What is the Direct Deposit for Job form?

The Direct Deposit for Job form allows employees to enroll in or change their direct deposit or rapid! PayCard account. This process ensures that paychecks are deposited directly into a specified bank account or onto a pay card, making it more convenient for employees to receive their wages.

How long does it take to process the Direct Deposit form?

What steps do I need to follow to complete the form?

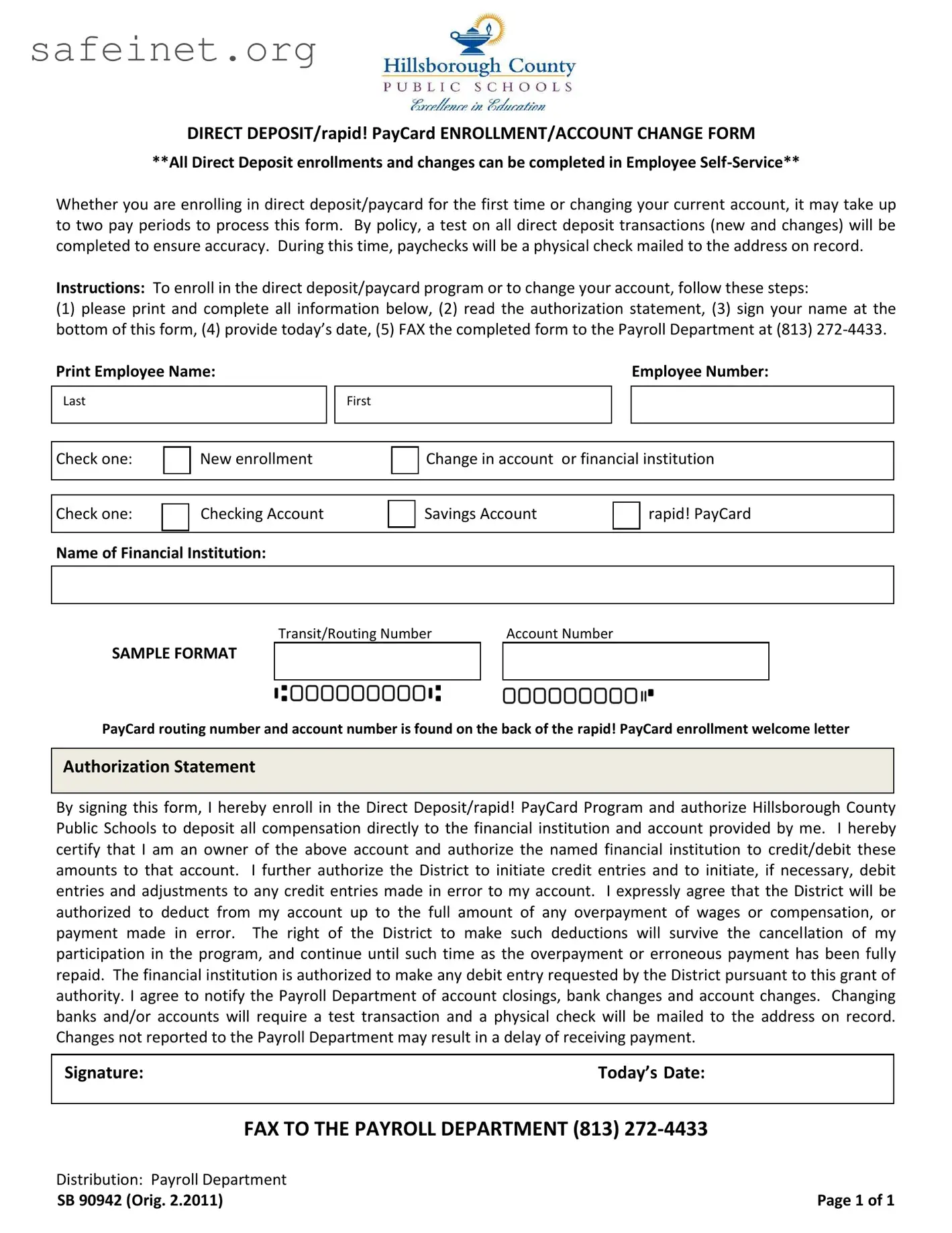

To enroll in the Direct Deposit program or to make changes, follow these steps: 1) Print and fill out the form completely. 2) Read and understand the authorization statement. 3) Sign the form. 4) Date the form. 5) Fax the completed form to the Payroll Department at the provided number.

What should I do if my bank account changes?

If there are changes to your bank account or if you close your account, you must notify the Payroll Department. Any changes require another test transaction. A physical check will be mailed until the new account has been set up correctly.

What will happen if I do not report changes to my account?

Failing to inform the Payroll Department of changes may lead to delays in receiving payments. It is important to keep them updated to ensure that funds are deposited accurately and on time.

What information do I need to provide on the form?

You need to provide your first and last name, employee number, whether you are enrolling for the first time or changing your account, the type of account (checking or savings), the name of your financial institution, the routing number, and the account number.

How do I find my routing and account numbers for rapid! PayCard?

The routing and account numbers for the rapid! PayCard can be found on the back of the rapid! PayCard enrollment welcome letter. Make sure to double-check these details to avoid errors.

What is the authorization statement?

The authorization statement grants permission for Hillsborough County Public Schools to deposit funds directly into your account. By signing, you authorize the financial institution to credit and debit your account as needed, including correcting any errors related to overpayments.

What do I do if I need assistance with the Direct Deposit form?

If you require assistance with the Direct Deposit form, you can reach out to the Payroll Department. They can provide guidance and answer any questions you might have regarding the process.