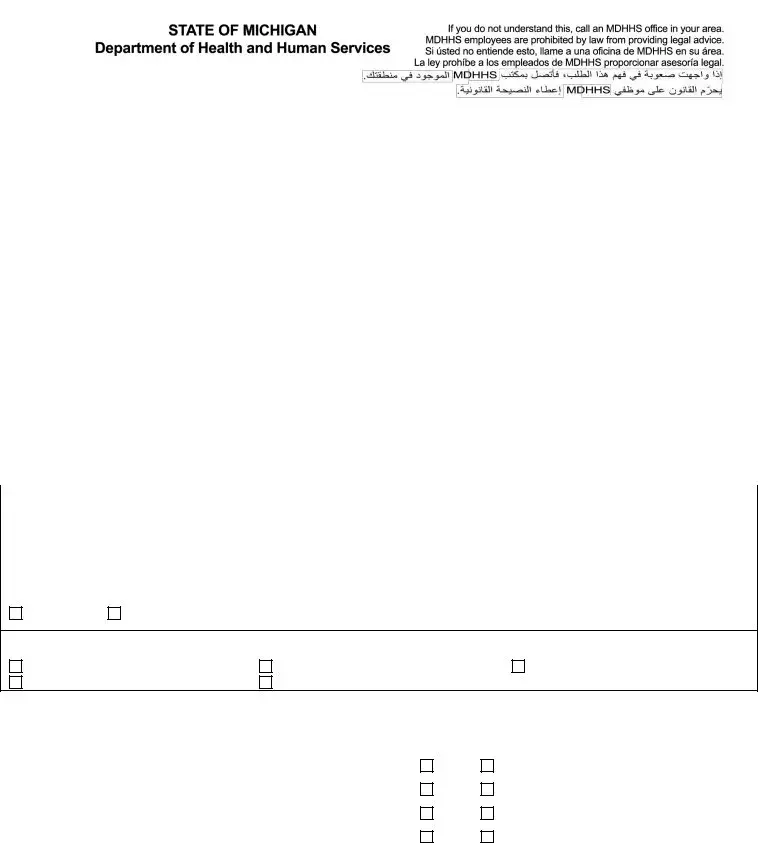

SECTION 3: PARENT/SUBSTITUTE PARENT AGREEMENT (To be completed by the parent) By signing, you agree to the following:

1.I understand that if I choose an unlicensed provider:

a.I am responsible for any child care expenses for the time my child is in care before my provider completes the Great Start to Quality Orientation training.

b.CDC payments will be issued to me and I am responsible for paying my provider.

c.I am responsible for reporting child care payments to the IRS and issuing my provider a Form W-2 or Form 1099 MISC, if appropriate.

2.I certify that my child or children are or will be in care with this provider as of the “date care began” listed in Section 2.

3.I understand that my child care agreement is between myself and my provider.

4.I understand that the Department may request information from me in order to verify my provider’s billing information.

5.I understand and agree that if an overpayment is made to my provider for any reason, my provider must repay the extra payments. To help repay the money, the Department may reduce any future payments to my provider by up to 20%.

6.I understand that I may be prosecuted for perjury or fraud if I intentionally leave out or give any false information that causes me to receive CDC benefits that I am either not qualified for, or are greater than what I should receive.

7.I understand if I violate any of the program rules, I may be disqualified from the program for six (6) months, 12 months, or a lifetime.

Parent/Substitute Parent Signature |

Date |

SECTION 3: PROVIDER AGREEMENT (To be completed by the provider)

By signing, you agree to the following:

1.I understand if I am an unlicensed provider:

a.I must apply to be a CDC provider by completing the CDC Unlicensed Provider Application. The application can be found at www.michigan.gov/childcare

b.I will not receive CDC payment for any care I provide in the period before I complete the Great Start to Quality Orientation training. More information on the training can be found at www.GreatStarttoQuality.org.

c.CDC payments will be issued to the parent of the child or children in care. The parent is responsible for paying me, reporting my wages to the IRS, and issuing me a Form W-2 or Form 1099 MISC, when appropriate.

d.I will use the CDC Daily Time and Attendance form found at http://www.michigan.gov/childcare.

2.I understand that I am not employed by the State of Michigan or the CDC Program, and that I will not receive unemployment insurance.

3.I will maintain time and attendance records for each child in my care. Each child’s parent/substitute parent must sign the records each day they are in my care. I will retain these records for four (4) years.

4.Parents of the children in care will have unlimited access to their children while in my care.

5.If an audit or investigation finds that I do not keep accurate time and attendance records, I may have to return CDC payments to the Department.

6.If I am overpaid for any reason, I must repay the Department, even if I am overpaid in error. If I am overpaid, the Department may hold up to 20% of any future payments.

7.I am responsible for what happens in the CDC I-Billing system by anyone using my PIN.

8.I will immediately contact the CDC Central Reconciliation Unit at 866-990-3227 to request a PIN reset if someone has accessed my PIN without my permission.

9.I will not bill for hours when the child is in school, to hold a spot for a child, or if the child is not expected to return to my care.

10.I understand that I may be prosecuted for perjury or fraud if I intentionally leave out or give false information that causes the parent/substitute parent to receive CDC benefits they are either not qualified for, or are greater than what they should receive.

11.I understand if I violate any of the program rules, I may be disqualified from the program for six (6) months, 12 months, or a lifetime.

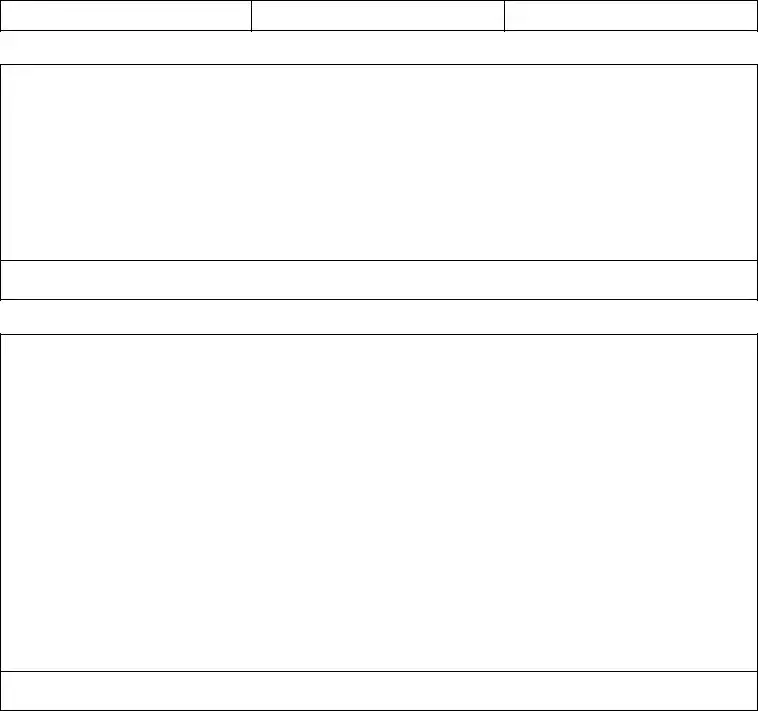

For more information and requirements, see the CDC program handbook at

http://www.michigan.gov/childcare