What is the purpose of the EMP5398 form?

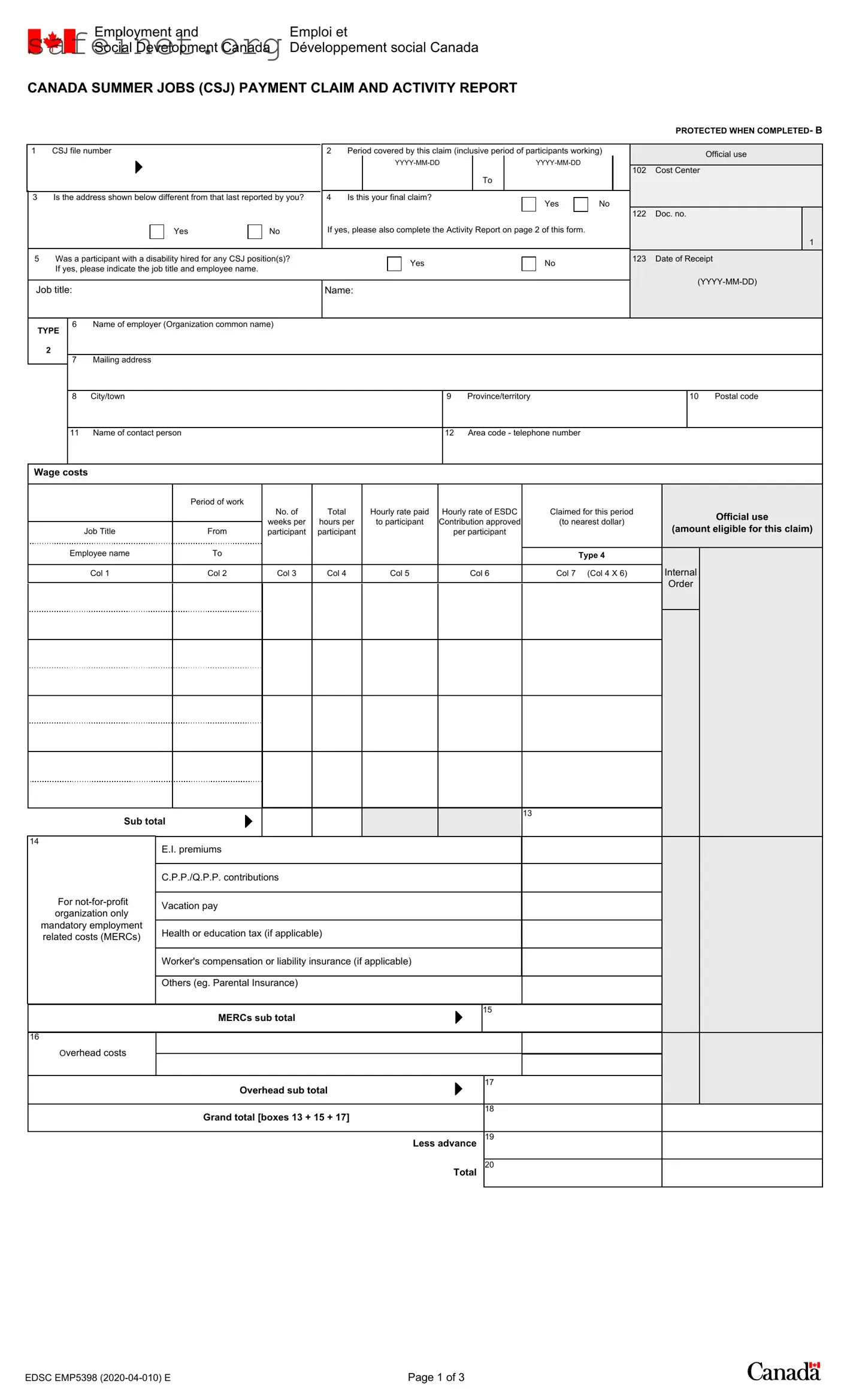

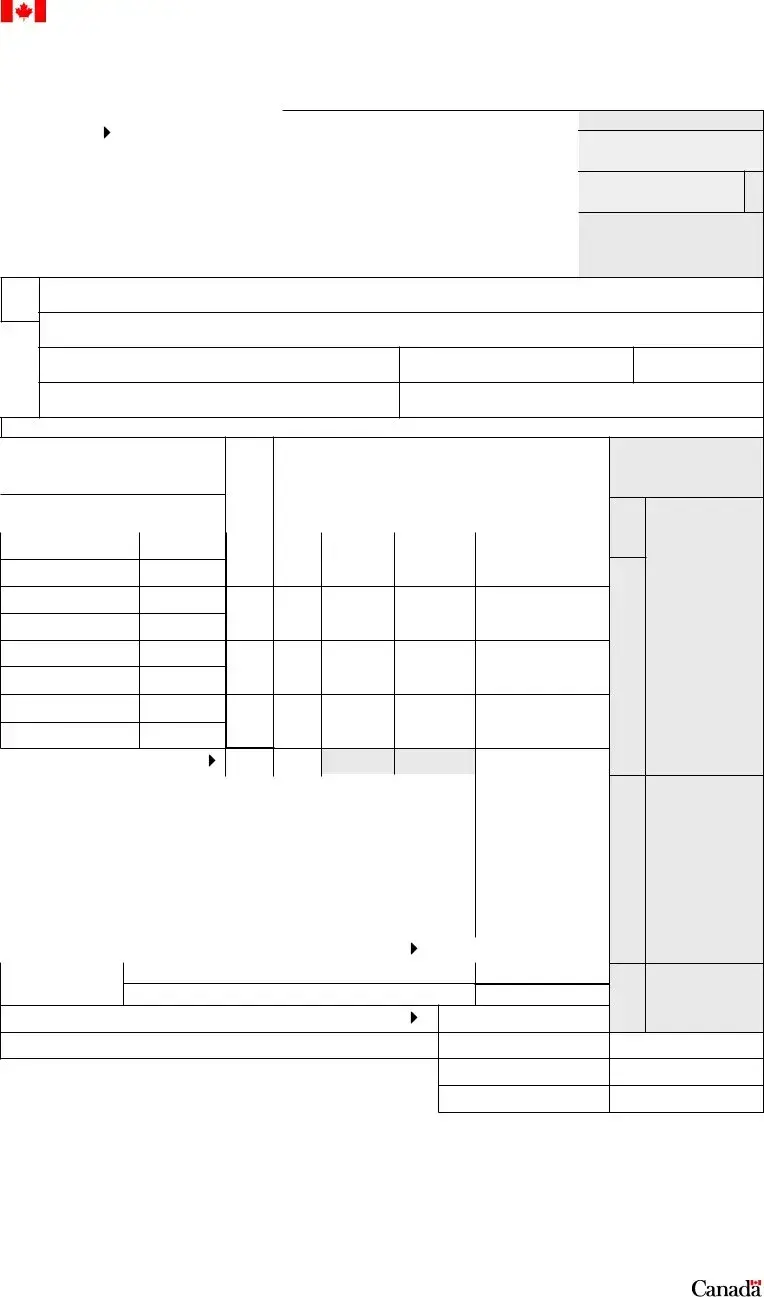

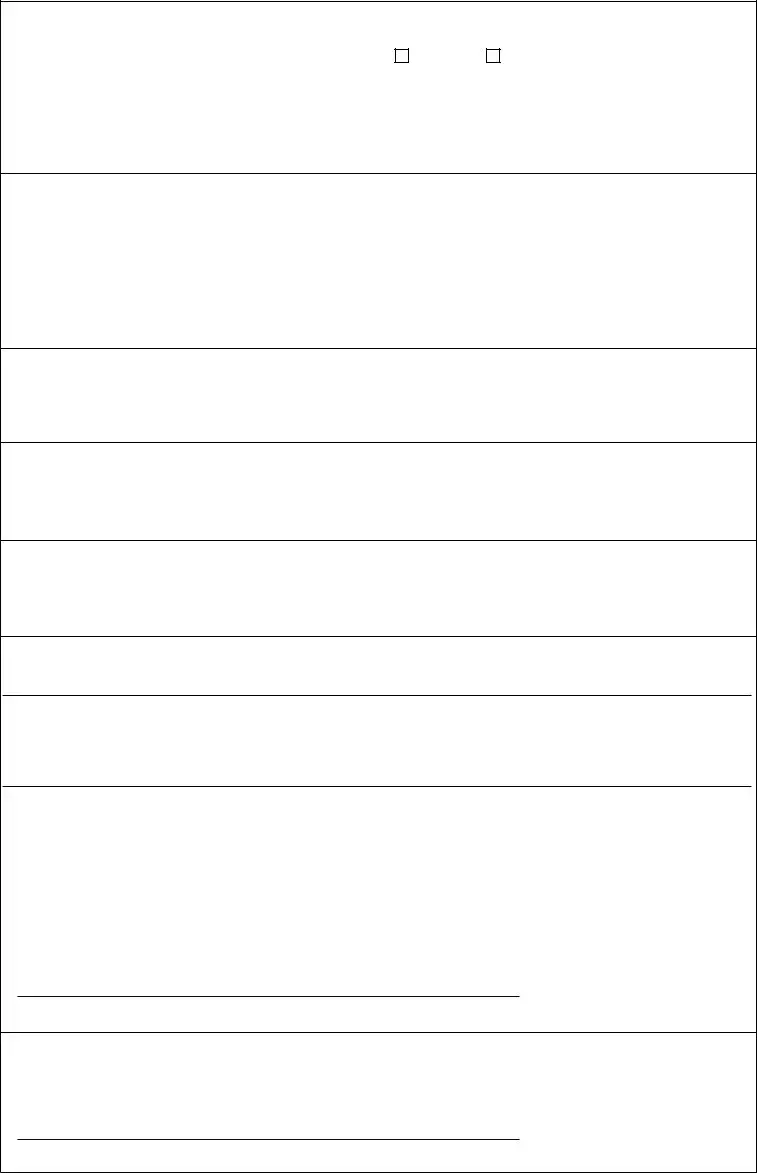

The EMP5398 form is used by employers participating in the Canada Summer Jobs (CSJ) program to submit a payment claim and activity report. Employers must provide details about the work experience of the participants they hired, including payment information and job duties performed.

Who is required to fill out the EMP5398 form?

Any employer who has hired participants through the CSJ program must fill out this form. This includes providing details about wages paid to participants and information related to their work experience.

What information is required to complete the EMP5398 form?

The form requires the employer's contact details, the period covered by the claim, employee names, job titles, the number of hours worked, and the hourly rates. In addition, employers must answer questions related to employee retention, health and safety, and the completion of an employer questionnaire before submission.

Is there a deadline for submitting the EMP5398 form?

Yes, the EMP5398 form should be submitted by the deadline specified in the CSJ program guidelines. It is essential for employers to check the guidelines to ensure timely and accurate submissions to receive the appropriate funding.

What happens if employees with disabilities are hired?

If an employer hires participants with disabilities, they must indicate this on the EMP5398 form. The form includes specific fields to report the job title and names of these employees, which is crucial for tracking the inclusivity of the program.

Do I need to provide any additional documentation when submitting the EMP5398 form?

How does the EMP5398 form protect the information I provide?

The information submitted on the EMP5398 form is protected under the Privacy Act and the Access to Information Act. This means that personal details will be handled confidentially and only used for program-related purposes.

What should I do if I have questions about the EMP5398 form?

If you have questions regarding the EMP5398 form or its completion, it is advisable to contact the designated area code/telephone number provided on the form. Assistance can also be sought from program administrators for clarification on specific queries related to the CSJ program.