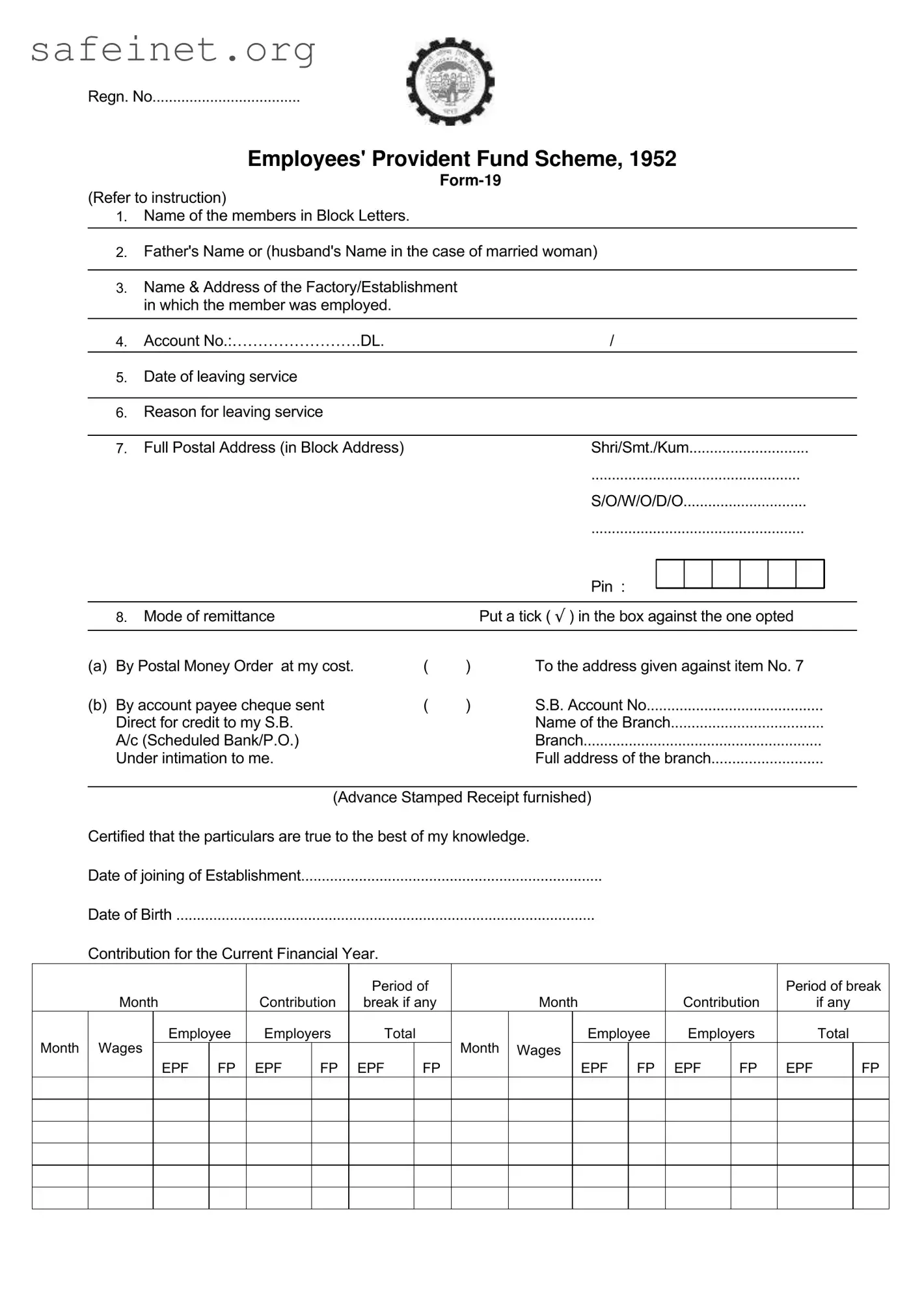

What is the Employees' Provident Fund form and who needs it?

The Employees' Provident Fund form is a crucial document for employees seeking to withdraw their provident fund savings after leaving their employment. This form must be completed by individuals who have been part of the Employees' Provident Fund Scheme, 1952 and have either terminated their employment or have become unemployed for an extended period.

What information is required on the form?

Essential details include the member's name, father's name (or husband’s name for married women), and the name and address of the establishment where employed. Additionally, you will need to provide your account number, the date of leaving service, reason for leaving, and your full postal address. The form also asks for information regarding your contributions for the current financial year.

How should I fill in the mode of remittance section?

For the mode of remittance, you must indicate your preferred option by placing a tick in the appropriate box. You can choose to receive your payment via Postal Money Order or by account payee cheque. If opting for a cheque, provide your Savings Bank account details along with the bank branch information.

What do I do if I am currently unemployed?

If you are unemployed, it is important to submit your application for settlement at least two months after leaving your job. The claim can only be processed if you maintain a continuous period of unemployment, in accordance with the provisions of the Employees' Provident Fund Scheme.

Is there an attestation required for the form?

Yes, the form requires attestation by the employer if the claim is to be processed under certain clauses. Your employer must certify that the contributions listed have been submitted regularly. This attestation serves to validate your employment details and contribution history.

What happens if I submit incorrect information?

Submitting incorrect information can delay the processing of your claim. To avoid complications, ensure all provided details are accurate and current. Inaccuracies may lead to your application being rejected or necessitate additional verification steps.

Can I track the status of my application?

Most offices provide a mechanism for tracking the status of your Provident Fund application. After submission, you may contact the relevant office or use their official website to get up-to-date information about your claim’s progress.

How long does it typically take to process the form?

Processing times can vary, but typically it takes a few weeks for claims to be processed and funds to be disbursed. Factors affecting the timeline include the completeness and accuracy of the application and overall processing load at the Provident Fund office.

What should I do if I encounter issues during the process?

If you face any issues, contact the regional Provident Fund office directly. They can provide guidance and assistance. It may also be helpful to consult with your former employer for additional support in resolving any discrepancies or problems.

Is there a specific deadline for submitting the form?

While there is no strict submission deadline, submitting your form as soon as possible after leaving employment is advisable. Remember that certain conditions apply regarding the timeline for those who remain unemployed, which can affect your eligibility for claiming benefits.