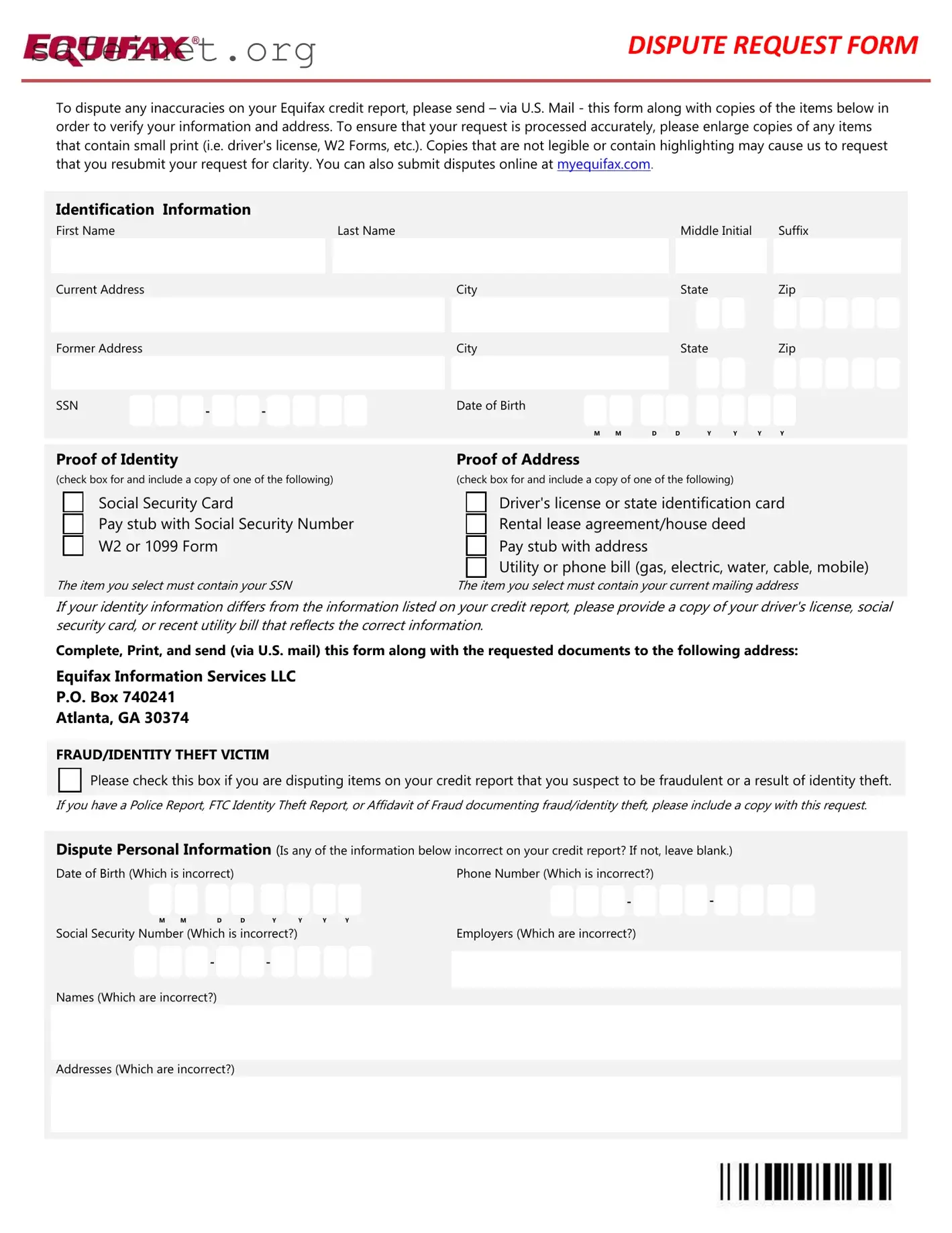

DISPUTE REQUEST FORM

To dispute any inaccuracies on your Equifax credit report, please send – via U.S. Mail - this form along with copies of the items below in order to verify your information and address. To ensure that your request is processed accurately, please enlarge copies of any items that contain small print (i.e. driver's license, W2 Forms, etc.). Copies that are not legible or contain highlighting may cause us to request that you resubmit your request for clarity. You can also submit disputes online at myequifax.com.

Identification |

Information |

|

|

|

|

|

|

|

|

|

First Name |

|

|

Last Name |

|

|

|

Middle Initial |

|

Suffix |

Current Address |

|

|

City |

|

|

|

State |

|

|

Zip |

Former Address |

|

|

City |

|

|

|

State |

|

|

Zip |

SSN |

- |

- |

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

Proof of Identity |

|

|

|

Proof of Address |

|

|

|

|

(check box for and include a copy of one of the following) |

|

|

|

(check box for and include a copy of one of the following) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Card |

|

|

|

Driver's license or state identification card |

|

|

|

|

Pay stub with Social Security Number |

|

|

|

Rental lease agreement/house deed |

|

|

|

|

W2 or 1099 Form |

|

|

|

Pay stub with address |

|

|

|

|

|

|

|

|

Utility or phone bill (gas, electric, water, cable, mobile) |

|

|

|

|

The item you select must contain your SSN |

|

|

|

The item you select must contain your current mailing address |

|

|

If your identity information differs from the information listed on your credit report, please provide a copy of your driver's license, social security card, or recent utility bill that reflects the correct information.

Complete, Print, and send (via U.S. mail) this form along with the requested documents to the following address:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374

FRAUD/IDENTITY THEFT VICTIM

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.

If you have a Police Report, FTC Identity Theft Report, or Affidavit of Fraud documenting fraud/identity theft, please include a copy with this request.

Dispute Personal Information (Is any of the information below incorrect on your credit report? If not, leave blank.)

|

|

Date of Birth (Which is incorrect) |

|

|

|

|

|

|

Phone Number (Which is incorrect?) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

M M |

D D |

Y |

Y |

Y Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number (Which is incorrect?) |

|

|

|

|

|

Employers (Which are incorrect?) |

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Names (Which are incorrect?)

Addresses (Which are incorrect?)

DISPUTE REQUEST FORM

Credit Account Information

Enter the information for accounts or inquiries on your credit report with any inaccuracies. Include correct information (e.g. Balance, payment date) and attach supporting documentation (e.g. account statement, payment confirmation) if applicable. Any documentation provided will be shared with the companies with which the dispute is being made as part of the dispute process.

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

Other (please explain)

Dispute Details

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.