|

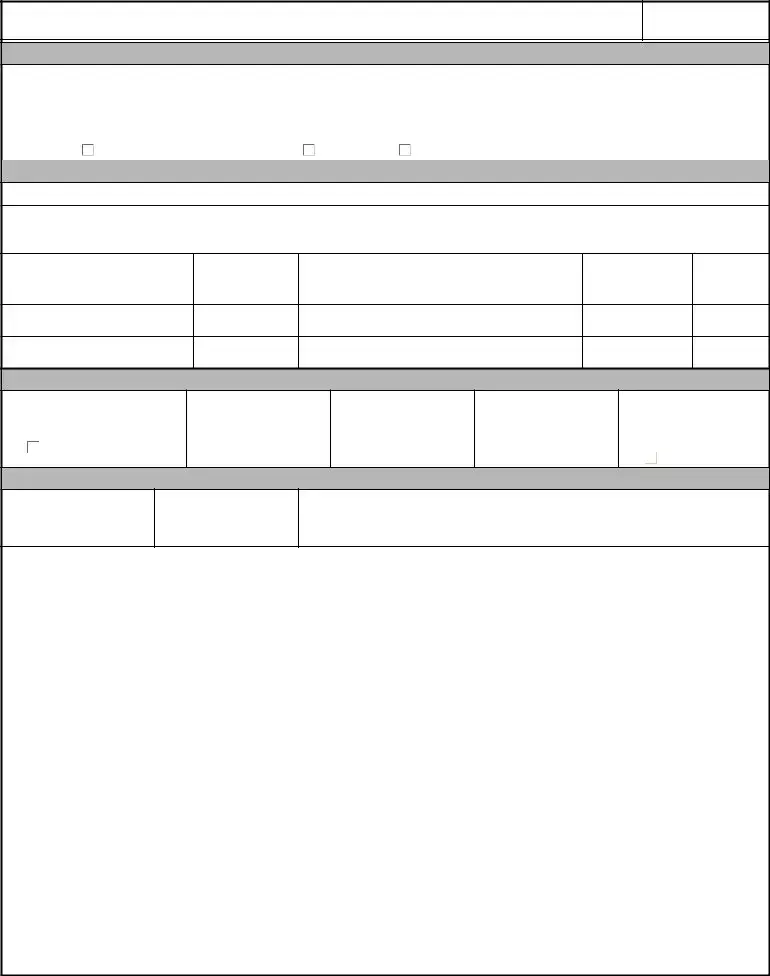

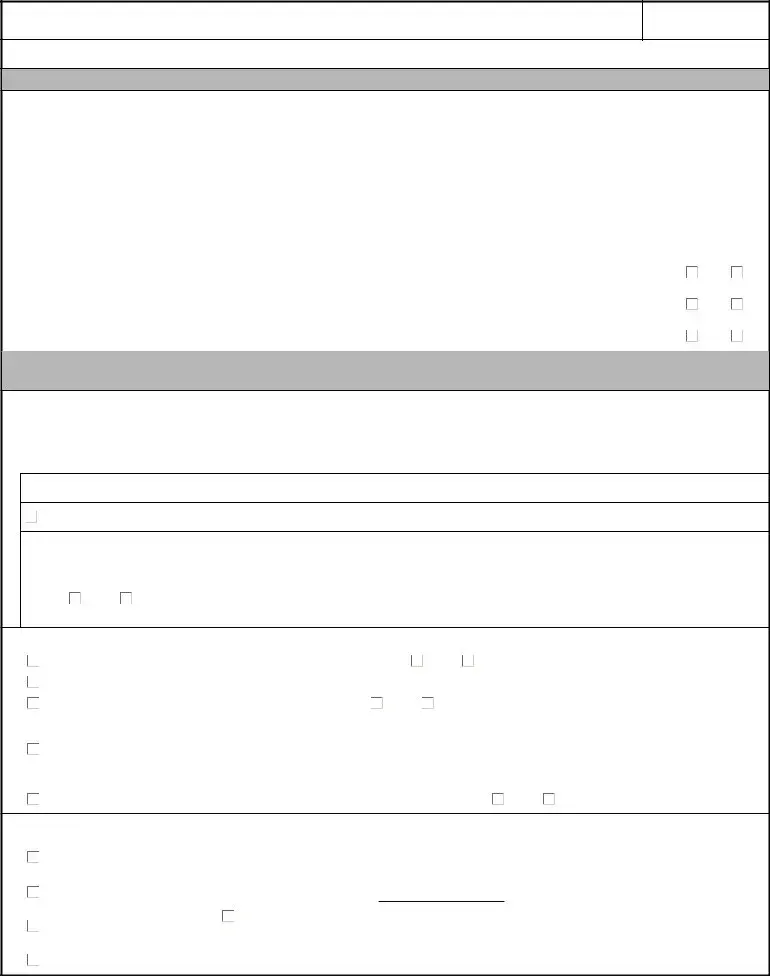

ITEM 18. Enter the number of exemptions claimed. |

|

PART III - SURVIVOR BENEFIT PLAN. |

|

|

ITEM 19. Enter the dollar amount of additional Federal income tax you desire |

It is very important that you are counseled and are fully aware of your options |

|

under the Survivor Benefit Plan (SBP). SBP pays your eligible beneficiary or |

|

withheld from each month's pay. Leave blank if you do not desire additional |

beneficiaries an inflation-protected annuity, based on your retired pay, in the |

|

withholding. |

|

|

|

|

|

event of your death. The cost of SBP is subsidized by the government, but you |

|

ITEM 20. Enter the word "EXEMPT" in this item only if you meet all the |

will be required to pay a portion of the cost of SBP through deductions from |

|

your retired pay. All retiring active duty members and all members of the |

|

following criteria: (1) you had no Federal income tax liability in the prior year; |

Reserves / National Guard who complete 20 qualifying years of service are |

|

(2) you anticipate no Federal income tax liability this year; and (3) you therefore |

|

automatically fully covered under the SBP or the Reserve Component SBP |

|

desire no Federal income tax to be withheld from your retired/retainer pay. |

(RC-SBP) unless electing to reduce or decline this coverage. There are |

|

NOTE: You must file a new exemption claim form with DFAS - Cleveland by |

|

