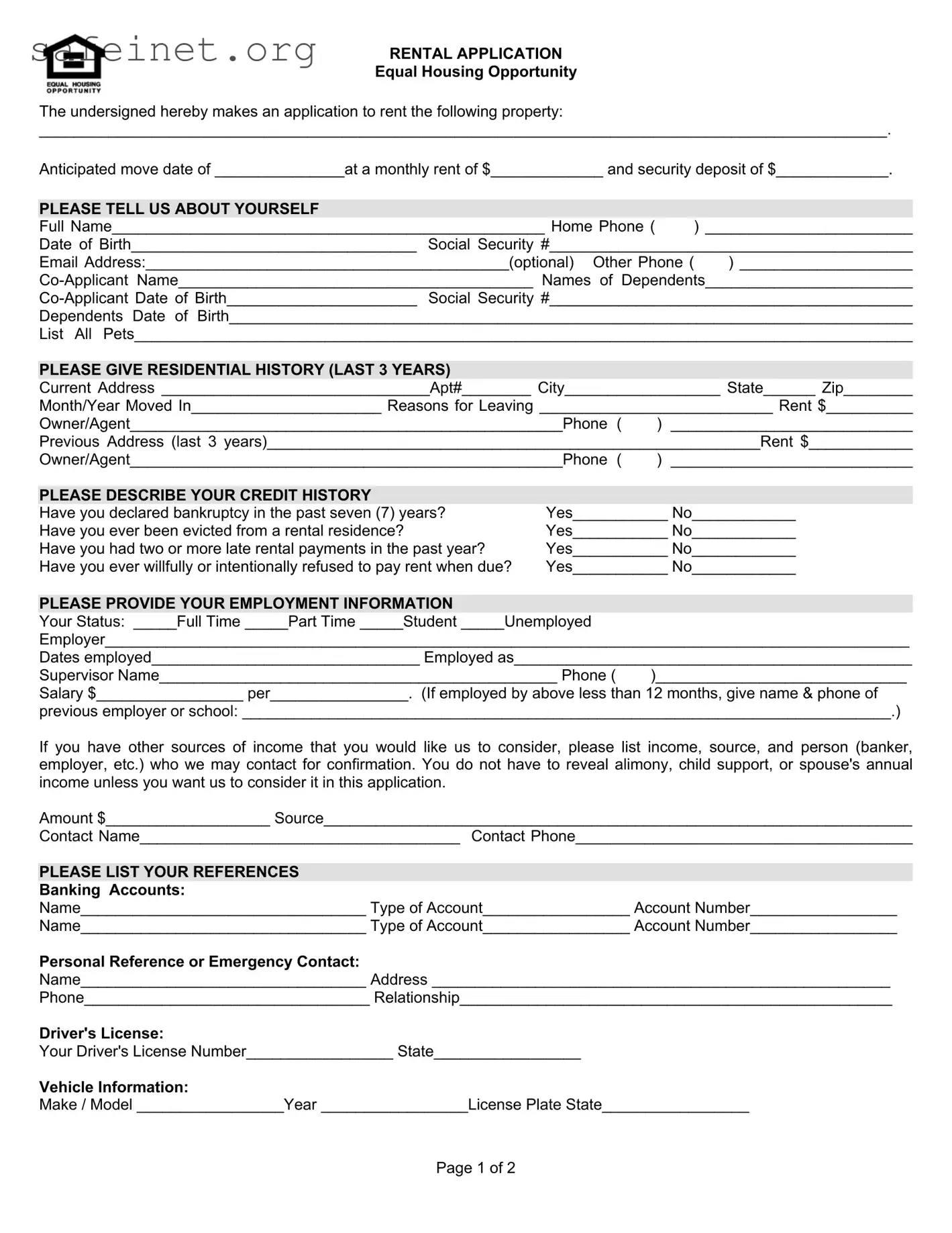

RENTAL APPLICATION

Equal Housing Opportunity

The undersigned hereby makes an application to rent the following property:

__________________________________________________________________________________________________.

Anticipated move date of _______________at a monthly rent of $_____________ and security deposit of $_____________.

PLEASE TELL US ABOUT YOURSELF |

|

|

Full Name__________________________________________________ Home Phone ( |

) ________________________ |

Date of Birth_________________________________ Social Security #__________________________________________ |

Email Address:__________________________________________(optional) Other Phone ( |

) ____________________ |

Co-Applicant Name_________________________________________ Names of Dependents________________________

Co-Applicant Date of Birth______________________ Social Security #__________________________________________

Dependents Date of Birth_______________________________________________________________________________

List All Pets__________________________________________________________________________________________

PLEASE GIVE RESIDENTIAL HISTORY (LAST 3 YEARS)

Current Address _______________________________Apt#________ City__________________ State______ Zip________

Month/Year Moved In______________________ Reasons for Leaving ___________________________ Rent $__________

Owner/Agent__________________________________________________Phone ( ) ____________________________

Previous Address (last 3 years)_________________________________________________________Rent $____________

Owner/Agent__________________________________________________Phone ( |

) ____________________________ |

|

|

|

PLEASE DESCRIBE YOUR CREDIT HISTORY |

|

|

Have you declared bankruptcy in the past seven (7) years? |

Yes___________ No____________ |

Have you ever been evicted from a rental residence? |

Yes___________ No____________ |

Have you had two or more late rental payments in the past year? |

Yes___________ No____________ |

Have you ever willfully or intentionally refused to pay rent when due? |

Yes___________ No____________ |

PLEASE PROVIDE YOUR EMPLOYMENT INFORMATION

Your Status: _____Full Time _____Part Time _____Student _____Unemployed

Employer_____________________________________________________________________________________________

Dates employed_______________________________ Employed as______________________________________________

Supervisor Name______________________________________________ Phone ( )_____________________________

Salary $_________________ per________________. (If employed by above less than 12 months, give name & phone of

previous employer or school: ___________________________________________________________________________.)

If you have other sources of income that you would like us to consider, please list income, source, and person (banker, employer, etc.) who we may contact for confirmation. You do not have to reveal alimony, child support, or spouse's annual income unless you want us to consider it in this application.

Amount $___________________ Source____________________________________________________________________

Contact Name_____________________________________ Contact Phone_______________________________________

PLEASE LIST YOUR REFERENCES

Banking Accounts:

Name_________________________________ Type of Account_________________ Account Number_________________

Name_________________________________ Type of Account_________________ Account Number_________________

Personal Reference or Emergency Contact:

Name_________________________________ Address _____________________________________________________

Phone_________________________________ Relationship__________________________________________________

Driver's License:

Your Driver's License Number_________________ State_________________

Vehicle Information:

Make / Model _________________Year _________________License Plate State_________________