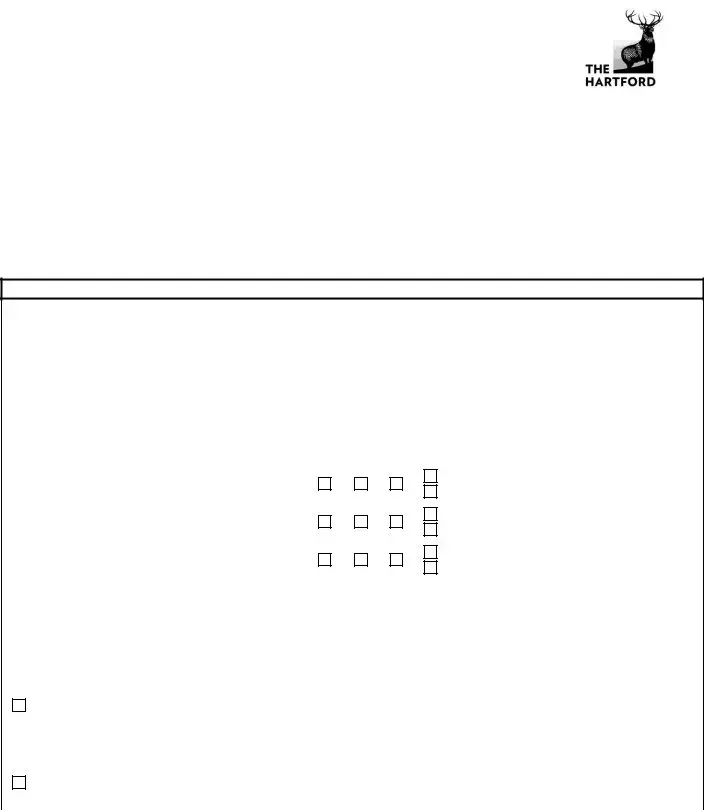

EVIDENCE OF INSURABILITY

HARTFORD LIFE AND ACCIDENT INSURANCE COMPANY

One Hartford Plaza, Hartford, CT 06155

Applicant Information

●If there are more than three Applicants, please provide the information on a separate sheet of paper.

Abbreviations: Employee = EE Spouse = SP Child = CH

First Name |

Last Name |

Social Security |

|

|

|

|

|

Height |

Weight |

Date of Birth |

|

|

Number |

EE |

SP |

CH |

|

Gender |

(ft./in.) |

(lbs.) |

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

If currently |

|

|

|

|

|

|

|

|

|

|

|

pregnant, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(check one) |

|

pre- |

|

|

|

|

|

|

|

pregnancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

weight |

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EE Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evening Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SP Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

same as EE |

|

|

|

|

|

Evening Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CH Address: |

|

|

|

|

Day Time Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evening Phone: |

|

|

|

|

same as EE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form PA-9597 (CA) |

Page 2 of 5 |

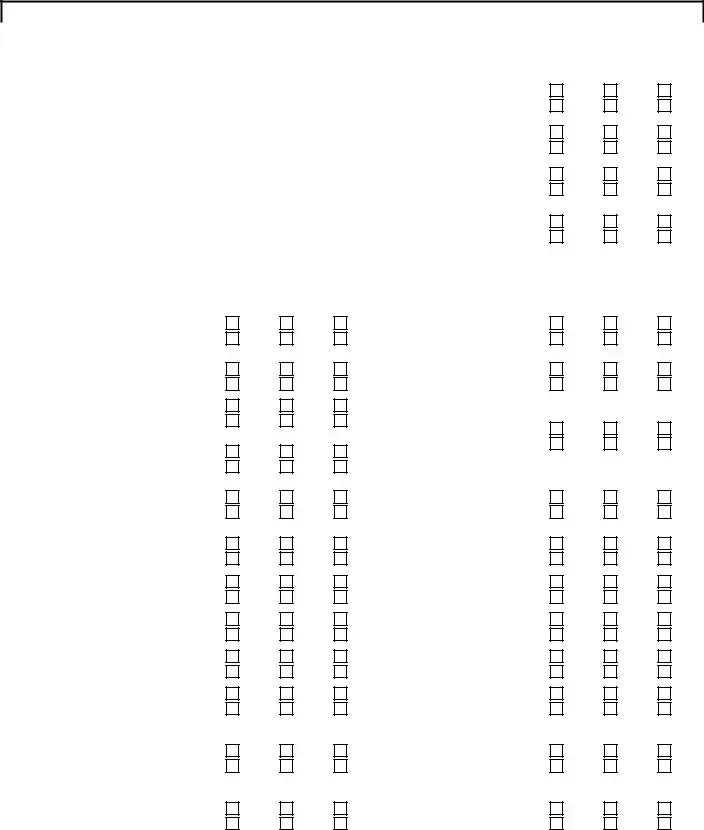

Medical Information

|

Each Applicant must answer each of the following questions to the best of their knowledge and |

|

|

|

|

belief. A Legal Guardian is required to answer each of the questions for minor children. If you have |

