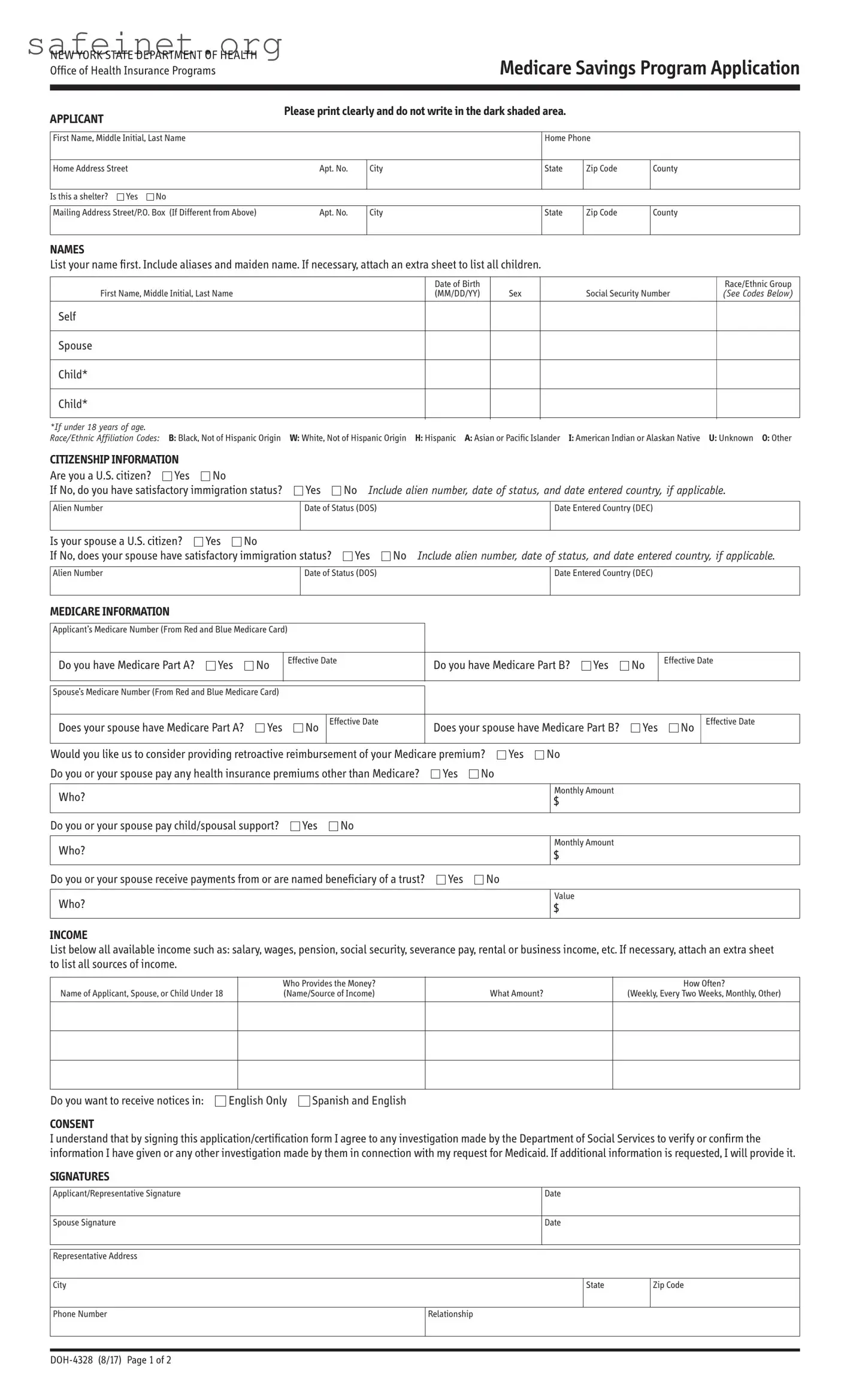

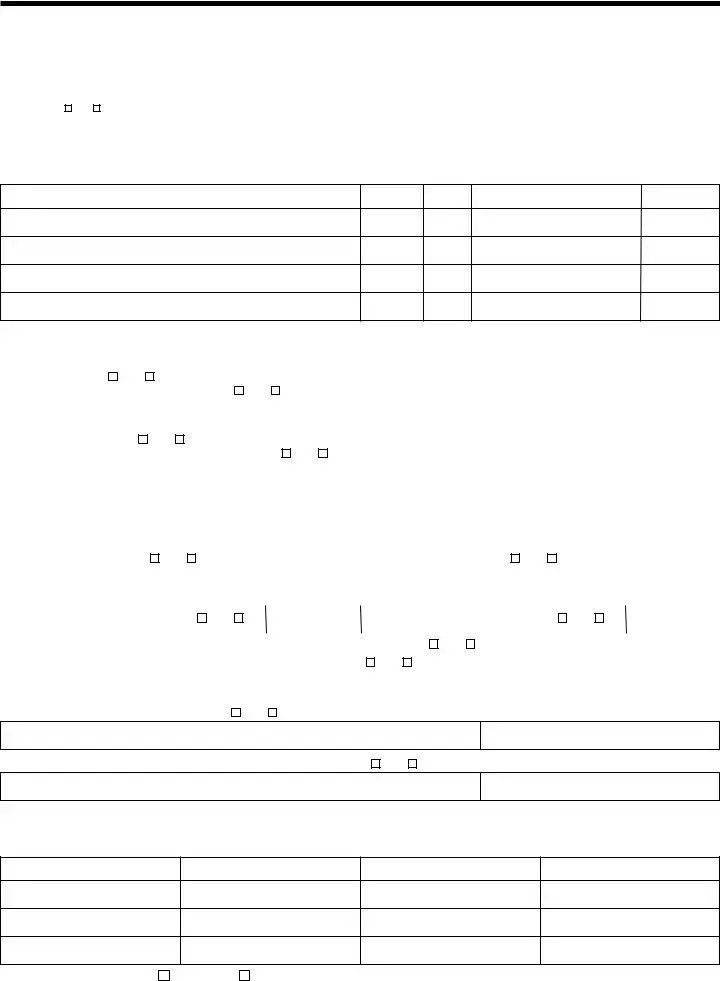

INSTRUCTIONS

COMPLETE THE APPLICATION

Be sure to answer all the questions. If you are married and living with your spouse, you must complete both the “Self” and “Spouse” questions on the application (even if the spouse is not applying for the MSP).

SIGN AND DATE THE APPLICATION

If both spouses are applying, both must sign the MSP application.

INCLUDE THE FOLLOWING VERIFICATION DOCUMENTS

Please review this list and submit the documents that you will need to provide in order for the Medicaid Program to determine if you are eligible for MSP. If you are requesting retroactive reimbursement of your Medicare premiums, you must send proof of income for the previous three-months. If there is an applying spouse, the spouse must also provide documentation.

•A photocopy of the front and back of your Medicare card.

•Proof of income: Paycheck stubs, letter from employer, income tax return, award letter for any unearned income benefit such as social security, unemployment, or veteran’s benefit, or letter from renter, boarder or tenant.

•Health insurance premiums that you pay other than Medicare: Letter from employer, premium statement, or pay stub.

•Proof of date of birth: State driver’s license, U.S. birth certificate, permanent resident card (“green card”), or NYS Benefit Identification Card.

•Proof of residence: Lease/letter/rent receipt with your home address from your landlord, driver’s license (if issued in the past 6 months), utility bill (gas, electric, phone, cable, fuel or water), government ID card with address, property tax records or mortgage statement, or postmarked envelope or postcard (cannot use if sent to a P.O. Box).

•If you are not a U.S. citizen, you must provide documents indicating your current immigration status.

Mail the application and required documentation to your local Department of Social Services (LDSS) or Human Resource Administration (HRA). To find the address in your county: http://www.health.ny.gov/health_care/medicaid/ldss.htm

TERMS, RIGHTS AND RESPONSIBILITIES

By completing and signing this form, I am applying for the Medicare Savings Program. PAYMENT OF YOUR MEDICARE PREMIUM IS A MEDICAID BENEFIT.

PENALTIES

I understand that my application may be investigated, and I agree to cooperate in such an investigation. Federal and State laws provide for penalties of fine, imprisonment or both if you do not tell the truth when you apply for Medicaid benefits or at any time when you are questioned about your eligibility, or cause someone else not to tell the truth regarding your application or your continuing eligibility.

