What is the purpose of the Dispute Transunion form?

The Dispute Transunion form allows you to formally challenge inaccuracies found within your credit report. If you've noticed errors, such as incorrect account information or unfamiliar entries, this form helps you notify Transunion directly, ensuring those inaccuracies are addressed promptly.

How do I fill out the Dispute Transunion form?

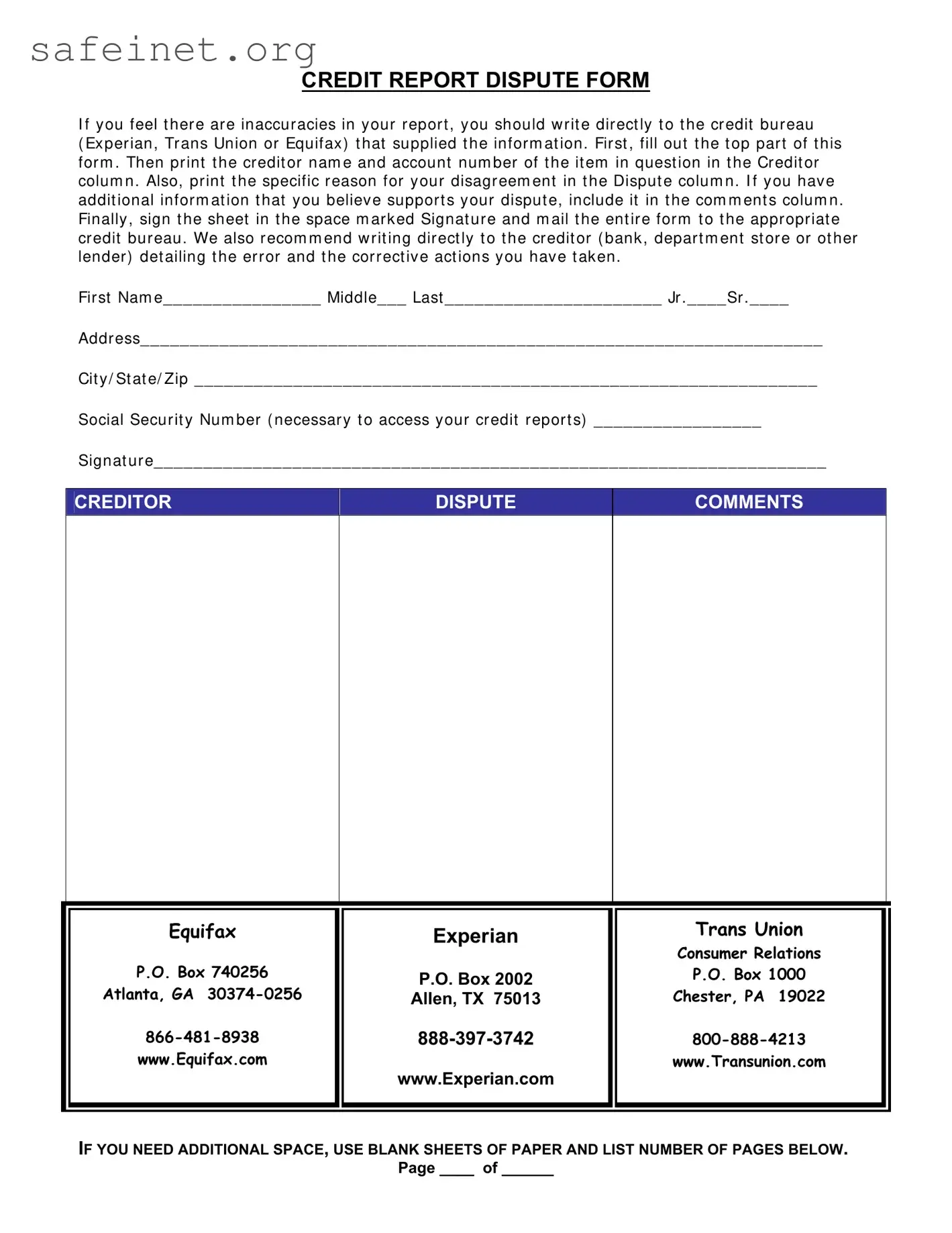

Start by filling in the basic information at the top of the form, including your name and address. Next, identify the specific creditor and account number related to the disputed item. In the dispute column, clearly state the reason for your disagreement. If you have any additional explanation or evidence to support your claim, include it in the comments section. Finally, remember to sign the form before mailing it to Transunion's address.

Where should I send the completed Dispute Transunion form?

Once you've filled out the form, send it to Transunion at the following address: P.O. Box 1000, Chester, PA 19022. It's advisable to use certified mail to have a record of your submission.

How long will it take for Transunion to investigate my dispute?

Transunion typically takes about 30 days to investigate a dispute after receiving your form. During this time, they will review your claim and get in touch with the creditor in question to verify the accuracy of the reported information.

What happens if Transunion finds that my dispute is valid?

If your dispute is validated, Transunion will correct the inaccurate information on your credit report. Additionally, they will inform you of the changes made. This can help improve your credit score and overall creditworthiness.

Can I dispute items with the creditor directly?

Yes, it is highly recommended to contact the creditor as well. Write them a separate letter detailing the error and specifying the corrections you seek. By doing this, you ensure that both the credit bureau and the creditor are aware of the issue, increasing your chances of resolving it swiftly.

What should I include in the comments section of the form?

In the comments section, you should provide any information that supports your dispute. This might include details about the inaccuracy, copies of relevant documents, or an explanation of why you believe the information is incorrect. The more detailed you are, the better your chances of a successful dispute.