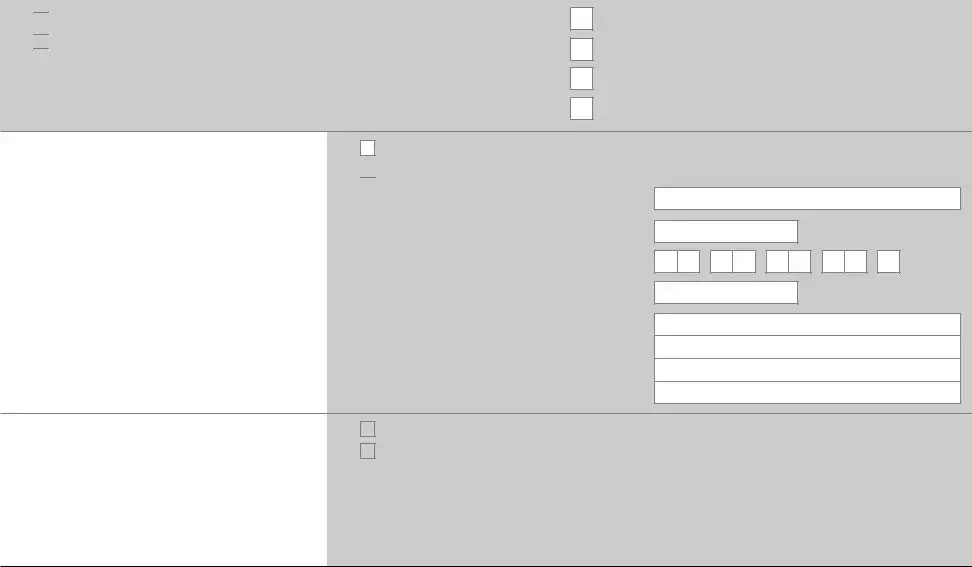

What is a Budgeting Loan and who can apply for it?

A Budgeting Loan is a type of financial assistance offered by the Social Fund to help individuals cover certain essential expenses. To qualify, you must have been receiving Income Support, income-based Jobseeker's Allowance, income-related Employment and Support Allowance, Pension Credit, or a related payment for at least 26 weeks when your application is processed. You also need to demonstrate a genuine need for assistance, such as purchasing furniture or clothing, paying for rent in advance, or settling related debts.

What is the maximum amount I can receive through a Budgeting Loan?

The maximum amount you can receive depends on your household situation. A single individual may qualify for up to £348. For couples without children, the maximum is £464. If you are a one or two-parent family with children, the maximum amount rises to £812. However, your individual circumstances and any outstanding debts to the Social Fund may affect these amounts.

Are there any restrictions on how I can use a Budgeting Loan?

Yes, Budgeting Loans can only be used for specific types of expenses. These include furniture and household equipment, clothing and footwear, rent in advance, home improvements, and expenses related to travel, maternity, funerals, or employment. Loans cannot be used for any items or services outside of these categories.

How is the repayment process handled?

When you receive a Budgeting Loan, repayment will be arranged based on your financial situation. The loan amount will be deducted from your benefits through weekly repayments. If you or your partner do not receive benefits, alternative repayment arrangements will be discussed. Additionally, if unexpected financial difficulties arise later, there may be options to modify the repayment terms with assistance from your local jobcentre.

What happens if I have outstanding debts to the Social Fund?

If you owe £1,500 or more to the Social Fund for any previous loans, you will not be eligible for another Budgeting Loan. It’s important to manage outstanding debts before applying for new financial assistance.

How does my savings balance affect my application?

Your savings may impact the amount you are eligible to receive. If you and your partner are under 63 years old, savings over £1,000 could reduce your loan amount. For those aged 63 or over, savings exceeding £2,000 may similarly affect your eligibility. It's crucial to report accurate savings amounts when applying.

Where can I find more information or help regarding my application?

If you need additional information, you can contact Jobcentre Plus by calling 0800 169 0140 or visit their website at www.gov.uk. You may also reach out to local advice centers like Citizens Advice for support with your application and financial situation.

What should I do if I need assistance completing the application form?

If you require help with the Budgeting Loan application, you can seek assistance from a trusted friend, family member, or a professional at an advice center. The application may seem complex, but taking it step by step will help ensure all necessary information is provided. Don’t hesitate to ask for guidance if needed.

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

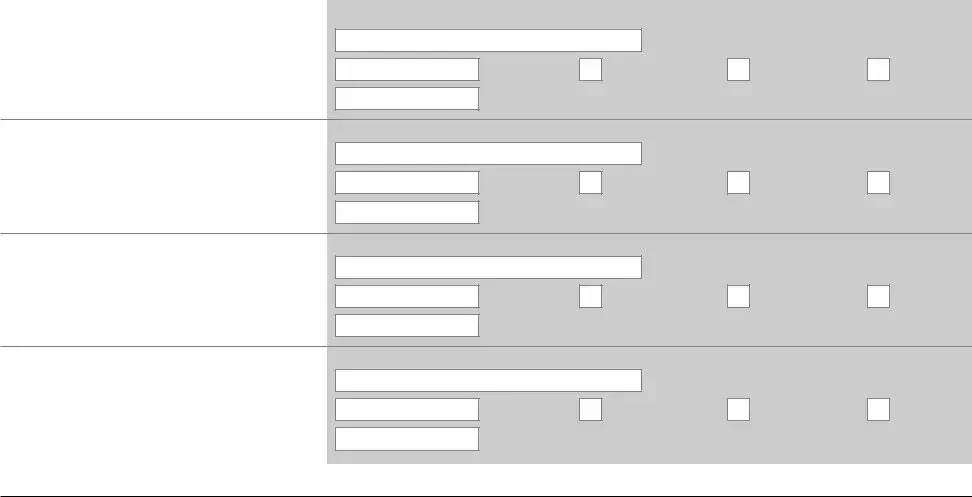

How much do you get a week?

How much do you get a week?

How much do you get a week?

How much do you get a week?

Yes

Yes

Tell us about this person:

Tell us about this person:

How much savings do you have?

How much savings do you have?