special requirements for reducing or declining coverage that are covered in |

|

February 15th of each year for which you claim exemption from withholding. |

|

Part III. |

|

|

|

|

|

|

|

ITEM 21. If you are not a U.S. citizen, provide, on an additional sheet, a list of |

SECTION IX - DEPENDENCY INFORMATION. |

|

|

all periods of ACTIVE DUTY served in the continental U.S., Alaska, and |

|

|

|

|

|

Hawaii. Indicate periods of service by year and month only. List only service at |

ITEM 29. Provide your spouse's name, SSN, and date of birth. If no current |

|

shore activities; do not report service aboard a ship. |

|

|

|

spouse, enter "N/A" and proceed to Item 32. |

|

|

|

|

|

|

|

For example: |

DUTY STATION |

TO (Year/Month) |

ITEMS 30 and 31. Enter the date and location of your marriage to your current |

|

FROM (Year/Month) |

spouse. In Item 30, if marriage occurred outside the United States, include city, |

|

1994/02 |

NAVSTA, Norfolk, VA |

1995/01 |

|

province, and name of country. |

|

|

|

|

|

|

|

NOTE: This information may affect the portion of retired/retainer pay which is |

ITEM 32. If you do not have dependent children, enter "N/A" in this item. If you |

|

taxable in accordance with the Internal Revenue Code if you maintain a |

|

do have dependent children, provide the requested information. Designate |

|

permanent residence outside the U.S., Alaska, or Hawaii. |

|

|

|

which children resulted from marriage to a former spouse, if any, by indicating |

|

SECTION VII - VOLUNTARY STATE TAX WITHHOLDING. |

|

(FS) after the relationship in Item 32.d. |

|

|

|

|

|

|

Complete this section only if you want monthly state tax withholding. If you |

ITEM 32.e. Enter YES or NO as appropriate. A disabled child is an unmarried |

|

choose not to have a monthly deduction, you remain liable for state taxes, if |

|

child who meets one of the following conditions: a child who has become |

|

applicable. |

|

|

|

|

|

incapable of self-support before the age of 18, or, a child who has become |

|

ITEM 22. Enter the name of the state for which you desire state tax withheld. |

incapable of self-support after the age of 18 but before age 22 while a full-time |

|

student. If answering yes, attach documentation. |

|

|

ITEM 23. Enter the dollar amount you want deducted from your monthly retired/ |

SECTION X - SURVIVOR BENEFIT PLAN (SBP) ELECTION. |

|

retainer pay. This amount must not be less than $10.00 and in whole dollars |

In this section, you will be able to indicate your desired SBP election and |

|

(Example: $50.00, not $50.25). |

|

|

|

designate the beneficiary for SBP in the event of your death. If you make no |

|

ITEM 24. Enter only if different from the address in Item 9. |

|

election, you will automatically receive maximum coverage for all eligible family |

|

|

members (spouse and/or children). If you elect to reduce or decline your |

|

PART II - LUMP SUM ELECTION. |

|

coverage, your spouse will have to concur with that decision. You may |

|

|

discontinue your SBP participation within one year after the second |

|

OPTIONAL. Only complete Part II if you are: |

|

anniversary of the commencement of retired/retainer pay. Termination of SBP |

|

|

is effective the first of the month after DFAS-Cleveland receives the SBP |

|

Covered under the Blended Retirement System; AND, |

|

disenrollment request. There will be no refund of SBP costs paid for the period |

|

Want to elect a partial lump sum of retired pay |

|

|

|

before the SBP disenrollment. You are advised to consult with a SBP |

|

If you are not covered under the Blended Retirement System or do NOT want |

Counselor or Retirement Services Officer prior to completing this section. |

|

|

|

|

to elect a partial lump sum, proceed to PART III of the form. |

|

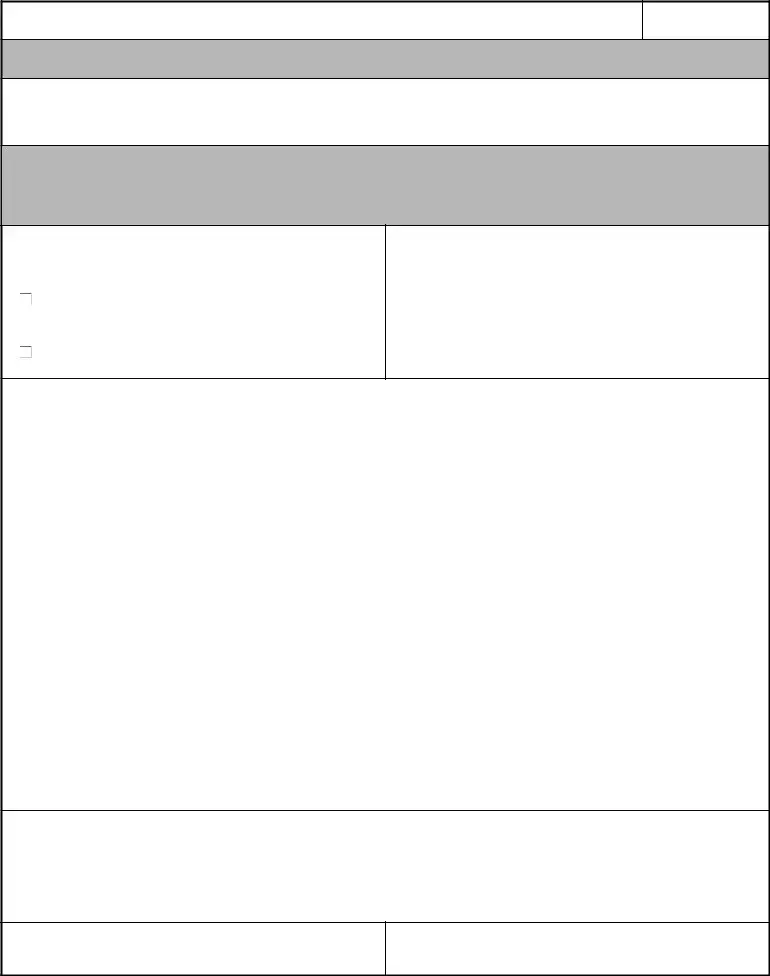

ITEM 33. RESERVE COMPONENT ONLY. Information to complete this |

|

SECTION VIII - BLENDED RETIREMENT SYSTEM LUMP SUM ELECTION. |

section can be found on the DD Form 2656-5 you submitted when you were |

|

first notified that you had completed 20 years of creditable service, known as |

|

ITEM 25. Indicate in Item 25.a OR 25.b whether you intend to receive a 25 |

your “Notification of Eligibility.” Reserve or National Guard members who |

|

previously completed 20 qualifying years of service are automatically covered |

|

percent or 50 percent lump sum of retired pay. |

|

under the RC-SBP unless electing, within 90 days of receiving their Notification |

|

ITEM 26. If indicating in Item 25.a or 25.b that you desire to receive a lump |

of Eligibility, to decline this coverage. Indicate in Item 33.a., 33.b., or 33.c. your |

|

previous election. If you elected immediate coverage (Item 33.c, or “Option |

|

sum of retired pay, indicate in 26.a through 26.d whether you would like that in |

C”), elected coverage to begin at age 60 (Item 33.b, or “Option B”) or made no |

|

one payment or a series of equal, annual installments over 2, 3, or 4 years. |

election previously, this remains your coverage and cannot be changed. |

|

ITEM 27. Before signing in Item 28, you must read the considerations listed in |

However, Reserve/National Guard members who declined to make an election |

|

until reaching the age of eligibility to receive retired pay (Item 33.a, or “Option |

|

Item 27. You are highly encouraged to review your options with a financial |

A”), or who were unmarried and had no eligible children at initial RC-SBP |

|

professional and compare your estimated retirement benefits with or without a |

|

election and made no subsequent RC-SBP election must complete Items 34 |

|

lump sum using the online calculator located at |

|

and 35 (and Items 36 through 38 if applicable). If you elected either Immediate |

|

http://militarypay.defense.gov/calculators/BRS. |

|

|

|

(Option C) or Deferred (Option B) RC-SBP coverage and the elected |

|

ITEM 28. If you mark Items 25 and Items 26, you must sign in the block at |

beneficiary is no longer eligible, provide supporting documentation with this |

|

form. |

|

|

28.a, and indicate the date you are signing in 28.b. The date in 28.b must be |

|

|

|

at least 90 days prior to the date of your retirement or the date you transfer to |

ITEM 34. Enter your desired coverage in Items 34.a through 34.g. You may |

|

the Fleet Reserve (shown in Item 4, this is also the same date indicated on |

only select one item. If you elect 34.a, 34.c, or 34.g, you MUST also indicate |

|

your DD 108 request for retirement). If you are a Reserve/National Guard |

|

whether you are declining coverage for other eligible dependents. |

|

member qualified to receive retired pay with a non-regular retirement, the date |

