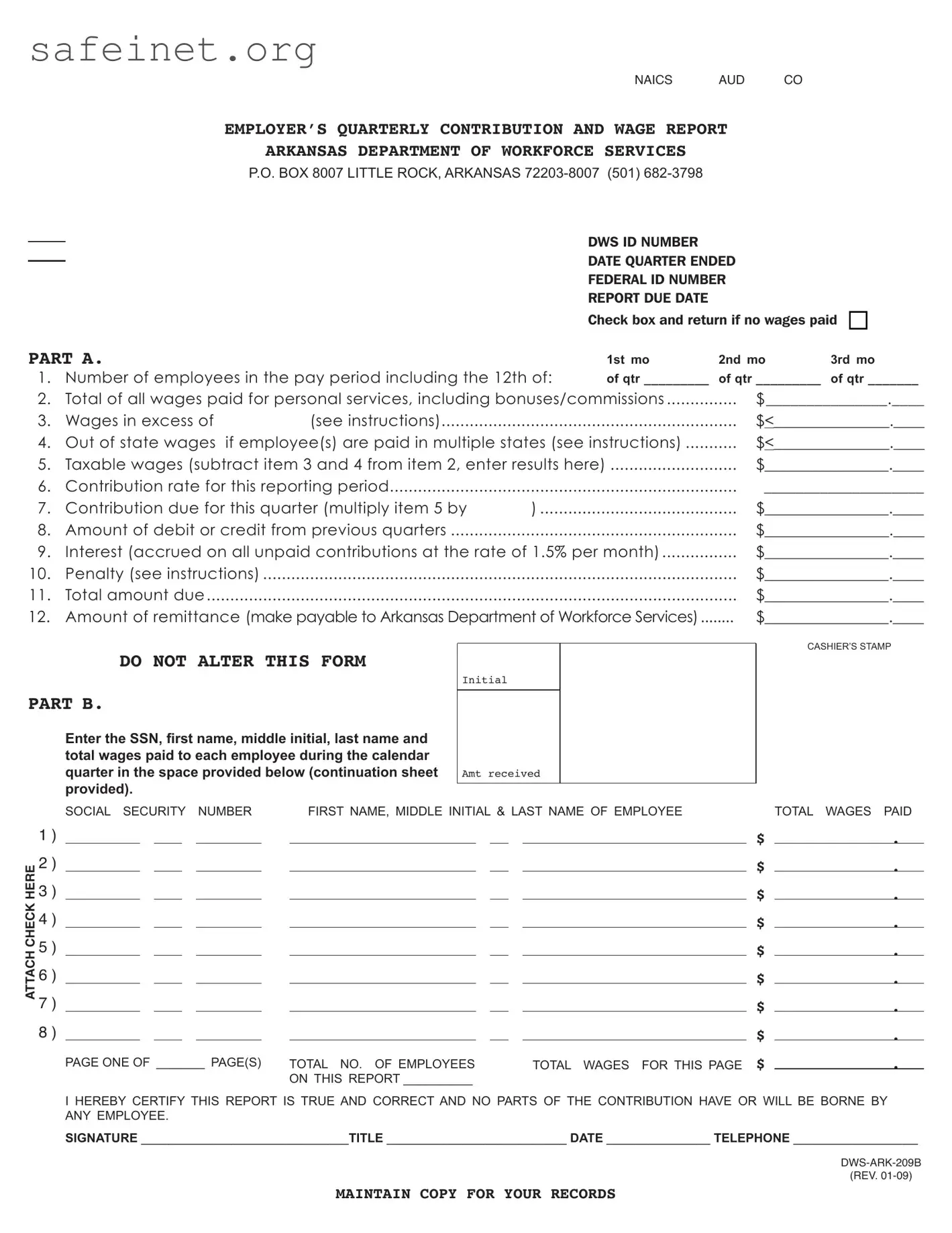

What is the Dws Ark 209B form used for?

The Dws Ark 209B form is utilized by employers in Arkansas to report their quarterly contribution and wage details to the Arkansas Department of Workforce Services. It encompasses information such as the number of employees, total wages paid, and taxable wages. This form is essential for ensuring compliance with state labor regulations and for calculating unemployment insurance contributions.

When is the Dws Ark 209B form due?

The Dws Ark 209B form is typically due on the last day of the month following the end of each quarter. Employers should ensure they submit the form on time to avoid penalties. Specifically, the quarters end on March 31, June 30, September 30, and December 31.

What information is required on the form?

The form requires several pieces of information including the employer's DWS ID number, Federal ID number, and the number of employees during the pay period. Additionally, employers must report total wages paid, out-of-state wages where applicable, and taxable wages. There are also sections for contribution rates, the amount due, and employee-specific data, including Social Security numbers and total wages paid.

What happens if an employer does not submit the form?

If an employer fails to submit the Dws Ark 209B form by the deadline, they may face penalties. This includes accrued interest on any unpaid contributions at a rate of 1.5% per month. Regularly submitting this form is crucial to avoid additional costs and legal complications.

Can employers complete the form if they have no wages to report?

Yes, employers can check the box indicating that no wages were paid during the quarter and return the form to the Arkansas Department of Workforce Services. It is important to submit the form even when there are no wages to ensure compliance and maintain accurate records.

How should payment be submitted with the form?

Employers must attach a check made payable to the Arkansas Department of Workforce Services when they submit the Dws Ark 209B form. The check amount should reflect the total contributions due. Properly attaching the payment ensures that the submission is processed without delay.