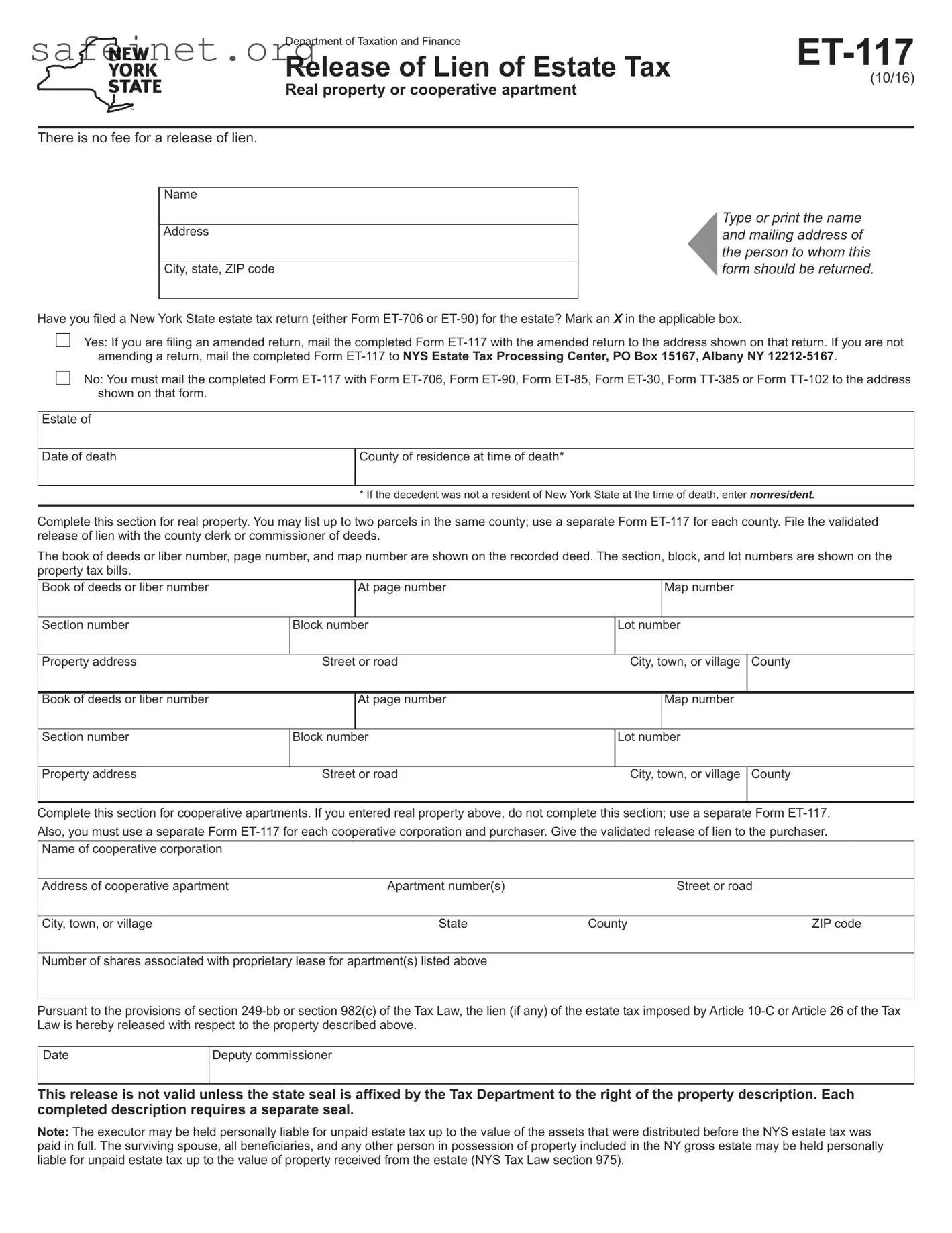

The Form ET-706, New York Estate Tax Return, is one of the primary documents related to estate tax. It is used to calculate the total estate tax liability of a decedent’s estate. Similar to the ET-117, it requires details about the decedent and the estate. Once the tax has been assessed, a lien may be placed against the estate, which the ET-117 can later release. Both forms require specific property details and share a common purpose surrounding the management and distribution of estate assets.

The Form ET-90, Claim for Refund for New York Estate Tax, serves a related function. It permits individuals to request refunds on any estate tax overpayments. Like the ET-117, the ET-90 requires the filer to provide details about the decedent and the estate. In the event that a return shows excess payments, the refund process begins, potentially leading to a release of liens similar to the ET-117. Each form plays a role in the tax lifecycle of an estate.

Form ET-85, New York State Affidavit of No Estate Tax Due, allows executors or administrators to confirm that no estate tax is owed. This document is crucial when handling assets after a death. It serves a similar purpose to the ET-117, which officially releases taxes on properties of the estate. Both forms assure interested parties that tax liabilities have been satisfied or are not present, which facilitates smoother property transactions.

The Form ET-30, New York State Estate Tax Extension Form, grants an extension for filing the estate tax return. This form encourages compliance by providing additional time for preparation. While the ET-117 is used for releasing liens on properties, the ET-30 helps to establish the timeline necessary for filing the documents associated with estate taxes. Both are essential in managing the estate's tax responsibilities.

The Form TT-385, Application for Estate Tax Exemption for Certain Multistate Estates, is also closely related to the ET-117. It is used by estates that qualify for a tax exemption under specific conditions. When completed and accepted, this form can ease the estate tax burden, similar to the lien release offered by the ET-117. Both forms require similar identification of the assets and beneficiaries involved.

Form TT-102, Application for Reinstatement of Estate Tax Exemption, works similarly by allowing estates to apply for reinstatement of tax exemptions that may have expired otherwise. This application can lead to the resolution of tax disputes related to estate tax liabilities. The ET-117 is then used to release any liens if the exemptions are granted. Each document is integral in ensuring that the estate tax obligations are properly managed.

The Form IRS 706, United States Estate (and Generation-Skipping Transfer) Tax Return, is a federal counterpart to the New York tax forms. It is necessary for reporting the value of an estate and calculating any federal estate tax owed. While the ET-117 releases property from a state lien, the IRS 706 ensures all federal obligations are addressed. Together, they streamline the process of settling an estate.

Form IRS 709, United States Gift (and Generation-Skipping Transfer) Tax Return, impacts estate planning by addressing gifts made during the lifetime of the decedent. This form allows for the appropriate accumulation of tax obligations that may influence the estate's value. The proper handling of this form may affect the claims resulting in releases on the estate’s properties, similar to what the ET-117 accomplishes.

The Form New York State Form 1040, Individual Income Tax Return, focuses on the decedent’s income tax obligations rather than estate taxes. While it serves a different purpose, it is equally important for resolving financial matters following a death. Understanding the combined implications of estate and income taxes is crucial for administering an estate effectively, tying it back to the significance of liens like those managed with the ET-117.