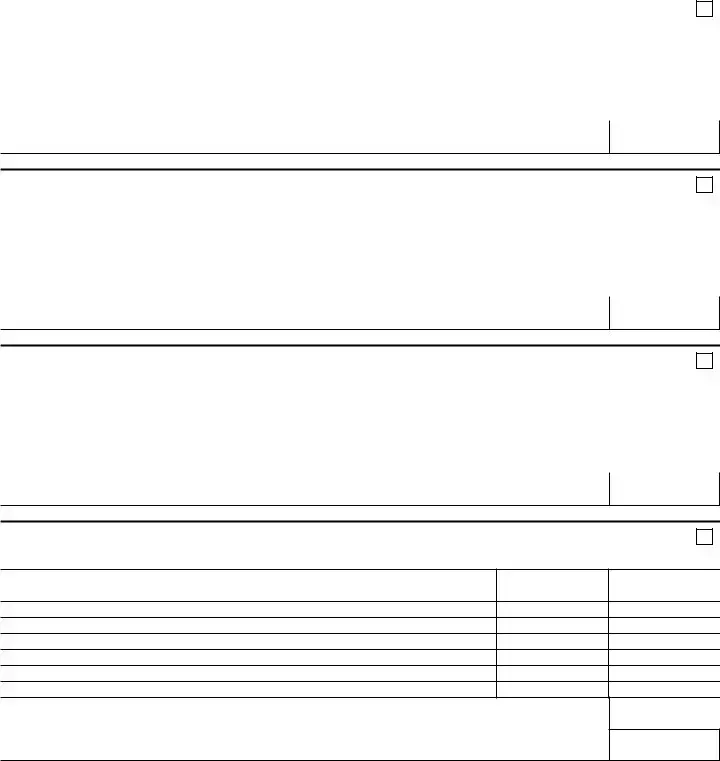

Page 10 of 10 DTF-5 (8/18)

•Attachments

Items 1, 2, and 3 must be attached; items 4 through 12, if applicable, must also be attached.

Failure to provide these returns, statements, and documents will cause immediate rejection of your compromise request, request for payment plan, or other proposal.

You must attach:

1. Federal returns for the preceding three years, with all schedules and statements attached. If you were not required to file, include an explanation. In addition:

•for all sole proprietorships or single-member LLC’s (Schedule C), also include the balance sheets for the preceding three years, as of each year-end. These balance sheets may be self-prepared.

•include all federal schedules K-1 from Form 1120S or Form 1065, or both, for the preceding three years, as applicable.

2. Complete credit reports issued by a credit bureau dated within 30 days of this submission.

3. All bank account statements, brokerage account statements, and retirement account statements for the preceding 12 months.

•If you receive certain statements on a quarterly basis, provide the four most recent quarterly statements for the applicable account(s).

•If you receive certain statements on an annual basis, provide the most recent annual statement for the applicable account(s).

You must attach, if applicable:

4. Federal application to compromise, with the results.

5. Recent mortgage or home equity loan statements(s) dated within 30 days of submission. The statement(s) must show monthly payment amounts and current balance outstanding. We may request a real estate appraisal.

6. All mortgage indentures and conveyances, as grantor or grantee, for the preceding 10 years.

7. Lease agreements, both as landlord and tenant.

8. Loan agreements, both for note(s) receivable and note(s) payable. Include the security/collateral agreements for all secured loans.

9. Contracts of sale of any assets having a fair market value of over $500.00 within the last five years. For example, sales agreement, closing statement, HUD-1 statement, etc.

10. Copies of legal instruments related to pending claims (insurance or otherwise), rights to sue, subrogations, assignments, and other assets.

11. Bankruptcy discharge papers, if applicable.

12. For any business (corporation, partnership, s corp, non-profit organization, professional corp, etc.): We may request the audited, reviewed, or company-prepared financial statements for the preceding three years. In addition, we may request an Accounts Receivable Aging Report for any business.

•Declaration

I declare that I have examined the information given in this statement and, to the best of my knowledge and belief, it is true, correct, and complete, and I further declare that I have no assets, owned either directly or indirectly, or income of any nature other than as shown in this statement. I make this statement with the knowledge that a willfully false representation is a misdemeanor punishable under New York State Penal Law section 210.45.

I authorize the New York State Department of Taxation and Finance (DTF) to contact certain third parties, including but not limited to financial institutions and consumer credit reporting agencies, and to obtain my consumer credit report for the purpose of verifying the information I provided to DTF for determining my eligibility for an installment payment agreement or other payment terms. In addition, I authorize DTF to use my Social Security number when requesting my credit history from consumer reporting agencies or when verifying the information provided. I understand that DTF will not notify me about which third parties, if any, are contacted by DTF as part of this review process.