|

|

|

|

|

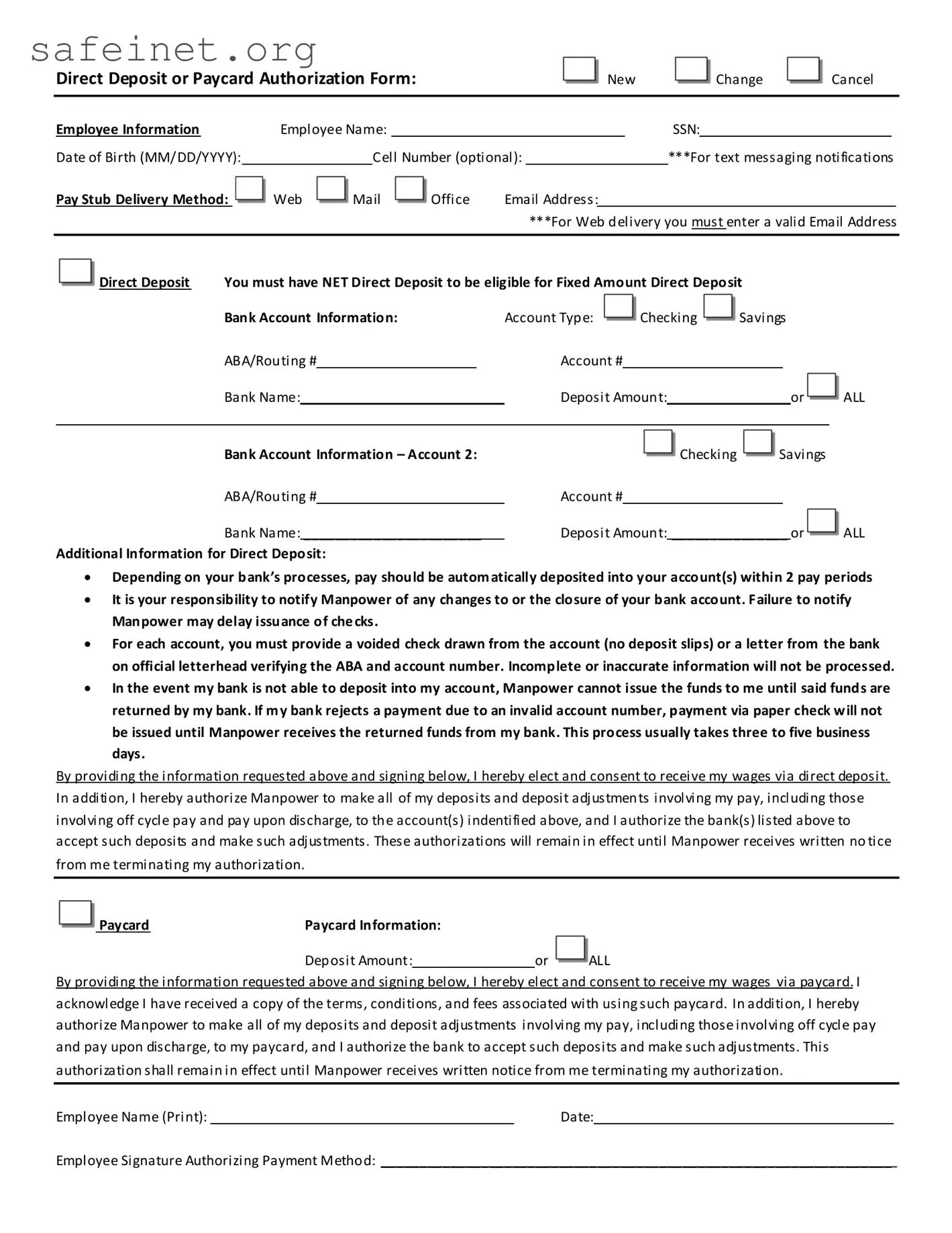

Direct Deposit or Paycard Authorization Form: |

New |

Change |

Cancel |

|

|

|

Employee Information |

Employee Name: ______________________________ |

SSN: ________________________ |

Date of Birth (MM/DD/YYYY): ________________ Cell Number (optional): __ _______________***For text messaging notifications

|

Pay Stub Delivery Method: |

Web |

Mail |

Office |

|

Email Address: ______________________________________ |

|

|

|

|

|

|

|

|

|

***For Web delivery you must enter a valid Email Address |

|

|

|

|

|

|

|

|

Direct Deposit |

You must have NET Direct Deposit to be eligible for Fixed Amount Direct Deposit |

|

|

|

Bank Account Information: |

|

|

Account Type: |

Checking |

Savings |

|

|

|

ABA/Routing # ____________________ |

|

Account # ____________________ |

|

|

|

Bank Name: _______________________ |

|

Deposit Amount: _______________ or |

ALL |

|

|

|

|

|

|

|

|

|

______________________________________________________________________________ |

|

|

|

Bank Account Information – Account 2: |

|

|

Checking |

Savings |

|

|

|

ABA/Routing # ____________________ |

|

Account # ____________________ |

|

|

|

|

|

|

|

|

|

|

Bank Name: _______________________ |

|

Deposit Amount: _______________ or |

ALL |

|

|

|

|

|

|

|

|

|

|

|

Additional Information for Direct Deposit: |

|

|

|

|

|

|

|

|

Depe di g o |

your |

a k’s pro esses, pay should |

e auto |

ati ally deposited i |

to your a ou t s |

withi 2 pay periods |

It is your responsibility to notify Manpower of any changes to or the closure of your bank account. Failure to notify Manpower may delay issuance of checks.

For each account, you must provide a voided check drawn from the account (no deposit slips) or a letter from the bank on official letterhead verifying the ABA and account number. Incomplete or inaccurate information will not be processed.

In the event my bank is not able to deposit into my account, Manpower cannot issue the funds to me until said funds are returned by my bank. If my bank rejects a payment due to an invalid account number, payment via paper check will not

be issued until Manpower receives the returned funds from my bank. This process usually takes three to five business days.

By providing the information requested above and signing below, I hereby elect and consent to receive my wages via direct deposit. In addition, I hereby authorize Manpower to make all of my deposits and deposit adjustments involving my pay, including those involving off cycle pay and pay upon discharge, to the account(s) indentified above, and I authorize the bank(s) listed above to accept such deposits and make such adjustments. These authorizations will remain in effect until Manpower receives written no tice from me terminating my authorization.

Paycard |

Paycard Information: |

|

|

Deposit Amount: _______________ or |

ALL |

By providing the information requested above and signing below, I hereby elect and consent to receive my wages via paycard. I acknowledge I have received a copy of the terms, conditions, and fees associated with using such paycard. In addition, I hereby authorize Manpower to make all of my deposits and deposit adjustments involving my pay, including those involving off cycle pay and pay upon discharge, to my paycard, and I authorize the bank to accept such deposits and make such adjustments. This authorization shall remain in effect until Manpower receives written notice from me terminating my authorization.

Employee Name (Print): _______________________________________ |

Date: ______________________________________ |

Employee Signature Authorizing Payment Method: __________________________________________________________________