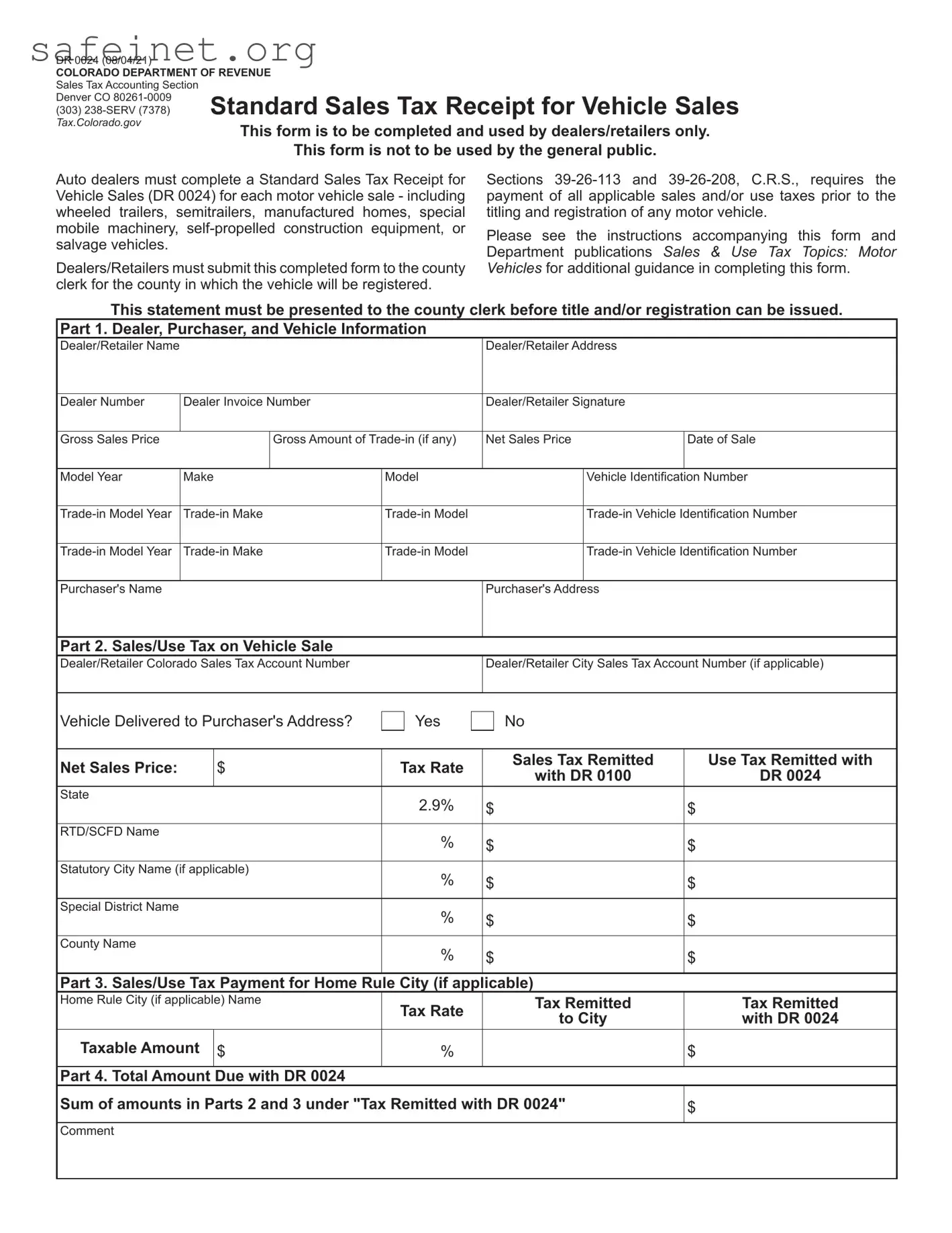

What is the DR 0024 form used for?

The DR 0024 form, officially known as the Standard Sales Tax Receipt for Vehicle Sales, is a document exclusively for use by auto dealers and retailers. This form is required for every sale of a motor vehicle, including wheeled trailers and other specialized machinery. It serves as proof of the sales tax collected on the sale and is critical for the titling and registration of the vehicle.

Who should complete the DR 0024 form?

Only licensed auto dealers and retailers are authorized to complete the DR 0024 form. It is not intended for use by individual consumers or the general public. Dealers must fill out the form accurately for each vehicle sale to fulfill their tax obligations.

What information is required on the form?

The DR 0024 form requires detailed information, including the dealer's name, address, and dealer number. It also requests specific data about the vehicle sold, such as the make, model, and Vehicle Identification Number (VIN). Additionally, it requires information about the purchaser, including their name and address, as well as details regarding any trade-ins involved in the sale.

Where should the completed form be submitted?

After completing the DR 0024 form, the dealer must submit it to the county clerk in the county where the vehicle will be registered. This submission is essential for the registration process and must occur before the title can be issued.

What are the sales tax obligations associated with the DR 0024 form?

According to Colorado law, all applicable sales and use taxes must be paid prior to the titling and registration of any vehicle. The DR 0024 form is designed to capture the sales tax and any use tax due. Dealers must ensure these amounts are calculated and reported accurately to the appropriate authorities.

Is there a specific deadline for submitting the DR 0024 form?

While the form must be submitted before the vehicle can be registered, there is no set deadline for when it must be completed and handed in. However, it is advisable to complete this process promptly to ensure a smooth registration and titling experience for the purchaser.

What happens if I fail to submit the DR 0024 form?

If a dealer fails to submit the DR 0024 form, the vehicle title and registration will be denied by the county clerk. Additionally, the dealer may face penalties or fines for non-compliance with tax laws, making it crucial to follow all submission requirements.

Are there any special tax rates that need to be reported?

Yes, the DR 0024 form requires reporting of various tax rates, including state sales tax, regional transportation district (RTD) tax, and any applicable local city or county taxes. Dealers must ensure they are using the correct rates based on the location of the sale.

Can multiple vehicles be reported on a single DR 0024 form?

No, the DR 0024 form must be completed for each individual vehicle sale. Each vehicle sale is treated separately for tax purposes, and therefore requires its own documentation to accurately account for sales tax collected on each transaction.

Where can I find additional resources for completing the DR 0024 form?

The Colorado Department of Revenue provides instructions along with the DR 0024 form, which can be found on their official website. Additionally, resources related to sales and use tax topics specifically for motor vehicles are available, offering further guidance to ensure compliance.