REQUEST FOR OWNERSHIP INFORMATION—ERM-14 FORM

The purpose of this confidential form is to obtain ownership information to assist in calculating premium for your workers compensation insurance policy. Your policy requires that you report ownership changes, and other changes as detailed below, to your insurance carrier in writing within 90 days of the change. If you have questions, contact your agent, insurance company, or the appropriate rating organization. Incomplete information or a missing signature may result in a delay in processing.

The ownership information required on this ERM-14 Form can also be submitted in narrative form on the letterhead of the employer, signed by an owner, partner, member, or executive officer.

Section A—Contact Information

Name of person completing this form ____________________________ Your Employer __________________________

Phone # _____________________________ Email Address ________________________________________________

Relationship to business entity reporting ownership information _______________________________________________

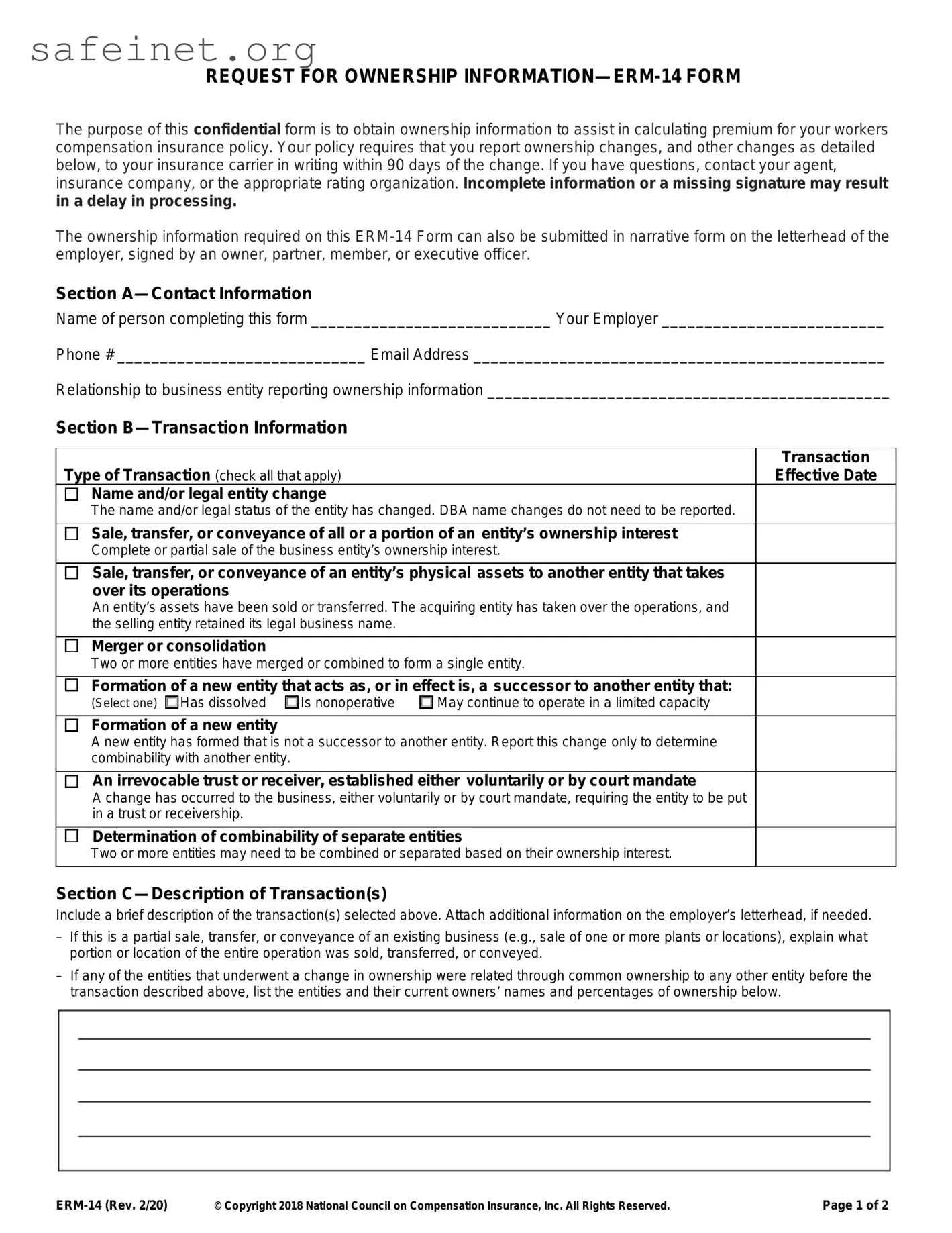

Section B—Transaction Information

Type of Transaction (check all that apply) |

Transaction |

Effective Date |

Name and/or legal entity change

The name and/or legal status of the entity has changed. DBA name changes do not need to be reported.

Sale, transfer, or conveyance of all or a portion of an entity’s ownership interest

Complete or partial sale of the business entity’s ownership interest.

Sale, transfer, or conveyance of an entity’s physical assets to another entity that takes over its operations

An entity’s assets have been sold or transferred. The acquiring entity has taken over the operations, and the selling entity retained its legal business name.

Merger or consolidation

Two or more entities have merged or combined to form a single entity.

Formation of a new entity that acts as, or in effect is, a successor to another entity that:

(Select one) |

Has dissolved |

Is nonoperative |

May continue to operate in a limited capacity |

Formation of a new entity

A new entity has formed that is not a successor to another entity. Report this change only to determine combinability with another entity.

An irrevocable trust or receiver, established either voluntarily or by court mandate

A change has occurred to the business, either voluntarily or by court mandate, requiring the entity to be put in a trust or receivership.

Determination of combinability of separate entities

Two or more entities may need to be combined or separated based on their ownership interest.

Section C—Description of Transaction(s)

Include a brief description of the transaction(s) selected above. Attach additional information on the employer’s letterhead, if needed.

–If this is a partial sale, transfer, or conveyance of an existing business (e.g., sale of one or more plants or locations), explain what portion or location of the entire operation was sold, transferred, or conveyed.

–If any of the entities that underwent a change in ownership were related through common ownership to any other entity before the transaction described above, list the entities and their current owners’ names and percentages of ownership below.