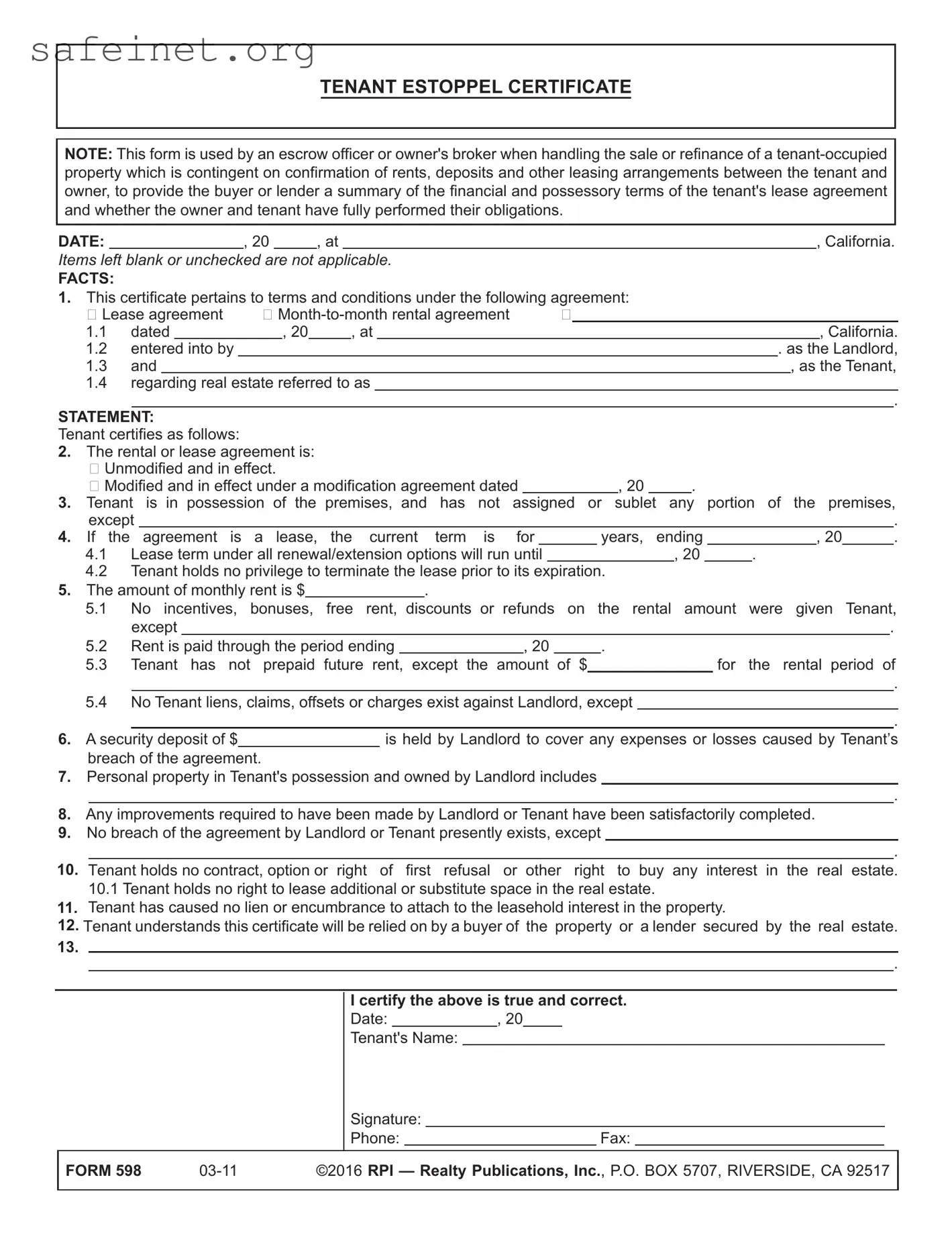

TENANT ESTOPPEL CERTIFICATE

NOTE: This form is used by an escrow officer or owner's broker when handling the sale or refinance of a tenant-occupied

property which is contingent on confirmation of rents, deposits and other leasing arrangements between the tenant and owner, to provide the buyer or lender a summary of the financial and possessory terms of the tenant's lease agreement and whether the owner and tenant have fully performed their obligations.

DATE: |

, 20 |

, at |

|

, California. |

|

|

|

|

|

|

|

Items left blank or unchecked are not applicable.

FACTS:

1.This certificate pertains to terms and conditions under the following agreement:

� Lease agreement |

� Month-to-month rental agreement |

� |

1.1 |

dated |

|

, 20 |

, at |

|

|

|

, California. |

1.2 |

entered |

|

|

|

|

|

|

|

|

|

into by |

|

|

|

|

|

|

. as the Landlord, |

1.3 |

and |

|

|

|

|

|

|

|

, as the Tenant, |

1.4regarding real estate referred to as

.

STATEMENT: |

|

|

Tenant certifies as follows: |

|

|

2. The rental or lease agreement is: |

|

|

� Unmodified and in effect. |

|

|

� Modified and in effect under a modification agreement dated |

, 20 |

. |

3.Tenant is in possession of the premises, and has not assigned or sublet any portion of the premises,

|

|

|

|

|

|

|

|

|

except |

|

|

|

. |

4. If the |

agreement is a lease, the current term is for |

years, ending |

, 20 |

|

. |

4.1 Lease term under all renewal/extension options will run until |

|

, 20 |

. |

|

|

|

|

4.2Tenant holds no privilege to terminate the lease prior to its expiration.

5. The amount of monthly rent is $ |

|

. |

5.1No incentives, bonuses, free rent, discounts or refunds on the rental amount were given Tenant,

5.2 |

except |

|

|

|

|

. |

|

|

|

|

|

|

|

|

Rent is paid through the period ending |

|

, 20 |

|

. |

|

|

|

5.3 |

|

|

|

|

|

|

|

|

for the rental period of |

Tenant has not prepaid future rent, |

except the amount of $ |

|

|

|

|

|

|

|

|

|

|

|

. |

5.4No Tenant liens, claims, offsets or charges exist against Landlord, except

|

|

|

|

|

. |

6. A security deposit of $ |

|

is held by Landlord to cover any expenses or losses caused by Tenant’s |

breach of the agreement. |

|

|

|

7.Personal property in Tenant's possession and owned by Landlord includes

.

8.Any improvements required to have been made by Landlord or Tenant have been satisfactorily completed.

9.No breach of the agreement by Landlord or Tenant presently exists, except

.

10. Tenant holds no contract, option or right of first refusal or other right to buy any interest in the real estate. 10.1 Tenant holds no right to lease additional or substitute space in the real estate.

11. Tenant has caused no lien or encumbrance to attach to the leasehold interest in the property.

12. Tenant understands this certificate will be relied on by a buyer of the property or a lender secured by the real estate.

13.

.

I certify the above is true and correct.

Date:, 20

Tenant's Name:

Signature:

Phone:Fax:

FORM 598 |

03-11 |

©2016 RPI — Realty Publications, Inc., P.O. BOX 5707, RIVERSIDE, CA 92517 |