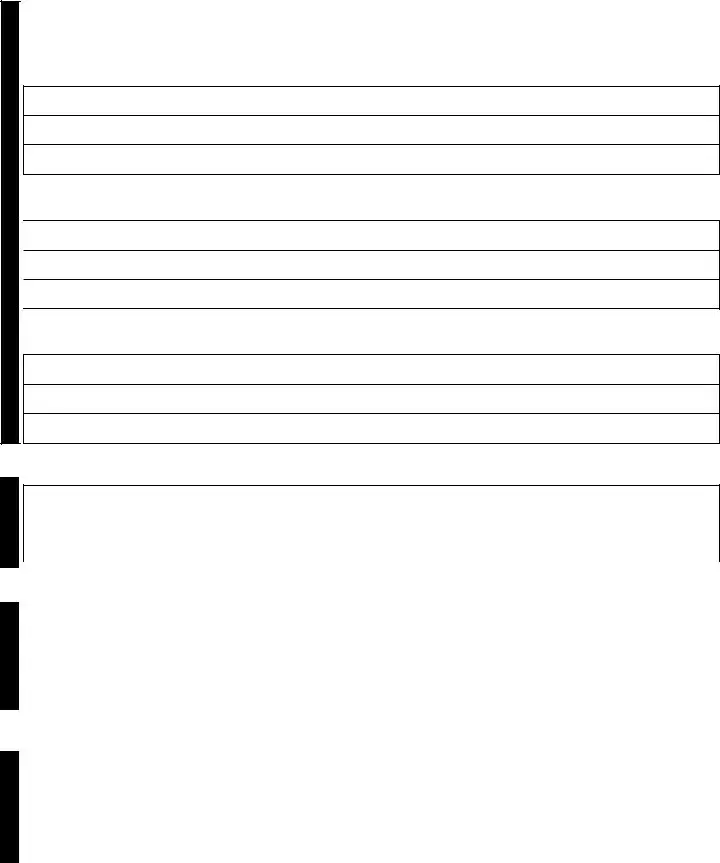

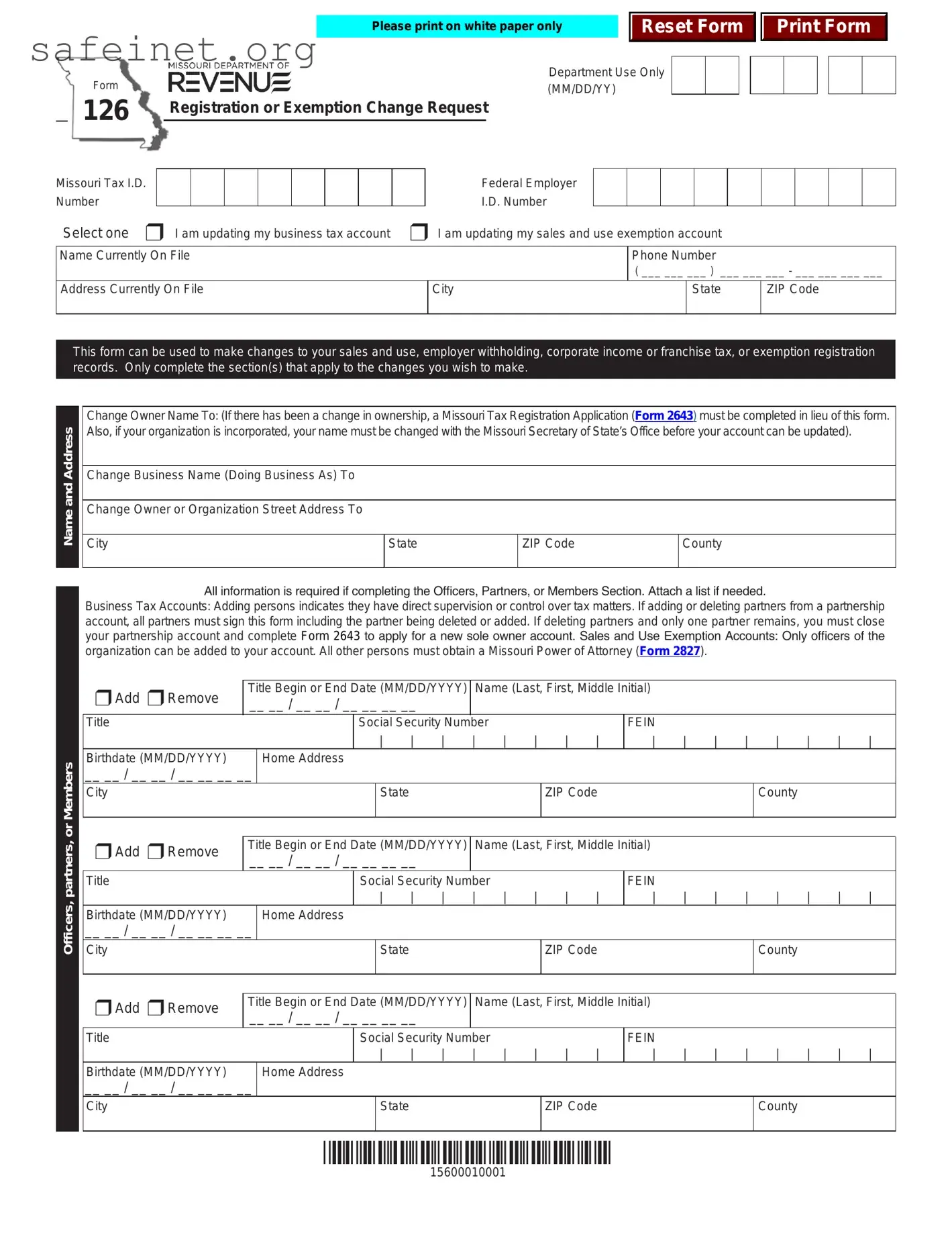

What is the purpose of the Dor 126 form?

The Dor 126 form is used to make changes to various tax registration records in Missouri. This includes updates related to sales and use tax, employer withholding tax, corporate income tax, franchise tax, or exemption registrations. It allows individuals and businesses to rectify their tax records without needing to submit multiple forms for different tax types.

Who should complete the Dor 126 form?

The form should be completed by business owners, partners, or authorized officers of an organization. Individuals updating business accounts, such as adding or removing partners, changing business names, or addressing changes in ownership, are required to use this form. If a change in ownership occurs, a Missouri Tax Registration Application (Form 2643) must be submitted as well.

What information is required on the Dor 126 form?

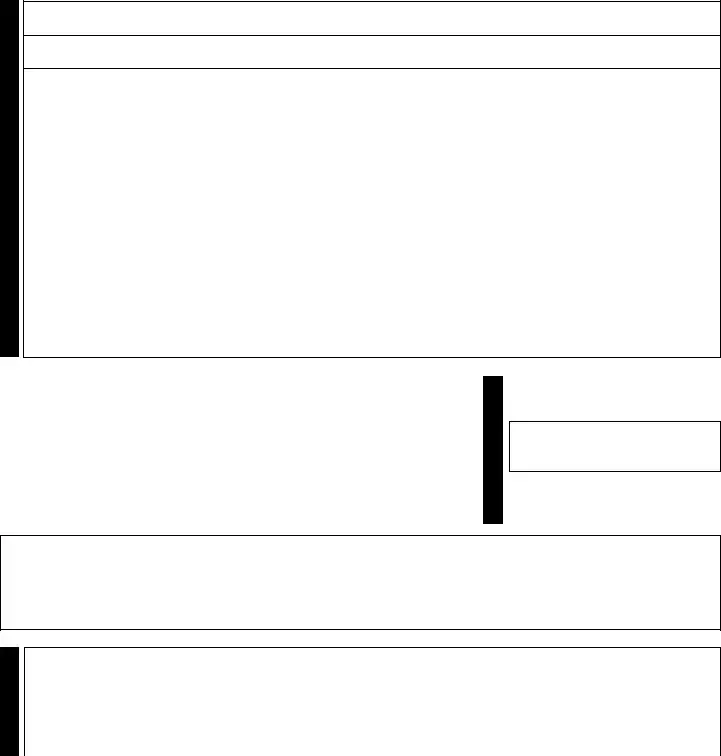

Completing the Dor 126 form requires various personal and business information. This includes the current business name, tax identification numbers, contact information, and the specific changes being made. If modifications involve adding or removing officers or partners, their names, titles, and social security numbers must be provided. It is essential to provide complete and accurate information to ensure proper processing.

How do I submit the completed Dor 126 form?

After completing the Dor 126 form, it can be submitted via mail. There are two specific mailing addresses based on the nature of the changes: one for registration changes and another for exemption changes. Ensure that the correct address is used to facilitate a smooth processing experience.

What should I do if I need assistance with the Dor 126 form?

If assistance is needed while completing the Dor 126 form or if you have questions about the process, you may contact the Missouri Department of Revenue. They offer help through various channels including phone numbers and emails listed on their website. Reach out for detailed guidance on filling out the form or addressing specific concerns.

Is there a deadline for submitting the Dor 126 form?

There is no specific deadline mentioned for submitting the Dor 126 form; however, it is advisable to complete and submit the form promptly whenever changes occur. Timely processing of the form helps maintain accurate records and ensures compliance with state tax regulations.

Officers, partners, or Members

Officers, partners, or Members