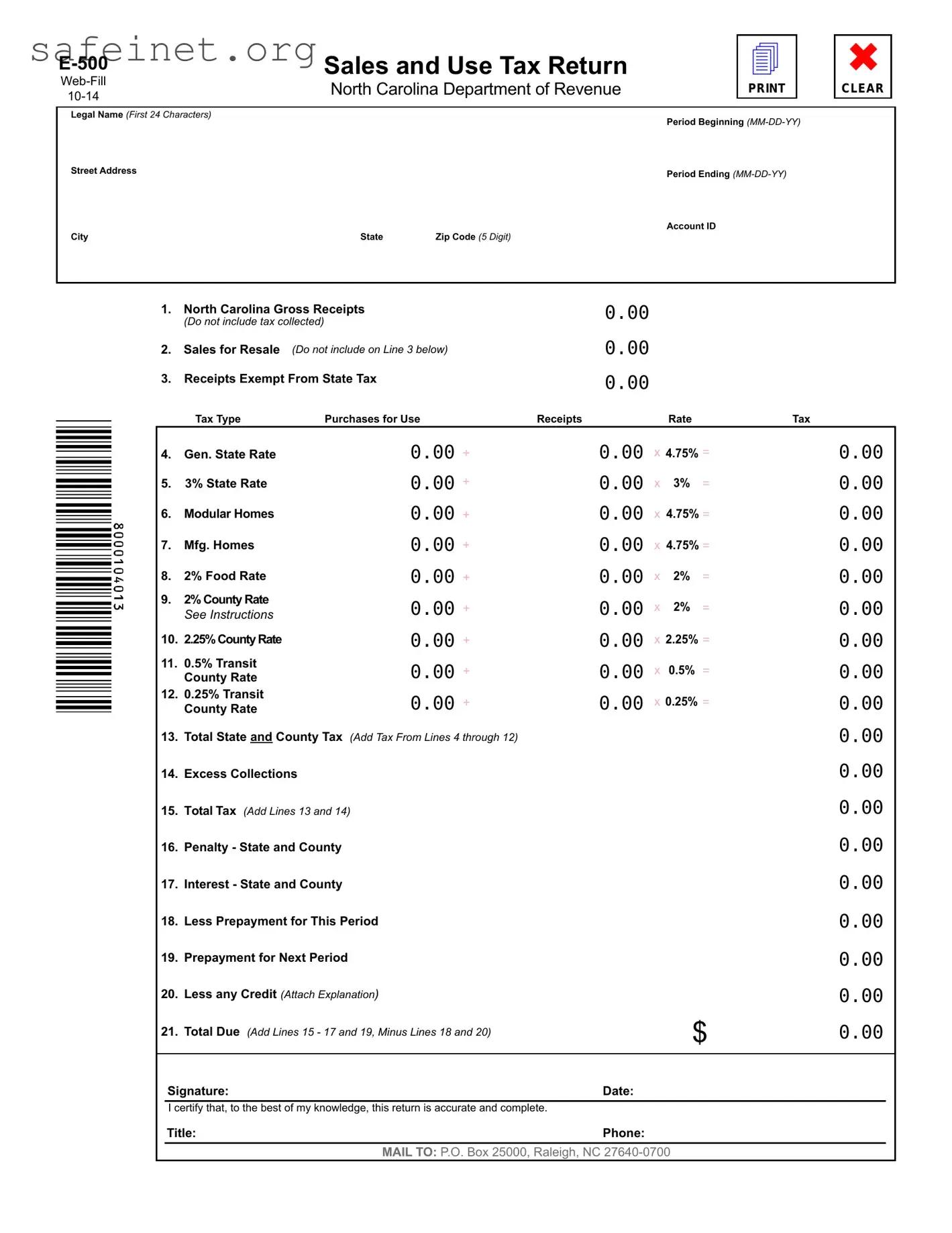

The E-500 form, which serves as the Sales and Use Tax Return for North Carolina's Department of Revenue, bears similarities to the IRS Form 1040, which is used for individual income tax returns. Both forms require accurate reporting of financial information, including income and taxable expenses. However, while the E-500 focuses on sales and use tax specific to North Carolina, Form 1040 centers around federal income tax. Both forms also necessitate the taxpayer's signature, certifying the accuracy of the data provided.

Another document comparable to the E-500 is the IRS Form 941, which employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Like the E-500, Form 941 requires periodic submission based on a set timeframe, generally quarterly. Each form collects specific financial data to determine tax obligations: the E-500 deals with sales and use tax liabilities, while Form 941 handles federal payroll taxes. Both documents must be filed to ensure compliance with relevant tax regulations.

The E-500 also shares characteristics with a state-specific sales tax exemption certificate, such as North Carolina's ST-3. This document allows buyers to purchase items without paying sales tax under certain circumstances. Exemption certificates, like the E-500, require particular details about the buyer and the nature of the exempt purchase. Both forms emphasize the necessity of accurate record-keeping to substantiate claims made when dealing with state tax authorities.

In addition, the E-500 is similar to the Form 1065, which partnerships use to report income, deductions, gains, and losses. Both documents detail financial activity over a specified period. The Form 1065, however, pertains to business entities, while the E-500 relates specifically to tax owed on sales transactions, highlighting unique aspects of revenue generation and tax liability within their respective frameworks.

The E-500 also resembles the IRS Form 1120, which is utilized by corporations to report income tax. Both forms are essential for determining tax obligations and include comprehensive information about revenue receipt. Nevertheless, the primary distinction lies in the type of entity each form represents—the E-500 targets sales in North Carolina, while Form 1120 focuses on corporate income generation at the federal level.

Another relevant document is the North Carolina Form D-400, which individuals use for income tax purposes. Like the E-500, it requires taxpayers to report certain financial figures based on a defined period. The E-500, on the other hand, specifically addresses sales and use tax collection, appealing to businesses rather than individual income earners. Both serve as crucial tools in ensuring that taxpayers fulfill their obligations to the state.

The E-500 form can also be compared to the IRS Form 720, which is used to report and pay federal excise taxes. While both documents require detailed financial reporting, the E-500 focuses on sales and use tax at the state level, whereas Form 720 deals with various federal excise taxes related to specific goods and activities. Both document types require periodic reporting and payment of taxes, but they cover different areas of financial obligations.

Furthermore, the E-500 is akin to the IRS Form 1099, which businesses use to report various types of payments made to contractors. Just as the E-500 collects information about sales transactions, Form 1099 captures payment information for services rendered. While both forms require accurate reporting, they pertain to distinct financial activities—sales versus payments for services—within the tax framework.

Lastly, the E-500 shares similarities with the North Carolina Corporate Income and Franchise Tax Return (Form CD-405), used by corporations to report their tax obligations. Both forms require precise financial information about revenue and tax rates applicable over a specified timeframe. However, the E-500 specifically targets sales and use tax, while Form CD-405 encompasses corporate income tax, depicting the broader landscape of tax liability for different types of entities in North Carolina.