CHANGES

I agree to immediately report any changes to the information on this application.

SOCIAL SECURITY NUMBER (SSN)

If you are applying for the Medicare Savings Program, you must report your SSN, unless you are a pregnant woman. The laws requiring this are: 18NYCRR Sections 351.2, 360-1.2, and 360-3.2(j)(3); 42USC 1320b-7. SSNs are used in many ways, both within the local social services districts and also between local social services districts and federal, state, and local agencies, both in New York and in other jurisdictions. Some uses of SSNs are: to check identity, to identify and verify earned and unearned income, to see if absent parents can get health insurance for applicants, to see if applicants can get child support and to see if applicants can get money or other help.

CERTIFICATION OF CITIZENSHIP & IMMIGRATION STATUS

I certify, under the penalty of perjury, by signing my name on this application, that I, and/or any person for whom I am signing is a U.S. citizen or national of the United States or has satisfactory immigration status. I understand that information about me will be submitted to the United States Citizenship and Immigration Services (USCIS) for verification of my immigration status, if applicable. I further understand that the use or disclosure of information about me is restricted to persons and organizations directly connected with the verification of immigration status and the administration and enforcement of the provisions of the Medicaid program.

NON-DISCRIMINATION NOTICE

This application will be considered without regard to race, color, sex, disability, religious creed, national origin, or political belief.

CERTIFICATION

In signing this application, I swear and affirm that the information I have given or will give to the Department of Social Services as a basis for Medicaid is correct. I also assign to the Department of Social Services any rights I have to pursue support from persons having legal responsibility for my support and to pursue other third-party resources. I understand that Medicaid paid on my behalf may be recovered from persons who had legal responsibility for my support at the time medical services were obtained.

If after reading and completing this form, you decide that you DO NOT want to apply for the Medicare Savings Program, please sign your name below:

I consent to withdraw my application: