What is the Employee Advance form?

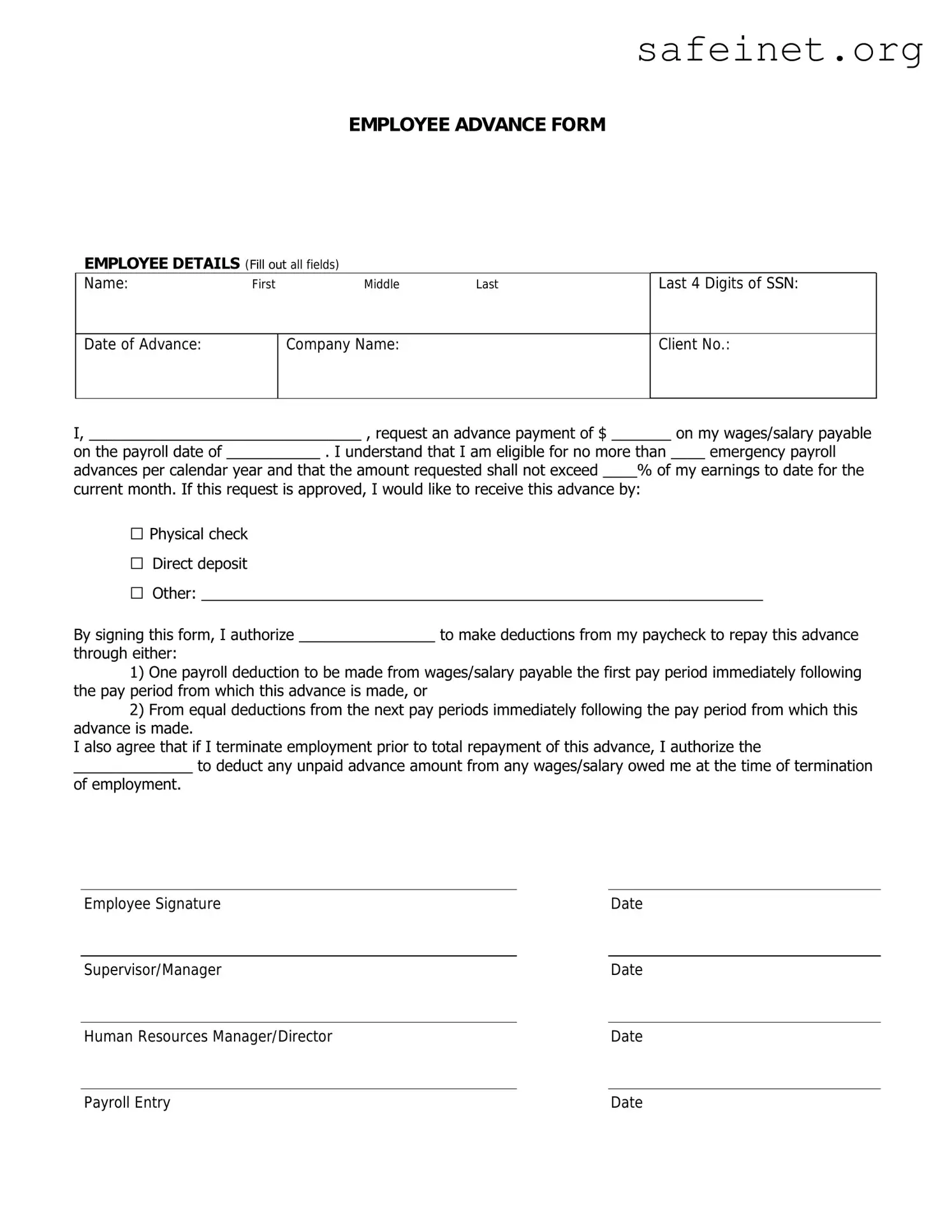

The Employee Advance form is a document that employees can use to request an advance payment from their employer. It serves as a formal record of the request for financial assistance for various reasons, such as travel expenses, emergency expenses, or work-related costs.

Who is eligible to use the Employee Advance form?

Generally, all employees of the organization may be eligible to use this form. However, specific eligibility criteria may apply based on the company policy. It is advisable to check with the HR department or internal guidelines for any restrictions that may exist.

What information do I need to provide on the form?

When filling out the form, you will typically need to include your name, employee ID, department, the amount you are requesting, and a description of the purpose for the advance. Additional documentation may be required to support your request, depending on company policy.

How do I submit the Employee Advance form?

After completing the form, submit it to your direct supervisor or the designated finance department personnel. Ensure you keep a copy for your records in case you need to follow up on your request.

What happens after I submit the form?

Once submitted, your request will be reviewed by the appropriate personnel. They will evaluate your reason for the advance and determine whether it meets the company's criteria. You should receive a response regarding the approval or denial within a specified timeframe.

How long does it take to get the advance?

The time frame for receiving the advance can vary. Typically, it ranges from a few days to a week after approval. Factors influencing this duration include payroll schedules and the internal processing times of the finance department.

Do I have to repay the advance?

Yes, advances are generally considered loans and must be repaid. The repayment schedule usually depends on company policy and may involve deductions from your future paychecks. Make sure to clarify the repayment terms before accepting the advance.

What if my request for the advance is denied?

If your request is denied, the reviewing party should provide a brief explanation. While it might be disappointing, you can seek feedback on how to strengthen future requests or discuss alternative options with your supervisor.

Can I appeal a denied advance request?

In some organizations, an appeal process may be available. You should inquire about the policy regarding appeals and whether you can provide additional information or justification for your original request.

Is there a limit to how much I can request?

Yes, there is often a limit on the amount you can request as an advance. This limit varies by employer and is outlined in the company's financial policies. It’s advisable to familiarize yourself with these limits before submitting your request.