EE |

SP |

CH |

|

more than 1 child, specify which child(ren) the answer applies to on a separate sheet of paper. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you been diagnosed with or treated by a licensed medical physician for |

Yes |

Yes |

Yes |

|

Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)? |

|

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

Are you currently pregnant? |

|

|

|

|

Yes |

Yes |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

Within the past 5 years, with the exception of a past pregnancy, have you lost time from work for more than |

Yes |

Yes |

Yes |

|

10 consecutive work days due to a disability, injury, or sickness? |

|

|

|

|

|

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you used any controlled substances, with the exception of those taken as |

Yes |

Yes |

Yes |

|

prescribed by your physician, been diagnosed or treated for drug or alcohol abuse (excluding support |

|

No |

No |

No |

|

groups), or been convicted of operating a motor vehicle while under the influence of drugs or alcohol? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Within the past 5 years, have you been diagnosed with or treated by a licensed member of the medical profession for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

EE |

SP |

CH |

|

EE |

SP |

CH |

|

Heart Disease |

Yes |

Yes |

Yes |

Disease, injury or surgery of |

Yes |

Yes |

Yes |

|

(Do not check “Yes” if you only have High |

Joint, Ligaments, Knee, Back, |

|

No |

No |

No |

No |

No |

No |

|

Blood Pressure or a Heart Murmur) |

or Neck (including Arthritis) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heart-Related Surgery or |

Yes |

Yes |

Yes |

Muscular Dystrophy |

Yes |

Yes |

Yes |

|

Heart Attack |

No |

No |

No |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

High Blood Pressure |

Yes |

Yes |

Yes |

|

|

|

|

|

|

No |

No |

No |

Hepatitis (Do not check “Yes” |

Yes |

Yes |

Yes |

|

If you checked “Yes” to High Blood |

|

|

|

|

|

|

|

for Hepatitis A) or Cirrhosis |

No |

No |

No |

|

Pressure, have you had a change in |

Yes |

Yes |

Yes |

|

|

|

|

|

|

medication within the last 6 months? |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blocked Arteries (Arteriosclerosis, |

Yes |

Yes |

Yes |

Amyotrophic Lateral Sclerosis |

Yes |

Yes |

Yes |

|

Atherosclerosis, Aneurysm, or Deep Vein |

(ALS) or Multiple Sclerosis |

|

No |

No |

No |

No |

No |

No |

|

Blood Clot) |

(MS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stroke or transient ischemic attack (TIA) |

Yes |

Yes |

Yes |

Alzheimer’s or Parkinson’s |

Yes |

Yes |

Yes |

|

No |

No |

No |

Disease |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

Chronic Obstructive Pulmonary Disease |

Yes |

Yes |

Yes |

Paralysis |

Yes |

Yes |

Yes |

|

(COPD) or Emphysema |

No |

No |

No |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

Diabetes |

Yes |

Yes |

Yes |

Major Organ Transplant |

Yes |

Yes |

Yes |

|

No |

No |

No |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depression |

Yes |

Yes |

Yes |

Chronic Fatigue Syndrome or |

Yes |

Yes |

Yes |

|

No |

No |

No |

Fibromyalgia |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

Sleep Apnea |

Yes |

Yes |

Yes |

Narcolepsy |

Yes |

Yes |

Yes |

|

No |

No |

No |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cancer (Do not check “Yes” for Basal |

|

|

|

|

|

|

|

|

Cell Carcinoma only) |

Yes |

Yes |

Yes |

Ulcerative Colitis or Crohn’s |

Yes |

Yes |

Yes |

|

|

|

If “Yes”, Date of Diagnosis: |

No |

No |

No |

Disease |

No |

No |

No |

|

|

|

|

|

|

|

|

|

_______________________________ |

|

|

|

|

|

|

|

|

Psychotic, Psychiatric, Personality, or Bi- |

Yes |

Yes |

Yes |

Kidney Failure or Dialysis |

Yes |

Yes |

Yes |

|

Polar Disorder |

No |

No |

No |

No |

No |

No |

|

|

|

|

|

|

|

|

|

|

|

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form PA-9597 (CA) |

Page 3 of 5 |

Notice

To the best of your knowledge, you are required to notify Hartford Life and Accident Insurance Company in writing of any changes in your medical condition between the date you sign this form and the date the coverage is approved.

