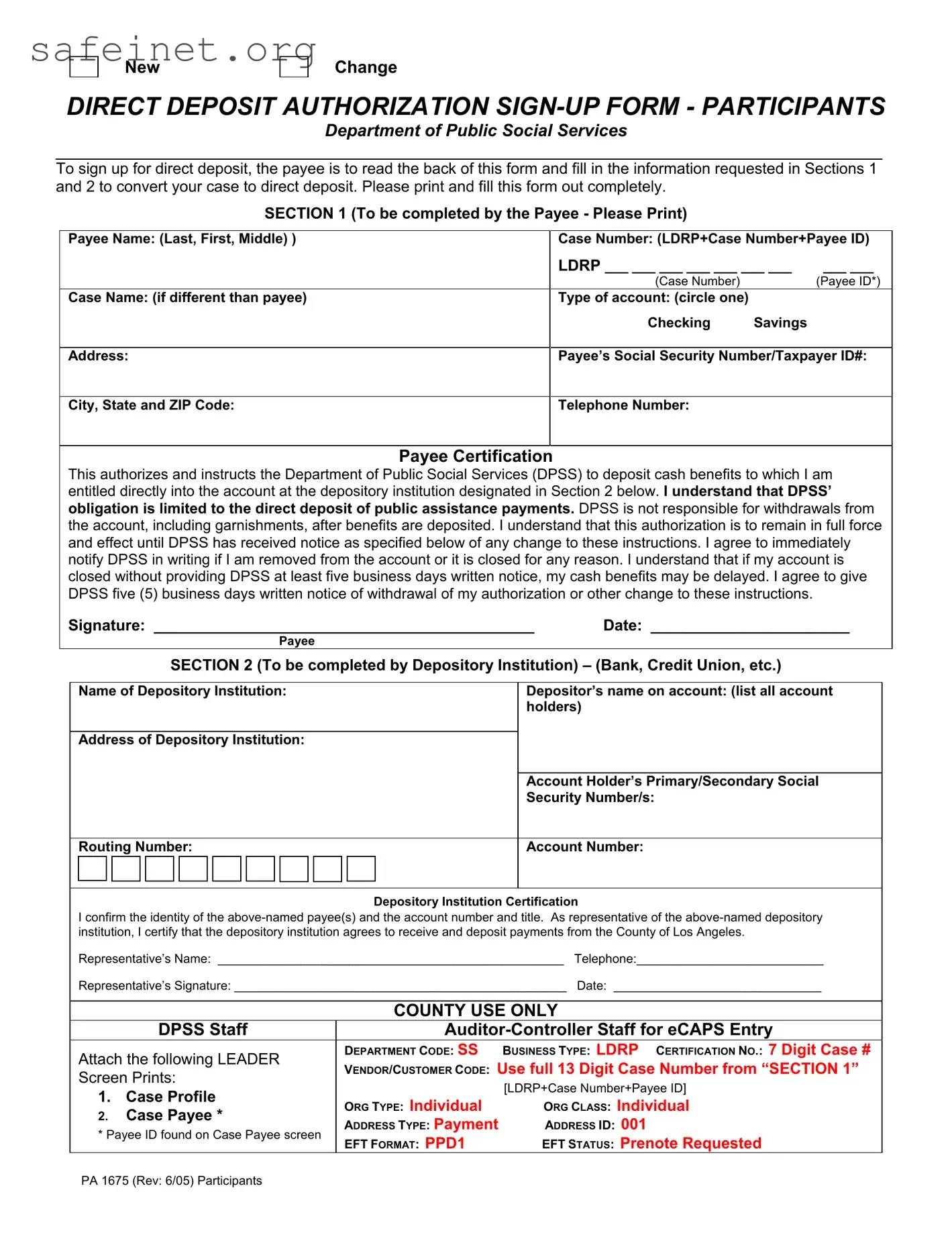

DIRECT DEPOSIT AUTHORIZATION SIGN-UP FORM - PARTICIPANTS

Department of Public Social Services

To sign up for direct deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2 to convert your case to direct deposit. Please print and fill this form out completely.