|

|

|

|

in 28.b must be 90 days prior to the date upon which you will be eligible to |

|

|

|

begin receiving retired pay (shown in Item 4, this is also the same date |

|

|

|

indicated on your DD 108 request for retirement). |

|

|

|

|

If you are NOT electing a lump sum of retired pay, DO NOT SIGN Item 28. |

|

|

|

|

|

|

|

|

DD FORM 2656 INSTRUCTIONS, OCT 2018 |

PREVIOUS EDITION IS OBSOLETE. |

Page 2 of 3 |

|

|

|

AEM LiveCycle Designer |

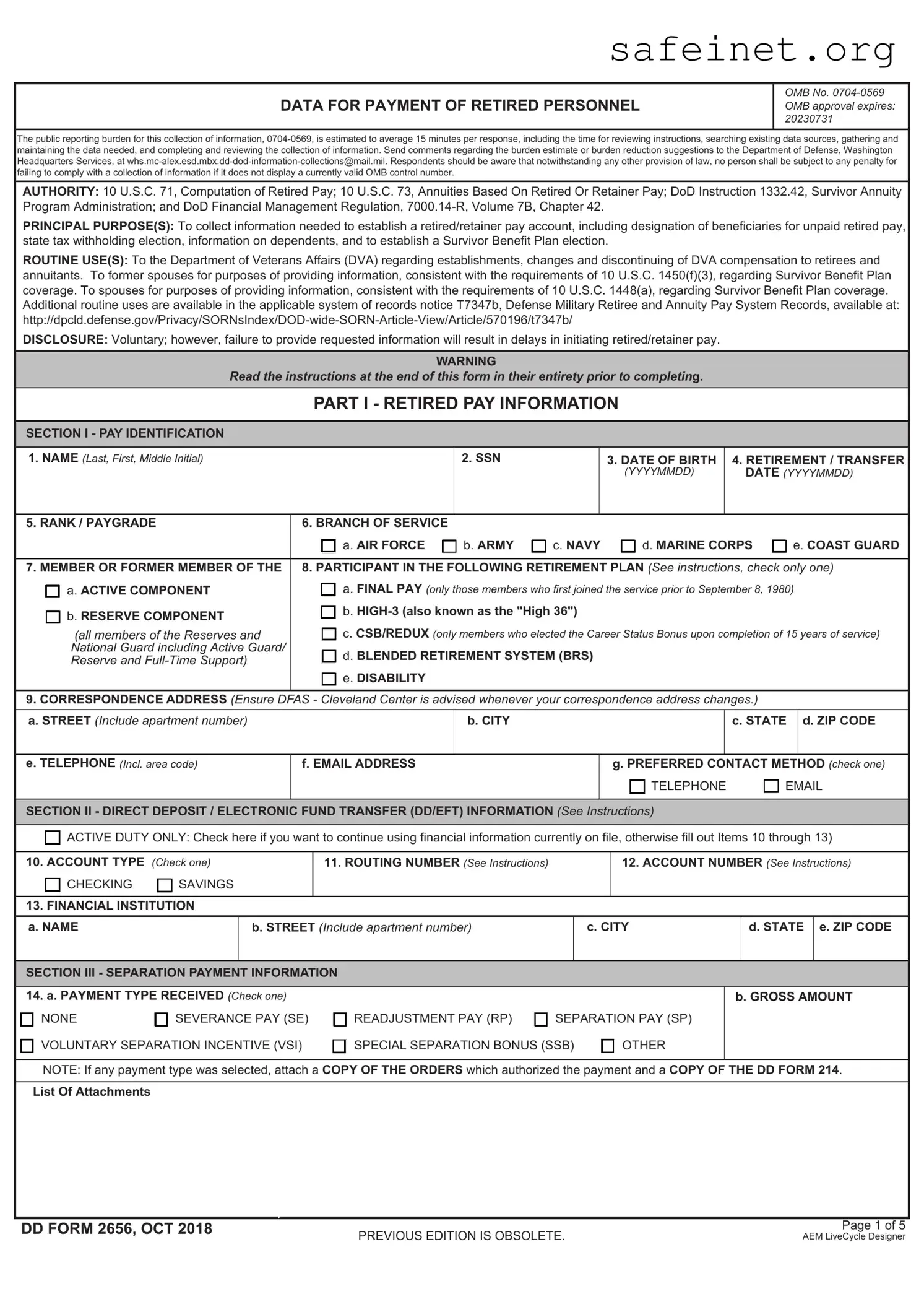

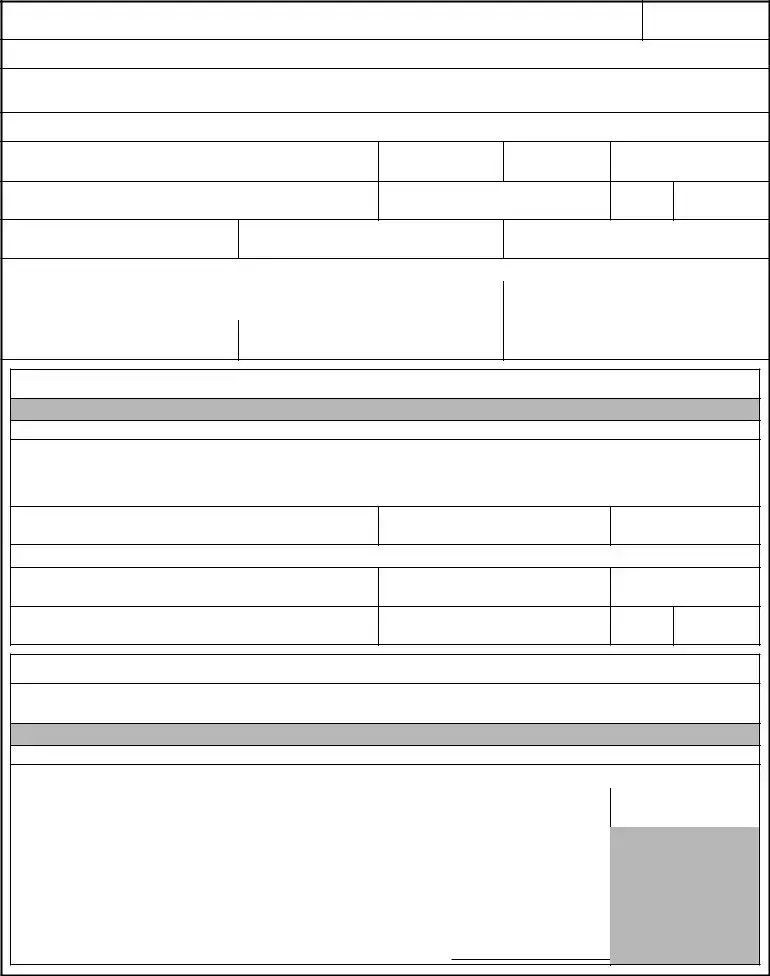

TELEPHONE

TELEPHONE  EMAIL

EMAIL ACTIVE DUTY ONLY: Check here if you want to continue using financial information currently on file, otherwise fill out Items 10 through 13)

ACTIVE DUTY ONLY: Check here if you want to continue using financial information currently on file, otherwise fill out Items 10 through 13)

Check this box if you want to designate your spouse as 100% beneficiary of any unpaid retired pay upon death

Check this box if you want to designate your spouse as 100% beneficiary of any unpaid retired pay upon death  SINGLE

