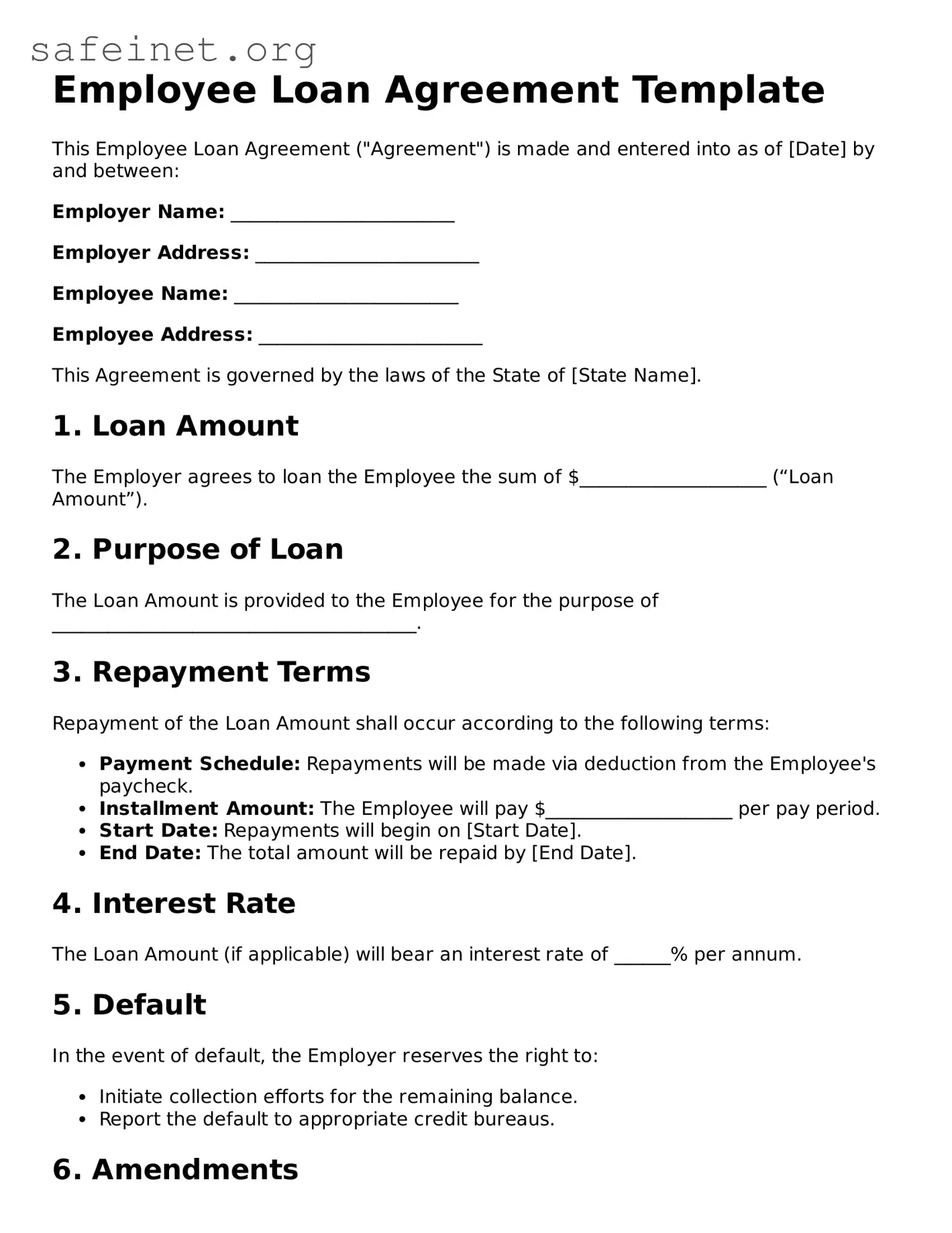

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into as of [Date] by and between:

Employer Name: ________________________

Employer Address: ________________________

Employee Name: ________________________

Employee Address: ________________________

This Agreement is governed by the laws of the State of [State Name].

1. Loan Amount

The Employer agrees to loan the Employee the sum of $____________________ (“Loan Amount”).

2. Purpose of Loan

The Loan Amount is provided to the Employee for the purpose of _______________________________________.

3. Repayment Terms

Repayment of the Loan Amount shall occur according to the following terms:

- Payment Schedule: Repayments will be made via deduction from the Employee's paycheck.

- Installment Amount: The Employee will pay $____________________ per pay period.

- Start Date: Repayments will begin on [Start Date].

- End Date: The total amount will be repaid by [End Date].

4. Interest Rate

The Loan Amount (if applicable) will bear an interest rate of ______% per annum.

5. Default

In the event of default, the Employer reserves the right to:

- Initiate collection efforts for the remaining balance.

- Report the default to appropriate credit bureaus.

6. Amendments

This Agreement may only be amended or modified in writing signed by both parties.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State Name].

8. Signatures

By signing below, both parties agree to the terms outlined in this Agreement.

Employer Signature: ________________________ Date: ________________________

Employee Signature: ________________________ Date: ________________________