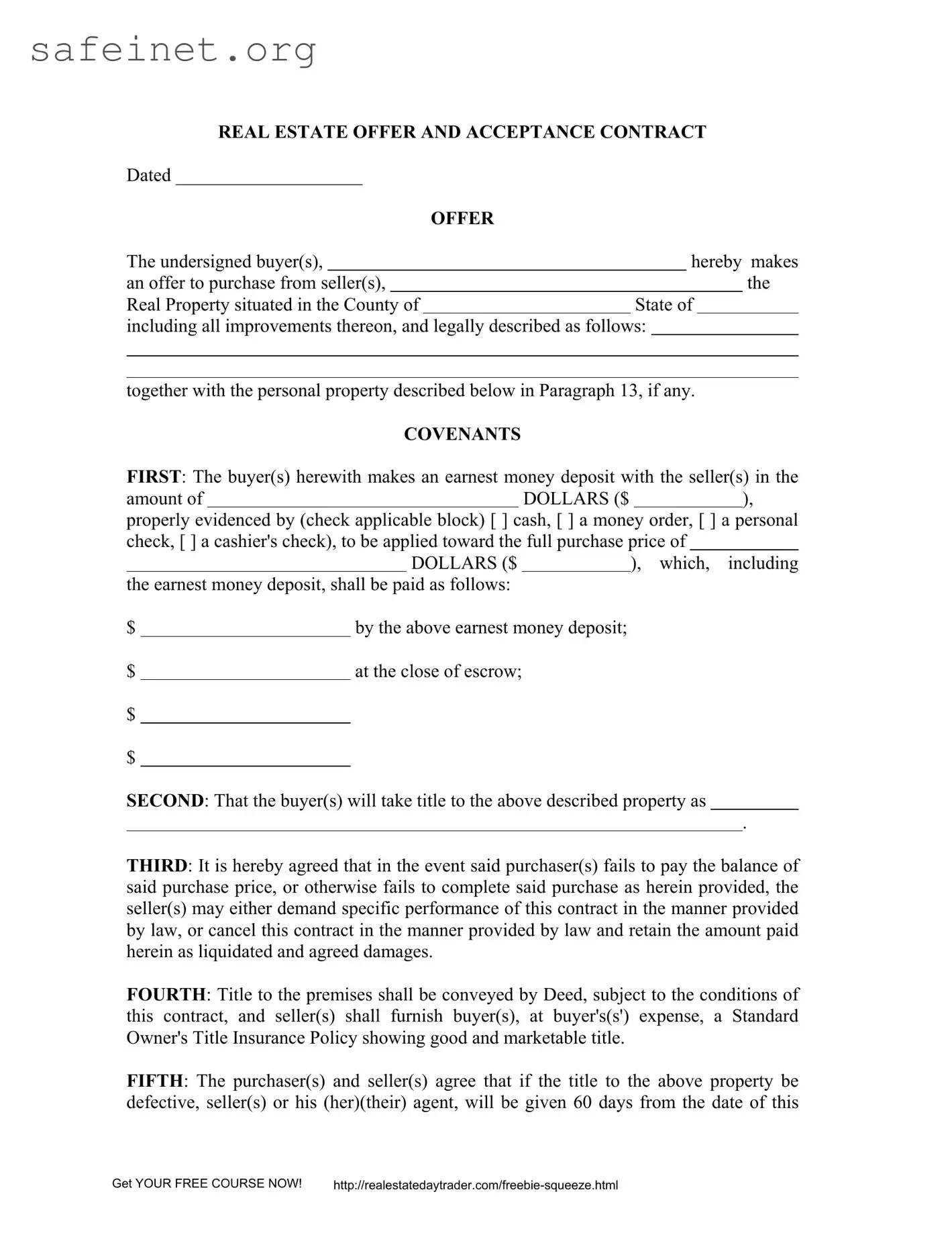

What is the Estate Acceptance form and its purpose?

The Estate Acceptance form is a legal document outlining the terms under which a buyer offers to purchase a property from a seller. It details the purchase price, payment structure, and responsibilities of both parties. This form serves as a contract that binds the buyer and seller to the agreed-upon terms once signed.

Who should complete the Estate Acceptance form?

Both buyers and sellers involved in the real estate transaction should complete the Estate Acceptance form. Buyers must provide their offer, while sellers must indicate their acceptance. Each party’s agreement is essential for the contract to be binding.

What happens after the form is signed?

Once the Estate Acceptance form is signed by both the buyer and seller, it becomes a legally binding contract. The earnest money deposit must be made, and the transaction will proceed to the escrow phase, where further negotiations and preparations for closing can take place.

What is an earnest money deposit?

An earnest money deposit is a sum of money given by the buyer to the seller as a show of good faith when making an offer. This amount is usually deducted from the total purchase price at closing. It demonstrates the buyer's commitment to the transaction.

What are the conditions for cancellation of the contract?

If the buyer fails to complete the purchase or pay the remaining balance, the seller has the right to cancel the contract. The seller can either demand specific performance or retain the earnest money deposit as agreed damages. This provision protects the seller's interests in case of buyer default.

What if there are defects in the property title?

If the title to the property is found to be defective, the seller has 60 days to rectify the issue. If it cannot be resolved within that timeframe, the buyer can request a return of their earnest money, and the contract will be canceled. Buyers might also choose to accept the title “as is,” accepting any defects without requiring corrections.

What is the role of an escrow agent?

The escrow agent is a neutral third party responsible for holding the earnest money deposit and ensuring that all terms of the Estate Acceptance form are adhered to during the transaction. They prepare necessary documents and manage the closing process once all conditions have been met.

Are there specific timelines involved in the process?

Yes, certain timelines are outlined in the Estate Acceptance form. For instance, the earnest money deposit must be made within ten days after acceptance of the contract. Additionally, the closing of escrow must occur on or before a specified date, providing a schedule for both parties to follow.

Can the buyer or seller modify terms after signing?

Once the Estate Acceptance form is signed by both parties, any changes to the terms would generally require a written agreement. Modifications can only proceed if both parties consent. It’s important to keep all communications documented to avoid confusion later on.

Where can I find or obtain the Estate Acceptance form?

The Estate Acceptance form can typically be obtained through real estate agents, brokers, or legal document providers. Online resources may also offer printable versions. Always ensure that any form you use is current and compliant with local laws.