SINGLE  MARRIED

MARRIED Yes

Yes

OPTION A - Previously declined to make an election until eligible to receive retired pay

OPTION A - Previously declined to make an election until eligible to receive retired pay  NOTE: If you were married at the time you were notified of eligibility for

NOTE: If you were married at the time you were notified of eligibility for  d. I ELECT COVERAGE FOR THE PERSON NAMED IN BLOCK 37 WHO HAS AN INSURABLE INTEREST IN ME

d. I ELECT COVERAGE FOR THE PERSON NAMED IN BLOCK 37 WHO HAS AN INSURABLE INTEREST IN ME  f. I ELECT COVERAGE FOR MY FORMER SPOUSE AND DEPENDENT CHILD(REN) OF THAT MARRIAGE

f. I ELECT COVERAGE FOR MY FORMER SPOUSE AND DEPENDENT CHILD(REN) OF THAT MARRIAGE I understand that this represents a Reduced Base Amount and requires Spouse Concurrence.

I understand that this represents a Reduced Base Amount and requires Spouse Concurrence.

I INTEND TO DESIGNATE AN SNT AS BENEFICIARY FOR THE CHILD OR CHILDREN DESIGNATED AS DISABLED IN BLOCK 32.

I INTEND TO DESIGNATE AN SNT AS BENEFICIARY FOR THE CHILD OR CHILDREN DESIGNATED AS DISABLED IN BLOCK 32.