The Loan Estimate form serves a similar purpose to the Escrow Disclosure form by providing essential information about a borrower’s mortgage. This document lays out important details including loan terms, estimated closing costs, and the expected monthly payment. Like the Escrow Disclosure, the Loan Estimate is designed to help borrowers understand their financial obligations over the life of the loan, allowing for informed decision-making. Both forms aim to enhance transparency between lenders and borrowers, ensuring that all costs are clearly communicated right from the start.

The Closing Disclosure form closely mirrors the Escrow Disclosure form in that it provides final details about the mortgage transaction right before closing. This piece of paperwork outlines the actual costs associated with the loan, including all fees and charges. Both documents share a common goal of clarifying the financial commitments required of borrowers, but the Closing Disclosure is more comprehensive as it reflects the agreed-upon terms following the negotiation process. It serves as a final reminder of what the borrower is committing to and ensures that they are fully informed before signing the final documents.

The Truth in Lending Act (TILA) disclosure is another document that resembles the Escrow Disclosure form. TILA mandates that lenders disclose the terms and conditions of credit in a clear and understandable manner. Like the Escrow Disclosure, TILA disclosures provide crucial information about the cost of borrowing, including interest rates and payment schedules. Both documents are designed to help consumers make educated financial choices and to promote transparency in lending practices. They empower borrowers with the knowledge they need to compare different mortgage options effectively.

The Good Faith Estimate (GFE), while somewhat older, has a similar function to the Escrow Disclosure form in that it also outlines the anticipated costs associated with a mortgage. This document provides borrowers with a breakdown of various fees involved in the loan process. Notably, both the GFE and Escrow Disclosure emphasize clear communication of costs, allowing borrowers to anticipate their financial obligations accurately. Although the GFE has been replaced by the Loan Estimate in many mortgage transactions, the principles governing both documents remain aligned in promoting transparency and consumer protection.

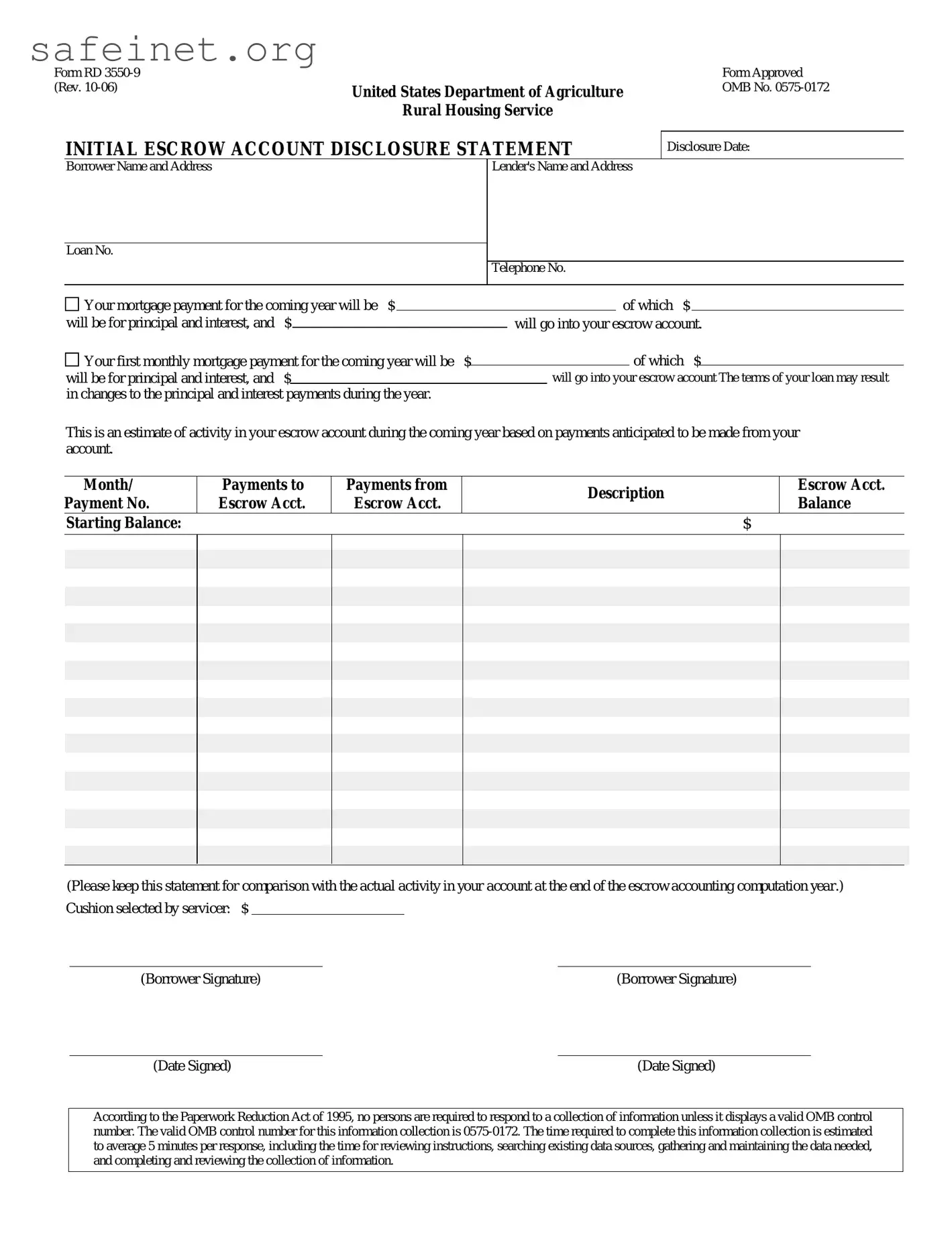

The Annual Escrow Account Disclosure Statement is yet another similar document that complements the Escrow Disclosure form. This statement provides borrowers with a yearly summary of their escrow account, detailing how much money was paid into or withdrawn from the account over the course of a year. In this way, both documents focus on the management of the escrow account, illuminating for borrowers how their funds are being utilized. By offering a clear picture of escrow activity, these forms enhance the overall understanding of what borrowers can expect in terms of their mortgage payments.

The Mortgage Servicing Disclosure Statement provides information about the entity servicing a mortgage loan, functioning somewhat similarly to the Escrow Disclosure form. This disclosure informs borrowers about their rights regarding mortgage servicing and whom to contact for questions. Both documents prioritize transparency and delineate essential information that ensures borrowers know whom they are dealing with and what to expect in servicing their loan. Such disclosures help foster a trusting relationship between borrowers and lenders, setting the stage for responsible lending practices.

The Loan Application form also has parallels to the Escrow Disclosure by capturing essential information about the borrower and the loan they seek. This application typically includes not only personal details but also background information about income and assets. Similarly, the Escrow Disclosure provides financial details pertinent to the loan. Both documents ultimately highlight the borrower’s financial landscape and assist lenders in making decisions about loan approval and terms, thus playing a crucial role in the transactional relationship.

Finally, the Homeowner’s Insurance Disclosure closely relates to the Escrow Disclosure form since both deal with cost considerations that affect mortgage payments. This document provides key information about the homeowner's insurance required by the lender, which is often paid out of the homeowner's escrow account. While the Escrow Disclosure focuses on the specific allocations within the escrow account, the Homeowner’s Insurance Disclosure emphasizes the importance of safeguarding the property through insurance coverage. Together, they contribute to a comprehensive understanding of all financial obligations tied to homeownership.