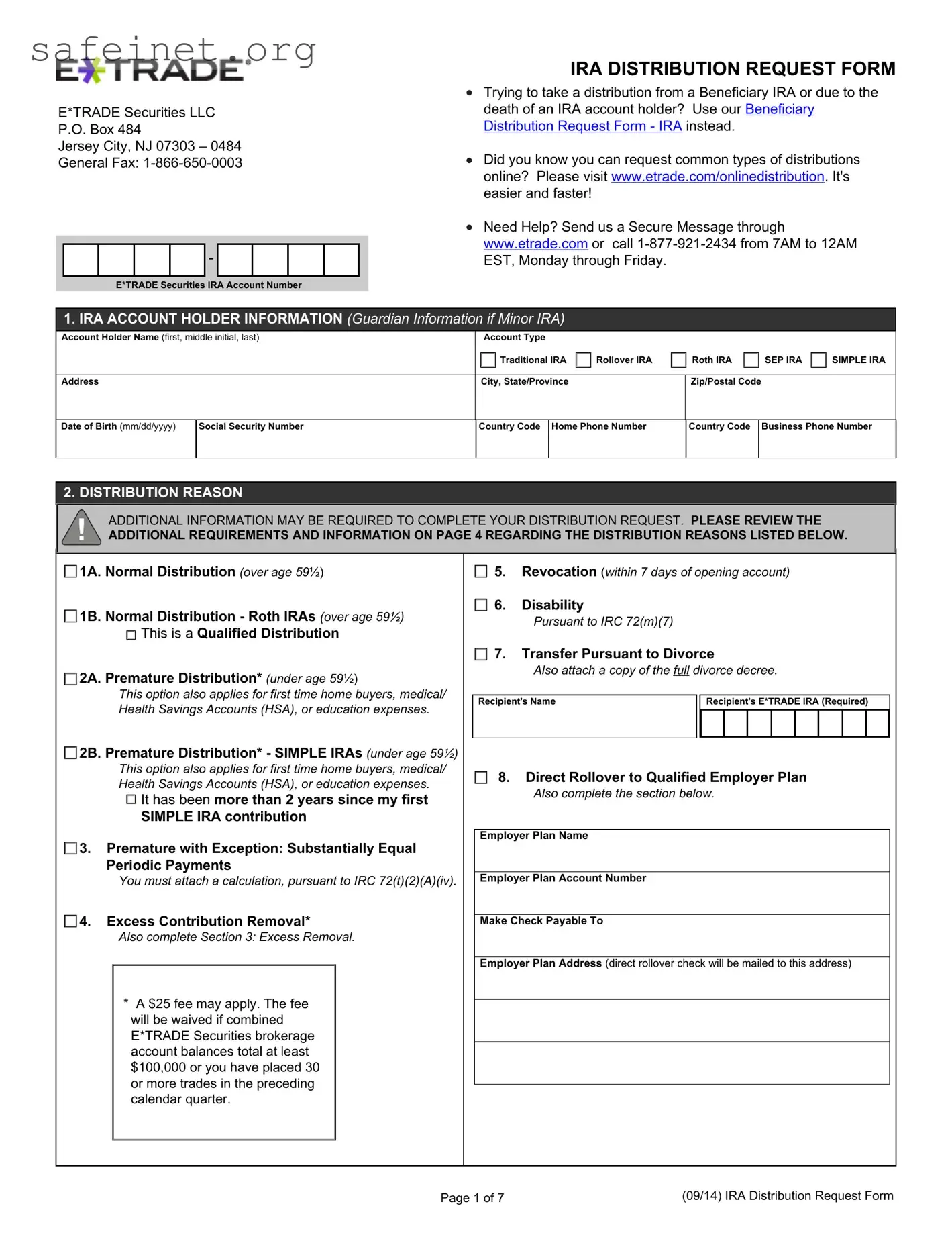

3.Premature with Exception: Substantially Equal Periodic Payments - Provide calculation, pursuant to IRC 72(t)(2)(A)(iv)

If you are under 59 ½ and take “substantially equal periodic payments” (as defined in Internal Revenue Code (IRC) Section 72(t)(2)(A)(iv)) from your IRA, you may qualify for an exception to the early distribution penalty. Once this payment series begins, generally, the payment schedule may not be altered for a period of five years (60 months) or attainment of age 59 ½, whichever is longer. Funds may not be added or subtracted from the account in any way, including contributions, transfers in or out, and distributions from the account other than the calculated payment once the payment period is complete. The account you are requesting this payment schedule for must have sufficient cash funds for the distribution. A missed payment not corrected by year’s end constitutes an alteration of the schedule and will terminate the exception. Please consult with a financial or tax professional before submitting this request.made.

4.Excess Contribution Removal

If you have made an excess contribution to your IRA, you must take the appropriate steps to remove or redesignate the distribution. Depending on when you take the necessary corrective action and the amount of the excess contribution, you may have to pay the IRS either an excess contribution or early distribution penalty tax, or both. Code 1, 7, 8, or P (or a combination of these codes) will be applicable on IRS Form 1099R depending on the timing of the removal.

If you marked Excess Contribution Removal as your distribution reason, you must complete Section 3:

EXCESS REMOVAL.

5.Revocation

If you receive a disclosure statement at the time you establish your IRA or Roth IRA, you have the right to revoke your account within seven (7) calendar days of its establishment. If revoked, you are entitled to a full return of the contribution made.

6.Disability

You may take a distribution due to disability only if the disability renders you unable to engage in any substantial gainful activity and it is medically determined that the condition will last continuously for at least 12 months or lead to your death.

7.Transfer Pursuant to Divorce

A transfer may be made by an IRA holder and a recipient under a transfer due to divorce. The following documents are required to process a divorce transfer: Official Divorce Decree signed by a judge referencing the settlement, IRA Application from receiving party (if the party does not already have an IRA with the same registration) and the IRA Distribution Request Form from the releasing party.

8.Direct Rollover to Qualified Employer Plan

If you qualify, you may rollover taxable IRA assets to your employer’s qualified plan, tax-sheltered annuity (403(b)), or 457 plan. The rules governing rollovers are very complex. You are advised to see a competent tax advisor if you have questions regarding eligibility to complete a rollover.

For Direct Rollovers to a Qualified Employer Plan, E*TRADE Clearing will send assets directly to that plan. Checks are typically be made out to the plan, for the benefit of the IRA holder. If you are unsure to whom the check should be made payable, check with your plan administrator. Checks are mailed to the Employer Plan Address supplied by you, in this section.

If you indicated the reason for your distribution is an excess contribution removal, you must complete this section.

Question 5: If you marked response "A", please note that if the application of earnings to the current tax year will create an excess contribution, the earnings will be disbursed to you by check to the address of record, instead.

-

-

1A. Normal Distribution

1A. Normal Distribution  1B. Normal Distribution - Roth IRAs

1B. Normal Distribution - Roth IRAs

2A. Premature Distribution*

2A. Premature Distribution*

3. Premature with Exception: Substantially Equal Periodic Payments

3. Premature with Exception: Substantially Equal Periodic Payments 4. Excess Contribution Removal*

4. Excess Contribution Removal*

6. Disability

6. Disability 7. Transfer Pursuant to Divorce

7. Transfer Pursuant to Divorce

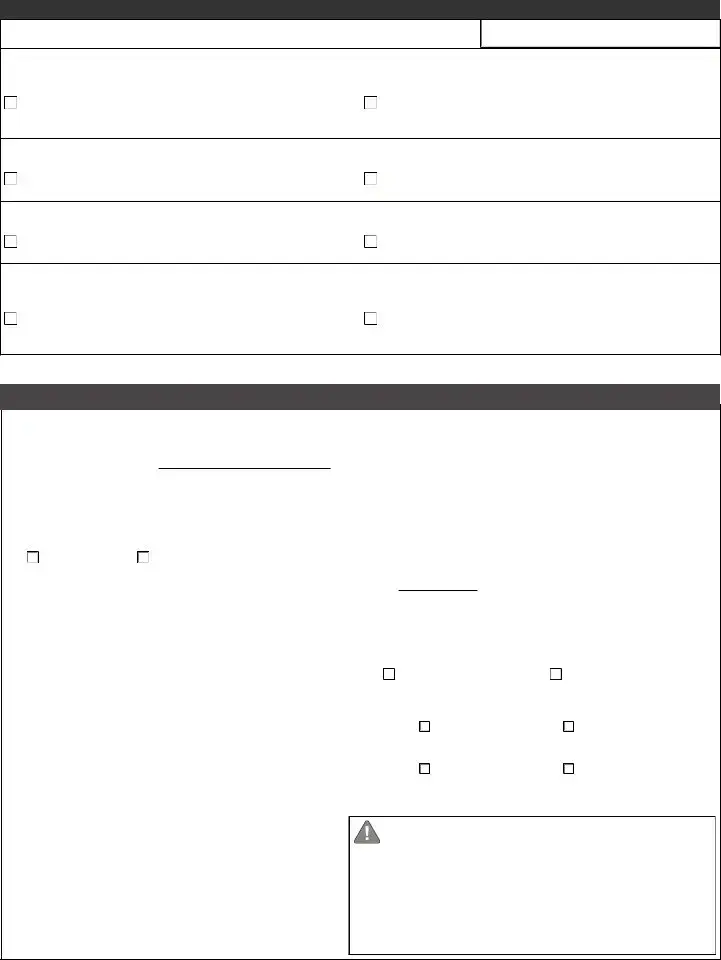

One Time Payment of

One Time Payment of  Balance of Account (lump sum)

Balance of Account (lump sum) Required Minimum Distribution

Required Minimum Distribution  Transfer Securities

Transfer Securities  All securities positions

All securities positions

Installment Payments of (choose one):

Installment Payments of (choose one):

Check

Check Check by Express Mail (additional $20.00 fee)

Check by Express Mail (additional $20.00 fee) Deposit to existing E*TRADE Securities brokerage account number:

Deposit to existing E*TRADE Securities brokerage account number: Deposit to existing E*TRADE Bank account number:

Deposit to existing E*TRADE Bank account number: Do not withhold State income tax.

Do not withhold State income tax. Withhold State income tax from my requested amount in accordance with State requirements.

Withhold State income tax from my requested amount in accordance with State requirements.