The Disability Claim form shares similarities with the Health Insurance Claim form. Both documents require a detailed account of the circumstances surrounding a medical condition and its impact on the individual's ability to work or perform daily activities. Just like the Disability Claim form, the Health Insurance Claim form mandates the submission of patient identification details, the nature of the condition, and supporting information from medical providers to process claims correctly and efficiently.

Another closely related document is the Workers' Compensation Claim form. This form is used when an individual suffers an injury or illness related to their job. Similarly, both forms seek to establish the connection between the medical issue and the inability to work. Each requires specific dates indicating when the injury occurred and when the employee was last able to work, ensuring a clear timeline necessary for compliance and approval.

The Family Medical Leave Act (FMLA) Certification form is also similar. Both the FMLA form and the Disability Claim form focus on health-related matters and the individual's ability to work. While the FMLA form is primarily concerned with leave entitlements, it requires medical verification and documentation, paralleling the requirements for providing proof of disability and medical conditions in the Disability Claim form.

Additionally, the Social Security Disability Insurance (SSDI) application shares common traits with the Disability Claim form. Like the Disability Claim form, the SSDI application requests extensive details about the applicant's medical conditions and work history. Both documents aim to validate an individual's claim for benefits, relying heavily on accurate medical records and careful documentation from healthcare providers.

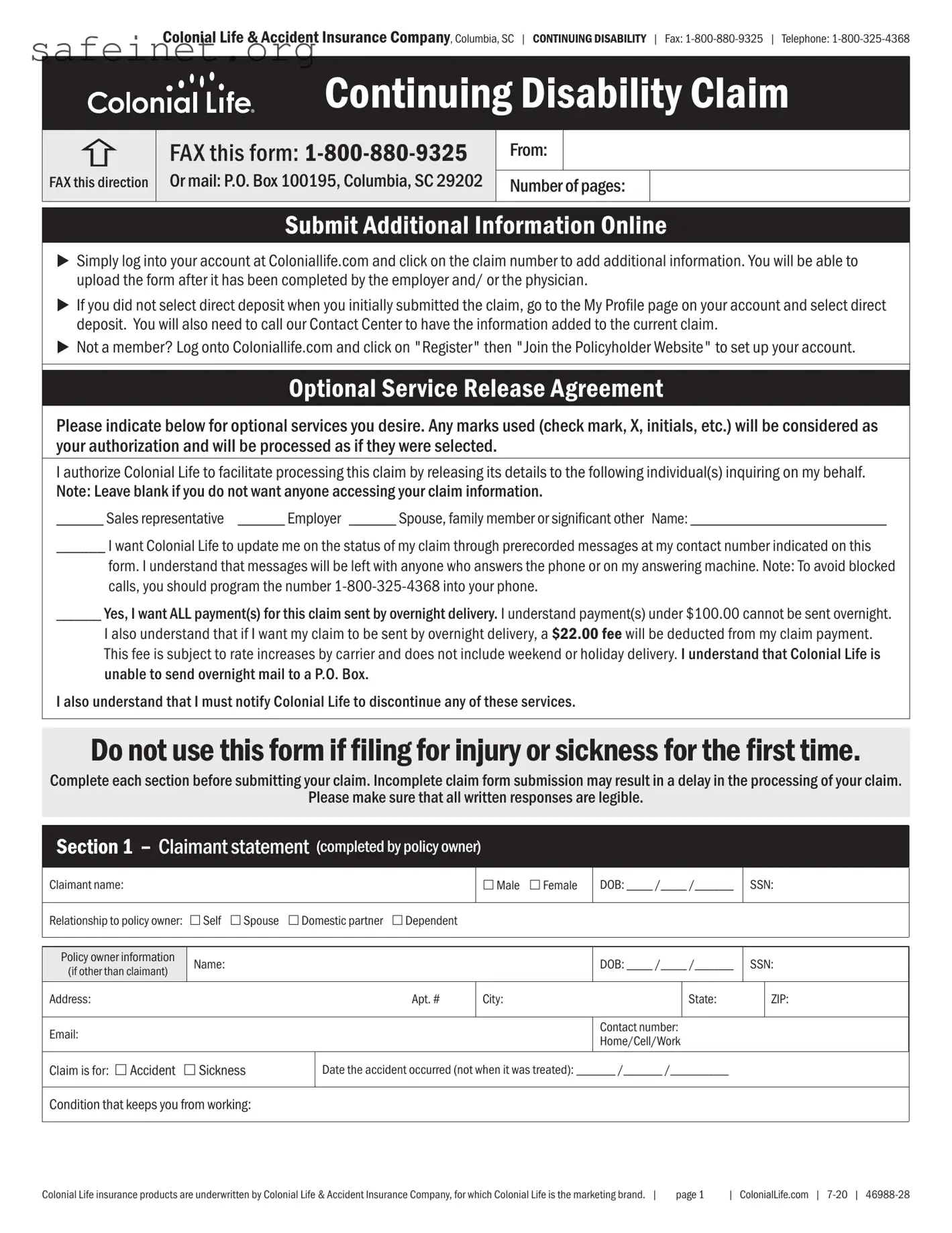

Similarly, the Long-Term Disability Claim form has much in common with the Disability Claim form. Both documents are meant to secure benefits for individuals unable to work due to ongoing medical issues. They often require similar information, such as medical diagnosis, treatments, and the impact on daily living and work capabilities. Completion in both cases is crucial, as incomplete submissions may result in delays or denials.

The Short-Term Disability Claim form is another related document. It has a similar purpose—providing financial assistance to individuals temporarily unable to work due to illness or injury. Both forms focus on the applicant's condition, and both may require input from healthcare professionals to authenticate the claim. Accuracy and thoroughness in completion are paramount to avoid complications in processing claims.

Next, the Health Care Provider Letter serves a related function. While it may not be a formal claim form, it documents the physician's assessment and can support a Disability Claim. It often includes details about the diagnosis, treatment plan, and expected recovery timeline, providing essential context regarding the claimant's inability to work, just like the Disability Claim form requires.

Insurance Policyholder Forms are also akin to the Disability Claim form. These documents summarize the terms and conditions of the insurance coverage, detailing what is required for a claim to be valid. Both forms emphasize the need for proper documentation, accuracy, and compliance with policy stipulations to ensure that claims are processed swiftly without complications or misunderstandings.

The Residual Disability Claim form is similarly focused on providing benefits to individuals who experience a partial inability to work due to disability. Both forms assess the extent of the disability and its effect on employment. Validation from medical professionals is critical in both cases, as it directly influences the outcome of the disability claim being filed.

Lastly, the Critical Illness Claim form is similar as it addresses claims based on the diagnosis of life-altering conditions. The requirement for clear medical input, detailed account of the illness, and how it affects the individual's life mirrors the aspects of the Disability Claim form. Both forms highlight the importance of a medical professional's signature and support to validate the claim for benefits effectively.