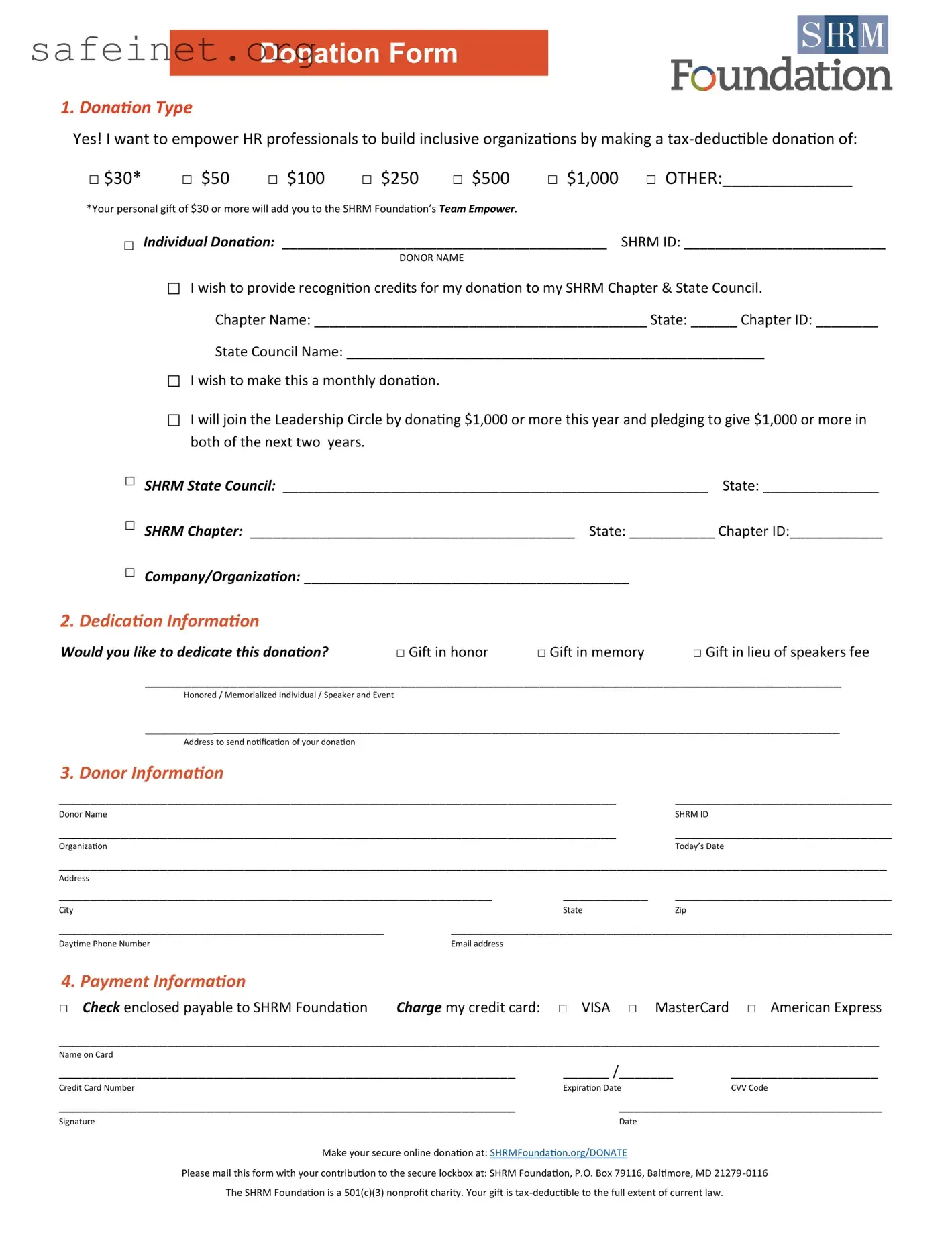

What types of donations can I make through the Donation Form?

You can choose from several amounts: $30, $50, $100, $250, $500, and $1,000. If you prefer to donate a different amount, the form provides an option to specify the amount under "OTHER." Additionally, monthly donation options are available, as well as contributions that recognize your local SHRM Chapter or State Council.

Can I dedicate my donation to someone special?

Yes, you can dedicate your donation to honor an individual, in memory of someone, or in lieu of a speaker's fee. The form allows you to provide details about whom you are honoring or memorializing, and an address for sending a notification of your donation.

How do I ensure my donation is tax-deductible?

The SHRM Foundation is a recognized 501(c)(3) nonprofit charity. This means your donation is tax-deductible to the full extent allowed by current law. It is advised to keep your donation receipt for your records when filing your taxes.

What payment methods are accepted?

You can make your donation through various methods, including checks payable to SHRM Foundation or by credit card. Accepted credit cards include VISA, MasterCard, and American Express. Provide the necessary payment information directly on the form for a secure transaction.

Is there a way to recognize my donation with my SHRM Chapter or State Council?

Yes, if you wish to provide recognition credits for your donation to your SHRM Chapter and State Council, you can specify the chapter's name, state, and chapter ID on the Donation Form. This enables your donation to contribute towards the goals of your local organization.

How can I make a monthly donation?

To set up a monthly donation, simply check the option for a monthly donation on the form. By committing to this, you will join the Leadership Circle if you pledge to donate $1,000 or more this year and continue this pledge for the next two years. Your ongoing support can significantly empower HR professionals.

What should I do if I want to make my donation online?

You can make a secure online donation at SHRMFoundation.org/DONATE. This method provides a quick and easy way to support the foundation without mailing a physical form. If you prefer a paper submission, you can still mail your completed form to the specified secure lockbox address.