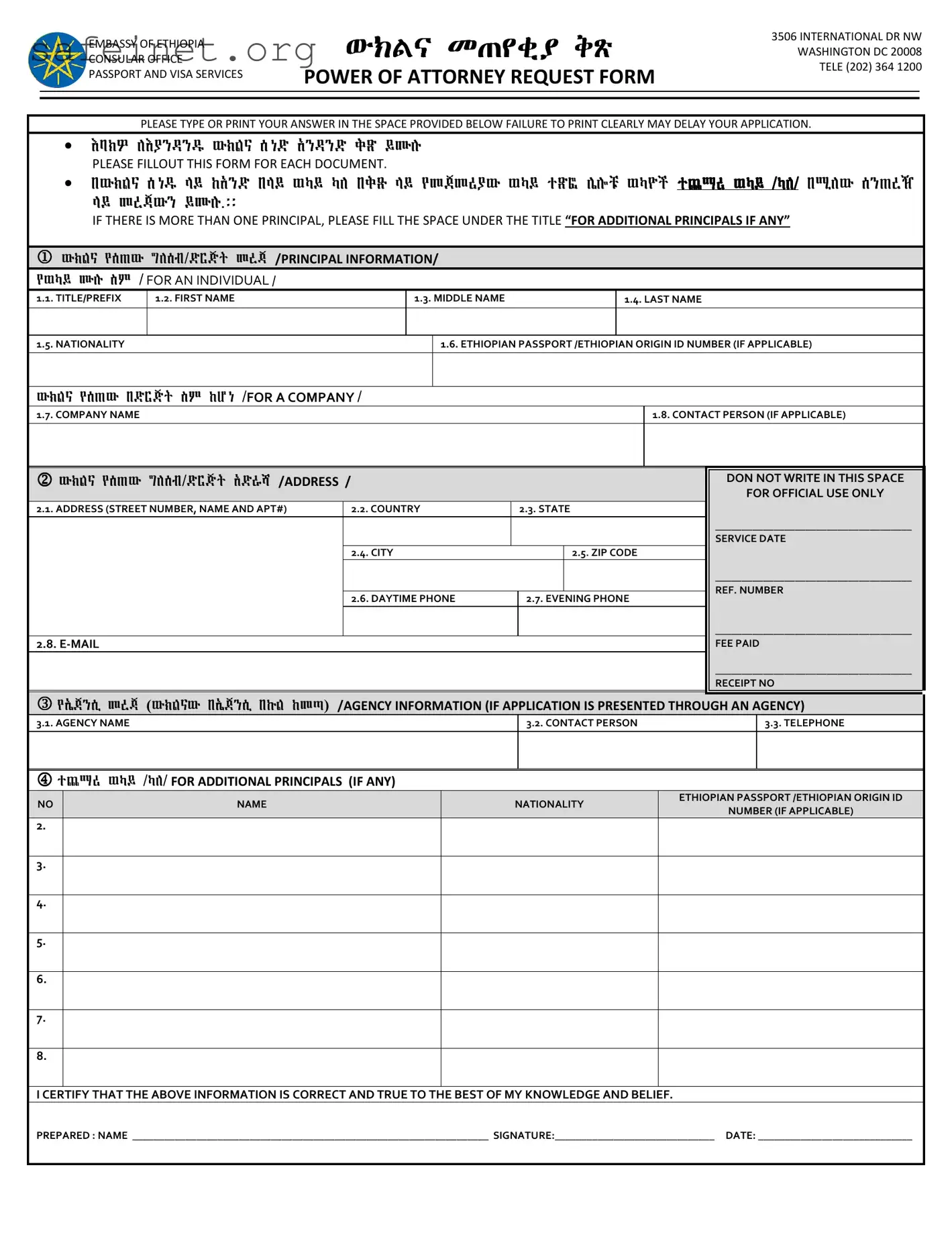

The Ethiopia Power of Attorney form closely resembles the General Power of Attorney document. Both forms allow a person, known as the principal, to authorize another individual, the agent, to act on their behalf. This authorization can cover a broad range of responsibilities, including financial decisions, legal matters, and more. The key similarity lies in the fact that they both must be filled out carefully, ensuring all required information is presented clearly to avoid delays in processing. The main difference may reside in the specific geographic or jurisdictional stipulations associated with each form, as the Ethiopia form is designed to facilitate processes specifically related to Ethiopian nationals.

Another similar document is the Limited Power of Attorney. Like the Ethiopia Power of Attorney, this form allows the principal to delegate authority to the agent; however, it restricts the agent’s powers to specific tasks or for a defined period. For instance, someone might use a Limited Power of Attorney to manage real estate transactions or handle a particular investment. This control helps to streamline responsibilities while still granting necessary agency for particular matters, making it a tailored option for individuals who need focused assistance.

The Medical Power of Attorney is also akin to the Ethiopia Power of Attorney in that it grants authority for another person to make healthcare decisions on behalf of the principal. Both forms require a clear declaration and understanding of the principal's wishes. In this case, the primary focus is the health and medical treatment of the principal, which allows the designated agent to make decisions when the principal is unable to do so. This document is crucial during emergencies or medical scenarios where timely decisions are essential.

A Financial Power of Attorney mirrors the Ethiopia Power of Attorney in purpose but centers specifically on financial affairs. By using this document, the principal can authorize someone to manage their finances, such as paying bills, managing bank accounts, or filing taxes. While the Ethiopia form may allow for a variety of actions, the Financial Power of Attorney distinctly narrows its focus to fiscal matters, making it a valuable tool for anyone concerned about their financial future.

The Durable Power of Attorney shares similarities with the Ethiopia Power of Attorney, particularly in its ability to remain effective even if the principal becomes incapacitated. This ensures that the agent retains the authority to manage the principal's affairs whenever they can no longer do so themselves. Given its enduring nature, the Durable Power of Attorney is often combined with considerations of long-term care and asset protection, making it a comprehensive choice for those looking ahead.

The Springing Power of Attorney is another document that resonates with the Ethiopia Power of Attorney. It becomes effective only upon the occurrence of a specified event, often the incapacity of the principal. Both forms serve to appoint an agent, but with the Springing Power, responsibility waits until it's needed. This type of arrangement allows individuals to control when the authority is activated, fostering peace of mind regarding when and why the agent may need to step in.

Lastly, the Corporate Power of Attorney serves a similar function but is tailored for business entities. Instead of an individual principal, a corporation may designate an agent to represent the company in various transactions. Commonly, this document includes provisions for specific actions related to business operations, thereby aligning with the Ethiopia Power of Attorney's intent but within a corporate framework. Overall, both forms facilitate representation and decision-making, albeit in different contexts.