In order to complete the evaluation of this application, Hartford Life and Accident Insurance Company may contact you, through the mail or over the telephone:

1.to clarify any information contained on this form;

2.to obtain any information missing from this form;

3.to ask additional questions of you or your physician about the information that you have provided; or

4.to request a paramedical exam.

We may also use information about you obtained from other sources, including our claim files, evidence of insurability applications you have previously submitted to us, copies of medical records which you have authorized us to review, and information obtained from MIB, Inc. Only information that is relevant to determining Evidence of Insurability for the coverage which you are currently requesting will be considered.

Authorization

I, an undersigned applicant, authorize Hartford Life and Accident Insurance Company, together with its affiliates, (“Company”) to contact me, during the evaluation of this application, through the mail, secure e-mail, or over the telephone, at the address or telephone number identified in this application, or otherwise provided by me:

1.to clarify any information contained on this form;

2.to obtain any information missing from this form; or

3.to request a paramedical exam.

In the event that I cannot be reached via telephone, I authorize a representative of the Company to leave a voice message identifying his or her name, the Company name, and a return phone number, indicating that he or she is calling to obtain information necessary to complete my recent application for insurance. The message will also contain an underwriting ID number and the hours during which I may reach a representative of the Company by telephone.

❒Yes, you may leave a message as indicated above. |

❒No, please do not leave a message. |

In addition to the information that I have provided on this application, I authorize the Company to use information about me obtained from Company claim files, insurance applications and medical information I or my physician(s) have previously submitted to the Company. I further authorize my employer, any health or benefits plan, physician, medical professional, hospital, clinic, laboratory, MIB Group, Inc. (MIB, Inc), pharmacy or pharmacy benefits manager that possesses my protected personal health information (“PHI”), including copies of records concerning physical or mental illness, diagnosis, prognosis, prescription information, care or treatment provided to me (but excluding HIV and genetic testing), to furnish such protected health information to the Company or its representative. The Company may only use information disclosed under this authorization that is relevant to underwrite this or any other insurance application to the Company during the period that the Authorization is valid (as described below), at any time to aid in the detection of fraud, and for internal research purposes.

I authorize the Company to disclose the “PHI” in its files to its reinsurer(s) and affiliates, other insurance companies and their affiliates, other persons, representatives and/or organizations performing functions on behalf of the Company and their affiliates, my employer, or as required by law, including any mandated reporting to state agencies. I understand that I may request details about any of the information gathered about me that relates to this application and that such requested information and the identity of the source of the information shall be released to me or, in the case of medical information, to a licensed medical professional of my choice.

I/We authorize Hartford Life and Accident Insurance Company, or its reinsurers, to make a brief report of my/our personal health information to Medical Information Bureau.

I agree that a photocopy of this authorization is valid as the original and I understand that I or my authorized representative is entitled to receive a copy of this authorization upon request.

This authorization shall be valid for twenty-four (24) months from the date signed below. This authorization may be revoked upon written request to the Company, and will not remain valid beyond the date the revocation is received by the Company. I understand the revocation may be a basis for denying my insurance application, and that it does not alter the Company’s right to use the application for purposes of determining misrepresentation once coverage has been issued.

I have received and read a copy of the Notice of Insurance Information Practices.

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form PA-9597 (CA) |

Page 4 of 5 |

Fraud

For your protection, California law requires the following to appear on this form: The falsity of any statement in the application for any policy shall not bar the right to recovery under the policy unless such false statement was made with the actual intent to deceive or unless it materially affected either the acceptance of the risk or the hazard assumed by the insurer.

Certification

I hereby represent that I have reviewed the above questions and that all statements and answers contained herein are full, complete, and true to the best of my knowledge and belief. For residents of Virginia only: I have read, or had read to me, the completed application, and I realize that any false statement or misrepresentation in the application may result in loss of coverage under the policy.

This application will be made a part of the Policy.

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

/ |

/ |

Employee Signature |

|

Date Signed |

|

Spouse Signature |

|

Date Signed |

|

/ |

/ |

Child Signature |

|

Date Signed |

(Parent/Legal Guardian of the Child is |

|

|

|

required to sign when submitting

dependent Evidence of Insurability on a

minor child.)

Please mail the completed Employer Group Benefits Coverage Information page and Evidence of Insurability application to:

The Hartford

Group Medical Underwriting

P.O. Box 2999

Hartford, CT 06104-2999

If you have any questions or concerns, please call The Hartford Customer Service Department toll-free at 1-800-331-7234, Monday through

Friday, 8:00 a.m. to 6:00 p.m., Eastern Time, or email us at [email protected].

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries.

Form PA-9597 (CA) |

Page 5 of 5 |