SECTION 1 (To be completed by the Payee - Please Print)

Payee Name: (Last, First, Middle) ) |

Case Number: (LDRP+Case Number+Payee ID) |

|

LDRP ___ ___ ___ ___ ___ ___ ___ |

___ ___ |

|

(Case Number) |

|

(Payee ID*) |

Case Name: (if different than payee) |

Type of account: (circle one) |

|

|

|

Checking |

Savings |

|

|

|

Address: |

Payee’s Social Security Number/Taxpayer ID#: |

City, State and ZIP Code:

Payee Certification

This authorizes and instructs the Department of Public Social Services (DPSS) to deposit cash benefits to which I am entitled directly into the account at the depository institution designated in Section 2 below. I understand that DPSS’ obligation is limited to the direct deposit of public assistance payments. DPSS is not responsible for withdrawals from the account, including garnishments, after benefits are deposited. I understand that this authorization is to remain in full force and effect until DPSS has received notice as specified below of any change to these instructions. I agree to immediately notify DPSS in writing if I am removed from the account or it is closed for any reason. I understand that if my account is closed without providing DPSS at least five business days written notice, my cash benefits may be delayed. I agree to give DPSS five (5) business days written notice of withdrawal of my authorization or other change to these instructions.

Signature: ____________________________________________ |

Date: _______________________ |

Payee

SECTION 2 (To be completed by Depository Institution) – (Bank, Credit Union, etc.)

|

Name of Depository Institution: |

Depositor’s name on account: (list all account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

holders) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Depository Institution: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Holder’s Primary/Secondary Social |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Number/s: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Routing Number: |

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depository Institution Certification

I confirm the identity of the above-named payee(s) and the account number and title. As representative of the above-named depository institution, I certify that the depository institution agrees to receive and deposit payments from the County of Los Angeles.

|

|

|

|

|

|

|

Representative’s Name: __________________________________________________ |

Telephone:___________________________ |

|

Representative’s Signature: ________________________________________________ |

Date: ______________________________ |

|

|

|

|

|

|

|

|

COUNTY USE ONLY |

|

|

|

DPSS Staff |

Auditor-Controller Staff for eCAPS Entry |

|

Attach the following LEADER |

DEPARTMENT CODE: SS |

BUSINESS TYPE: LDRP CERTIFICATION NO.: 7 Digit Case # |

|

VENDOR/CUSTOMER CODE: Use full 13 Digit Case Number from “SECTION 1” |

|

Screen Prints: |

|

|

[LDRP+Case Number+Payee ID] |

|

1. |

Case Profile |

|

|

ORG TYPE: Individual |

ORG CLASS: Individual |

|

2. |

Case Payee * |

|

ADDRESS TYPE: Payment |

ADDRESS ID: 001 |

|

* Payee ID found on Case Payee screen |

|

EFT FORMAT: PPD1 |

EFT STATUS: Prenote Requested |

|

|

|

PA 1675 (Rev: 6/05) Participants

PLEASE READ THIS CAREFULLY

The information provided on this form will remain confidential and be kept by the Department of the Auditor- Controller on behalf of Los Angeles County. Failure to provide the requested information may affect the processing of this form and may delay or prevent the receipt of benefits through the Direct Deposit Program.

Return this form with the computer screen printouts attached by your Eligibility Worker to the Auditor-Controller using the envelope provided to you. If you did not receive an envelope to mail this form please return this form to:

Los Angeles County Auditor-Controller

P.O. Box 7000

Downey, CA 90241-9907

Instructions For Completing This Form

Print clearly and complete Section 1 of this form.

♦Write the payee name exactly as it appears on the printout.

♦Make sure the address on the printout provided by your Eligibility Worker is your current address. The County will reject applications if the address on the application does not match the printout.

♦Write your Case Number and Payee ID exactly as it appears on the printout.

If you want your cash benefits deposited into your checking account, attach a voided personal check to this form, and write, “VOID” on the front of the check OR ask your depository institution to complete Section 2. If you want your cash benefits to be deposited into your savings account, or into any credit union account, (checking or savings) a representative from your depository institution MUST complete Section 2.

If the address on your personal check is different from your current address, cross out your old address and print your new address on your personal check. The address printed or handwritten on your check must match your application and the printout provided by your Eligibility Worker.

Cancellation

Direct deposit will remain in effect until cancelled by either yourself or DPSS. To stop direct deposit, call your Eligibility Worker and request a PA 1675-3, Cancellation for Direct Deposit Form. If you or your depository institution closes your bank account, you must report the account closure to avoid delays in receiving your benefits.

Changing Depository Institutions

To change depository institutions for direct deposit, you must complete a Cancellation for Direct Deposit Form and a new Direct Deposit Sign-Up Form. Return all forms with computer screen printouts attached by your Eligibility Worker to the Auditor-Controller using the envelope provided to you. If you did not receive an envelope to mail the forms, please return them to:

Los Angeles County Auditor-Controller

P.O. Box 7000

Downey, CA 90241-9907

It is recommended that you maintain accounts at both depository institutions until the new depository institution receives the first direct deposit.

PA 1675 (Rev: 6/05) Participants