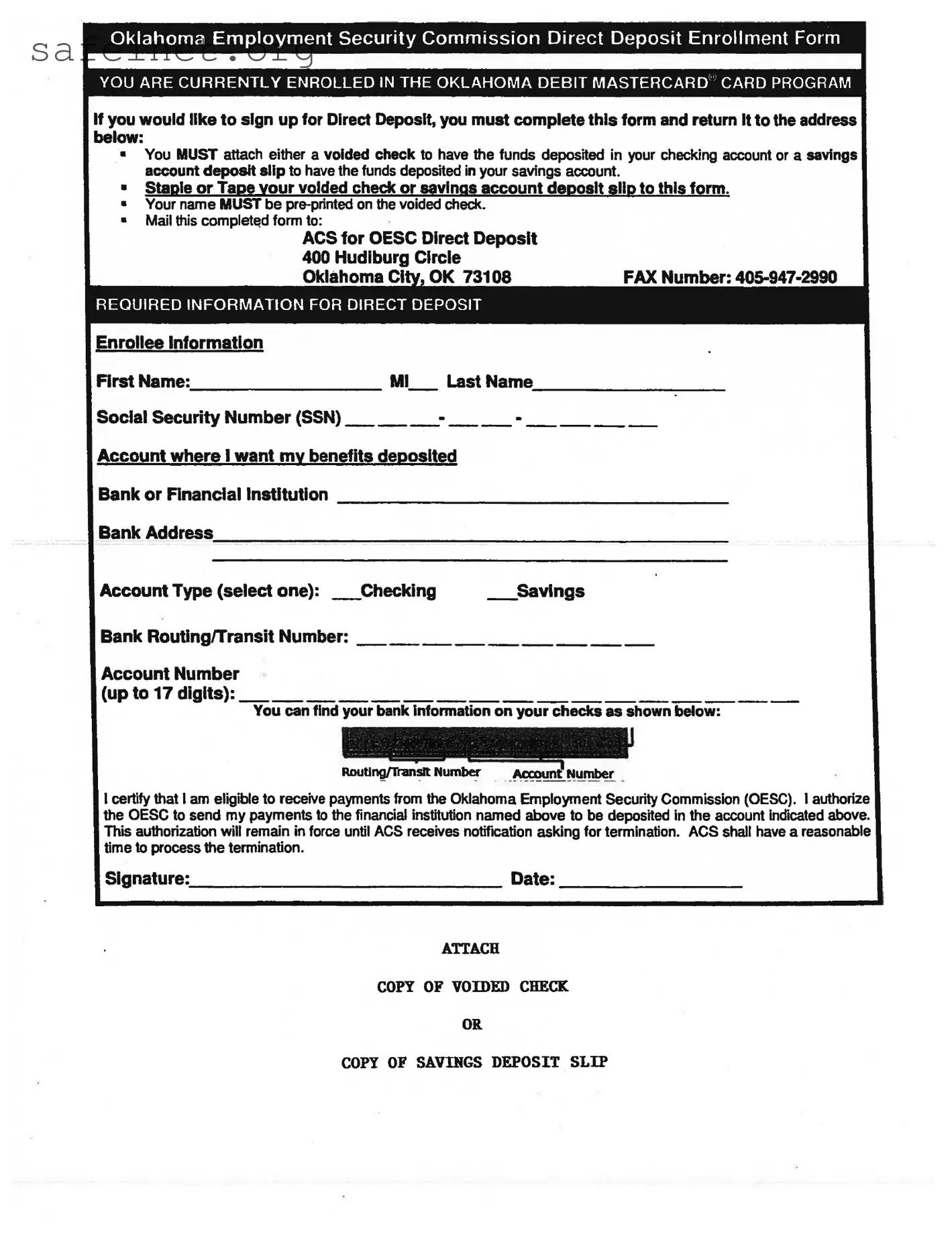

What is the Oklahoma Employment Security Commission Direct Deposit Enrollment Form?

The Oklahoma Employment Security Commission (OESC) Direct Deposit Enrollment Form allows individuals to authorize direct deposit of their benefits into a bank account. This simplifies the payment process and ensures timely receipt of funds directly into your chosen account.

How do I enroll in direct deposit using this form?

To enroll in direct deposit, you first need to fill out the form completely. Be sure to attach either a voided check from your checking account or a deposit slip from your savings account. Once everything is filled out and attached, mail the completed form to the specified address: ACS for OESC Direct Deposit, 400 Hudiburg Circle, Oklahoma City, OK 73108.

What information do I need to provide?

You'll need to provide your full name, Social Security Number (SSN), contact number, the name of your bank or financial institution, the bank address, account type (checking or savings), and the routing/transit number along with your account number. This information is necessary for setting up your direct deposit.

What types of bank accounts can I use for direct deposit?

You can choose to receive your benefits in either a checking or savings account. Just make sure to indicate your choice clearly on the form and attach the relevant documents accordingly.

Do I need to include a voided check or deposit slip?

Yes, attaching a voided check or a savings deposit slip is mandatory. The check or slip must show your name printed on it. This ensures that the funds are correctly deposited into your account.

Can I change my bank account after I’ve enrolled?

Yes, you can request to change your direct deposit information. However, you will need to submit a new Direct Deposit Enrollment Form with the updated bank details. It is important to allow time for processing this change, so don’t delay.

How will I know when my benefits have been deposited?

Your bank will typically send a confirmation to you, either through a statement or online banking notification. Additionally, you can monitor your bank account regularly to see when the funds have been deposited.

What happens if I make a mistake on the form?

If you realize you've made a mistake after submitting the form, it's best to contact the OESC directly as soon as possible. They will guide you on the necessary steps to correct the information and avoid any payment delays.

Is there a deadline for submitting this form?

While there may not be a strict deadline, it is recommended that you submit the form promptly to ensure your benefits are deposited into your account on time. Delays in submitting could result in a delay in receiving your payments.